- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Baker Hughes (NasdaqGS:BKR) Teams Up With NextDecade For Gas Tech At Rio Grande LNG Facility

Reviewed by Simply Wall St

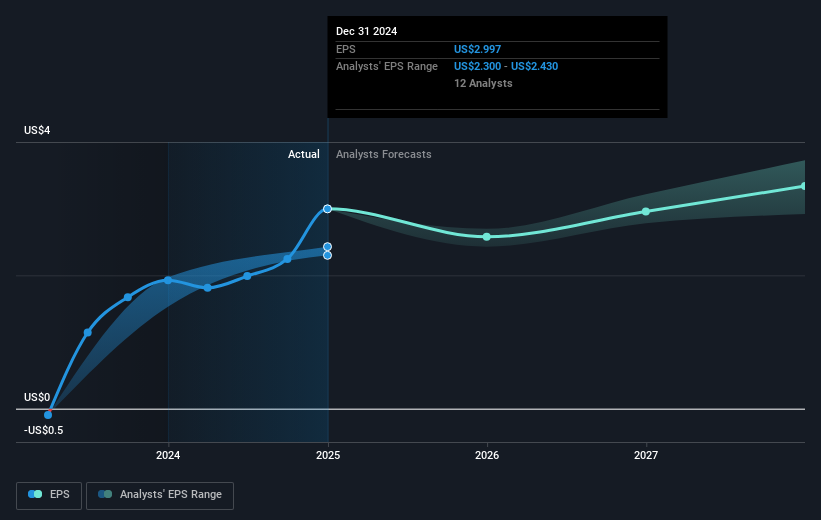

Baker Hughes (NasdaqGS:BKR) experienced a 1.44% decline in share price over the last quarter, a period marked by significant developments. The company's partnership framework with NextDecade Corporation to supply gas turbine and refrigerant compressor technology for the Rio Grande LNG Facility represents a long-term growth avenue. Despite this, the stock's performance may have been influenced by broader market factors, as the market saw a 3.7% drop over the past week amid economic uncertainty. Additionally, the Nasdaq's volatile performance, including gains driven by tech stocks like Tesla and Nvidia, did not benefit Baker Hughes. Meanwhile, positive earnings guidance and robust 2024 financial results outlined a strong backdrop, with net income and sales both increasing year-over-year. The company's strategic moves, such as client agreements with Argent LNG the and major contract award by ExxonMobil, also highlight ongoing opportunities that could affect future performance.

Examine Baker Hughes' earnings growth report to understand how analysts expect it to perform.

Over the longer-term period of the last five years, Baker Hughes demonstrated a total shareholder return of 330.29%, reflecting strong performance amidst various developments. A major factor during this time was the company's consistent expansion of its LNG capabilities, including several contracts with Argent LNG and Tellurian Inc, bolstering its position in the industry. Furthermore, Baker Hughes’ financial strength was highlighted by earnings growth that averaged 77.5% annually, along with a marked improvement in net profit margins. The introduction of integrated technologies through a coalition with Augury enhanced their industrial applications, contributing positively to the company's trajectory.

A key contributor to shareholder returns was also the company's commitment to returning value to investors, with a significant increase in cash dividends declared in early 2025, alongside a robust share repurchase program. In terms of market alignment, Baker Hughes outperformed the broader Energy Services industry over the past year. These elements, among others, underpin the substantial gains in Baker Hughes' total shareholder returns over the specified period.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives