- United States

- /

- Insurance

- /

- NYSE:GBLI

Undiscovered Gems in the United States for January 2025

Reviewed by Simply Wall St

The United States market has experienced a robust performance, climbing 3.1% over the last week and up 24% over the past year, with earnings forecasted to grow by 15% annually. In this vibrant environment, identifying undiscovered gems involves seeking stocks that not only align with these growth trends but also offer unique potential for long-term value creation.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Shore Bancshares (NasdaqGS:SHBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Shore Bancshares, Inc. functions as a bank holding company for Shore United Bank, N.A., with a market capitalization of $516.23 million.

Operations: Shore Bancshares generates revenue primarily from its community banking segment, amounting to $193.05 million. The company's net profit margin is a key financial metric, reflecting its profitability relative to total revenue.

Shore Bancshares, a financial entity with $5.9 billion in total assets and $533.3 million in equity, operates with primarily low-risk funding sources—97% of liabilities are customer deposits. Its total deposits reach $5.2 billion against loans of $4.7 billion, reflecting a solid balance sheet structure supported by a 0.3% bad loan allowance ratio and a net interest margin of 3.1%. The company reported impressive earnings growth of 349%, outpacing the industry average significantly, alongside maintaining an attractive price-to-earnings ratio at 12.6x compared to the US market's 18.9x, indicating potential value for investors seeking stable opportunities in banking stocks.

- Click to explore a detailed breakdown of our findings in Shore Bancshares' health report.

Explore historical data to track Shore Bancshares' performance over time in our Past section.

Global Indemnity Group (NYSE:GBLI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Global Indemnity Group, LLC operates through its subsidiaries to offer specialty property and casualty insurance and reinsurance products globally, with a market capitalization of approximately $475.79 million.

Operations: Global Indemnity Group generates revenue primarily from its Penn-America segment, contributing $545.53 million, and Non-core Operations at $103.15 million.

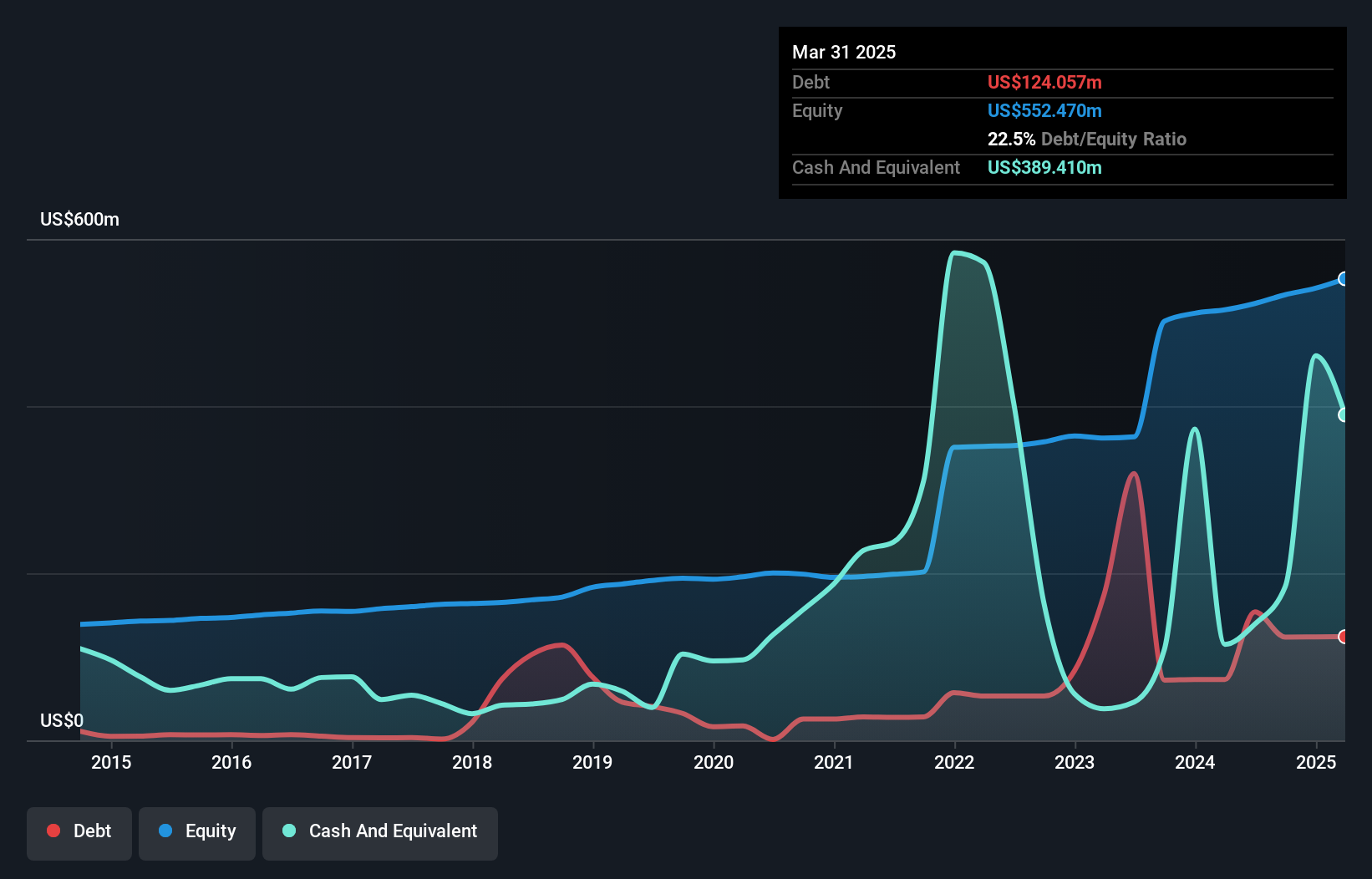

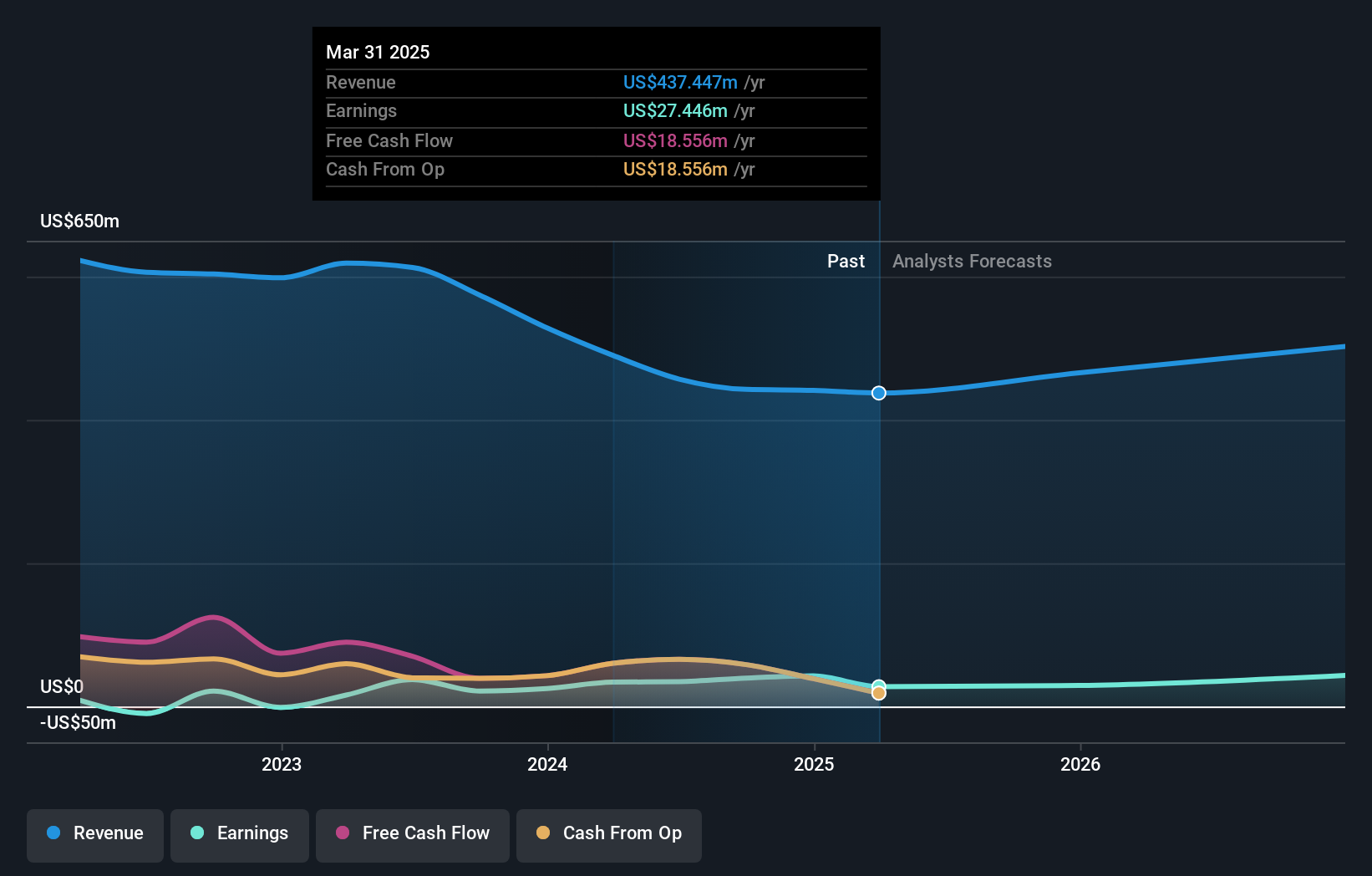

Global Indemnity Group, a nimble player in the insurance sector, is making waves with its impressive growth trajectory. Over the past year, earnings surged by 85.1%, outpacing the industry average of 35.6%. The company boasts a debt-free balance sheet and maintains high-quality earnings, reflecting robust financial health. Its price-to-earnings ratio stands at an attractive 12x compared to the US market's average of 18.9x, suggesting potential value for investors. However, challenges like increased expense ratios and technology costs could impact future performance despite anticipated revenue growth of 7.5% annually over the next three years.

X Financial (NYSE:XYF)

Simply Wall St Value Rating: ★★★★★★

Overview: X Financial is a company that offers personal finance services in the People's Republic of China, with a market cap of approximately $367.33 million.

Operations: X Financial generates revenue primarily through its personal finance services, with reported earnings of CN¥5.36 billion.

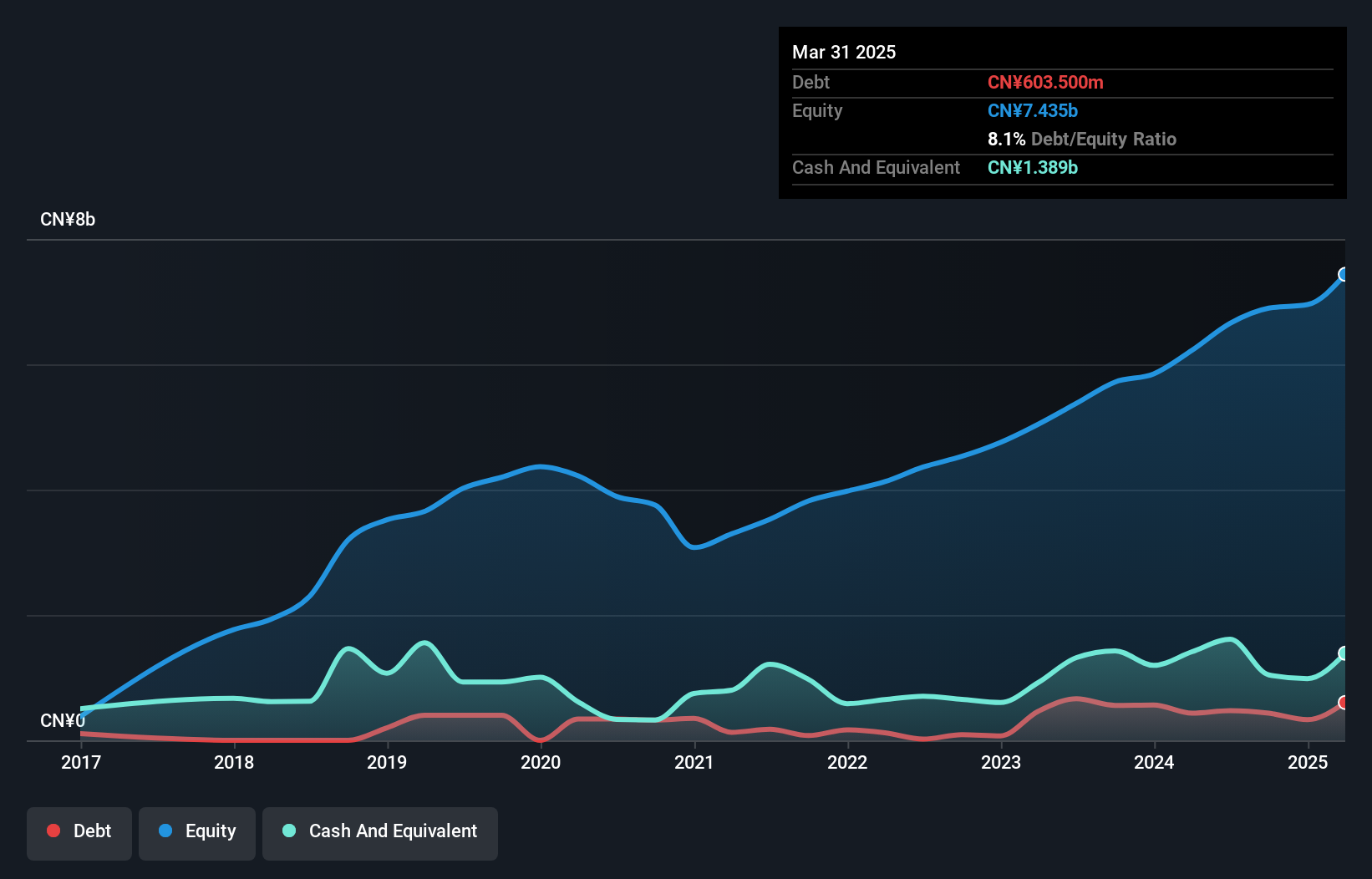

X Financial, a nimble player in the finance sector, is currently trading at 78.5% below its estimated fair value, hinting at potential undervaluation. Over the past year, its earnings growth of 5.6% outpaced the Consumer Finance industry's -5.4%, showcasing resilience and robust performance. The company has reduced its debt to equity ratio from 9.5 to 6.3 over five years, indicating improved financial health and stability in managing liabilities. Recently authorized a share repurchase program up to $50 million valid until June 2026, reflecting confidence in future prospects and commitment to enhancing shareholder value through strategic buybacks.

Seize The Opportunity

- Access the full spectrum of 253 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBLI

Global Indemnity Group

Through its subsidiaries, provides specialty property and casualty insurance, and reinsurance products in the United States.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives