- United States

- /

- Diversified Financial

- /

- NYSE:UWMC

UWM Holdings (UWMC): Assessing Valuation After Strong Q2 Earnings and $1 Billion Senior Notes Offering

Reviewed by Kshitija Bhandaru

UWM Holdings (UWMC) caught investor attention after its recent second-quarter results came in ahead of expectations for both revenue and earnings. The company also boosted its senior notes offering to $1 billion at 6.25%, up from an earlier $600 million plan, which reinforces its financial strategy and liquidity position.

See our latest analysis for UWM Holdings.

UWM Holdings’ share price has swung sharply in recent months, with a 27.4% gain over the past 90 days but a 19.6% decline in the last 30 days. This reflects shifting sentiment after its upbeat earnings and senior notes sale. While short-term moves have been volatile, the company still boasts a strong three-year total shareholder return of 116%, highlighting solid long-term performance despite a recent pullback.

If you’re interested in broadening your search beyond UWM Holdings, now’s a great time to discover fast growing stocks with high insider ownership.

With solid recent gains but ongoing volatility, the key question is whether UWM Holdings’ stock is now trading at an attractive discount for new investors or if the market has already priced in its future growth potential.

Most Popular Narrative: 17% Undervalued

UWM Holdings’ narrative fair value of $6.53 stands higher than its last close at $5.40, hinting at room for upside if optimistic forecasts come true. The most closely followed narrative in the market relies on improved credit performance, growing tech investments, and evolving industry sentiment. Here is a closer look at what is driving this view.

Bullish analysts point to resilient credit performance, noting that disciplined credit policies over the past two years have positioned the company well. The recent rally in interest rates has sparked optimism about the mortgage market and supported incremental price target increases.

Want to see what is fueling this bold potential? The narrative’s math is built on sharp improvements in margins and ambitious forecasts for future profitability. Curious which assumptions are behind that premium price? Click through to see the critical numbers influencing this fair value today.

Result: Fair Value of $6.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high rates or a shift in mortgage channels away from brokers could undermine UWM Holdings’ growth narrative and future margin expansion.

Find out about the key risks to this UWM Holdings narrative.

Another View: Market Ratios Raise Questions

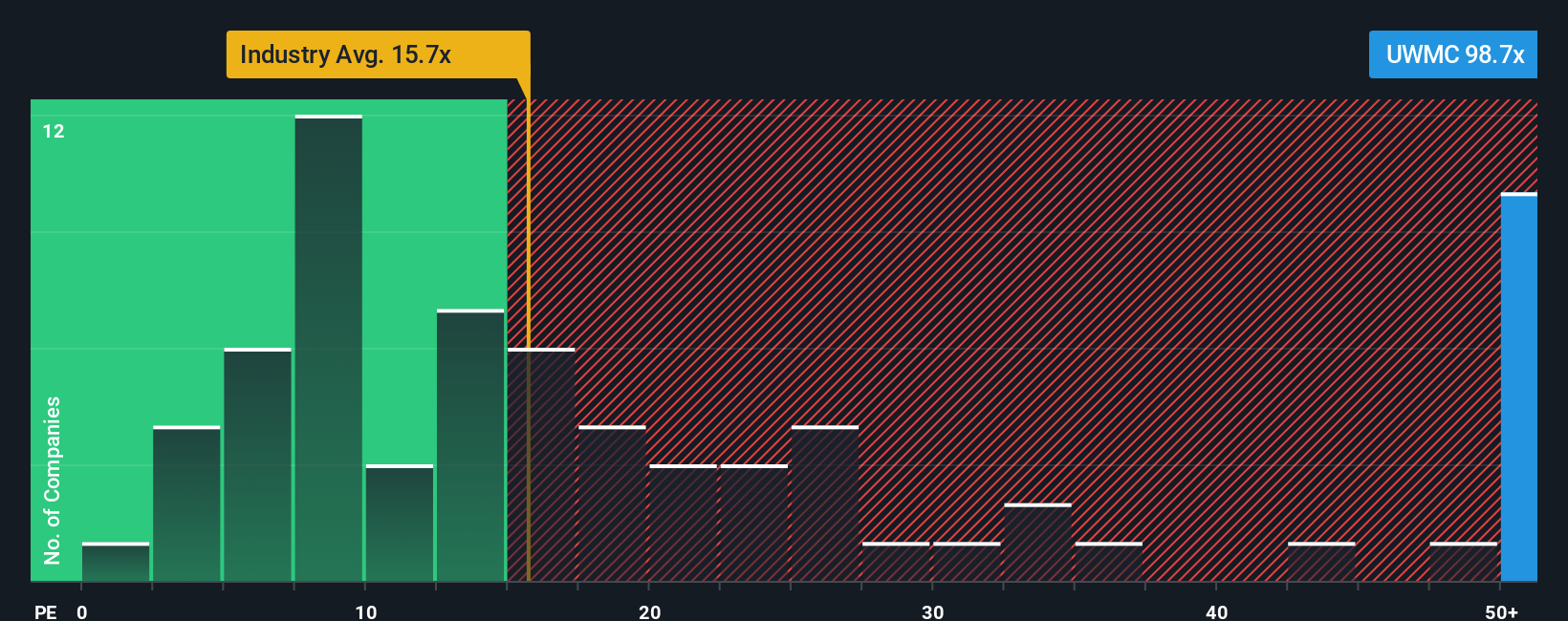

While the fair value narrative suggests upside, a look at UWM Holdings’ current price-to-earnings ratio tells a different story. At 99.6x, the ratio is not only far above the U.S. industry average of 16.1x and its peer average of 7.9x, but it is also much higher than the fair ratio of 32x. Such a wide gap could mean the stock is at risk of being overvalued unless earnings accelerate beyond expectations. How much weight should investors give to this warning?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UWM Holdings Narrative

If you see things differently or want to dig into the details yourself, building your own narrative takes just a few minutes. Do it your way

A great starting point for your UWM Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take the next step to build a smarter portfolio. Expand your watchlist with strategies tailored to today’s market trends before these opportunities pass you by.

- Maximize your search for value by scanning these 878 undervalued stocks based on cash flows aligned with robust cash flows and attractive entry points.

- Uncover rapidly emerging themes and momentum by checking out these 24 AI penny stocks accelerating innovation in artificial intelligence.

- Boost your income potential with these 18 dividend stocks with yields > 3% that offer yields over 3% and a track record of consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UWMC

UWM Holdings

Engages in the origination, sale, and servicing residential mortgage lending in the United States.

Exceptional growth potential with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)