- United States

- /

- Consumer Finance

- /

- NYSE:SYF

Synchrony Financial (NYSE:SYF) Falls 14% In A Week Amid U.S.-China Trade Tensions

Reviewed by Simply Wall St

Last week, global stock markets experienced significant turbulence due to new U.S. tariffs and retaliatory measures from China, leading to declines across major indices. During this period, Synchrony Financial (NYSE:SYF) saw its share price decline by 14%. This movement largely coincided with broader market concerns about impending recession risks and macroeconomic uncertainty sparked by the trade tension. Despite a stronger-than-expected U.S. jobs report, sentiment remained bearish as fears of inflation and reduced corporate earnings permeated the financial sector, impacting Synchrony Financial along with other major financial institutions. The overall market dropped by 5.6% during the same timeframe.

The last five years have seen Synchrony Financial achieve a total return of 200.87%, including dividends, which significantly surpasses industry growth. Notably, decisive actions such as securing renewed partnerships with Sam’s Club and JCPenney have likely played a role in reinforcing its market standing. From product diversification to digital engagement enhancements, such initiatives have helped bolster revenue channels and enhance customer interactions. Additionally, investments in digital wallets and strategic acquisitions have expanded Synchrony’s capabilities, as evidenced by the addition of over 45 new partners in 2024.

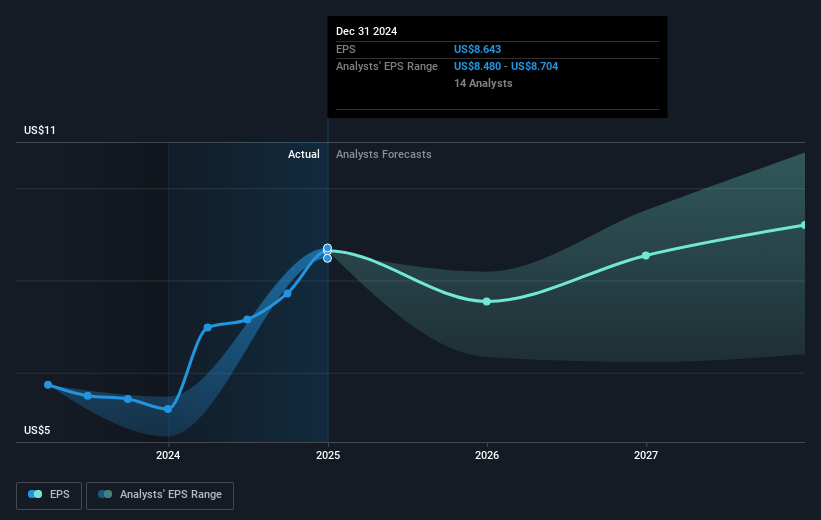

Furthermore, the company reported a significant increase in net income, climbing to US$3.50 billion for 2024 from US$2.24 billion the previous year. Consistent dividend affirmations and an active buyback program, which saw over 8 million shares repurchased, reflect a strong commitment to shareholder returns. This financial performance aligns with sustained growth and strategic collaborations, consolidating Synchrony's robust long-term gains despite recent market volatilities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYF

Synchrony Financial

Operates as a consumer financial services company in the United States.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives