- Taiwan

- /

- Tech Hardware

- /

- TWSE:2382

Spotify Technology And 2 Other Stocks Possibly Undervalued

Reviewed by Simply Wall St

In a week marked by significant rebounds in U.S. stocks and interest rate adjustments from the European Central Bank, investors are closely examining opportunities amid fluctuating economic indicators. As markets navigate these changes, identifying undervalued stocks becomes crucial for those looking to capitalize on potential growth. Understanding what makes a stock undervalued involves assessing its intrinsic value compared to its current market price, particularly during periods of economic uncertainty or recovery. In this context, Spotify Technology and two other companies may present compelling opportunities for investors seeking value amidst the evolving financial landscape.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First Solar (NasdaqGS:FSLR) | US$233.31 | US$465.98 | 49.9% |

| Zhongji Innolight (SZSE:300308) | CN¥115.94 | CN¥231.45 | 49.9% |

| Kotobuki Spirits (TSE:2222) | ¥1722.50 | ¥3434.73 | 49.9% |

| Gaming Realms (AIM:GMR) | £0.38 | £0.76 | 49.9% |

| Duolingo (NasdaqGS:DUOL) | US$234.00 | US$467.36 | 49.9% |

| Trustmark (NasdaqGS:TRMK) | US$32.55 | US$64.98 | 49.9% |

| Dino Polska (WSE:DNP) | PLN303.30 | PLN606.23 | 50% |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR1.08 | MYR2.15 | 49.8% |

| Tourn International (OM:TOURN) | SEK8.26 | SEK16.50 | 49.9% |

| Distribuidora Internacional de Alimentación (BME:DIA) | €0.0128 | €0.026 | 50% |

Below we spotlight a couple of our favorites from our exclusive screener.

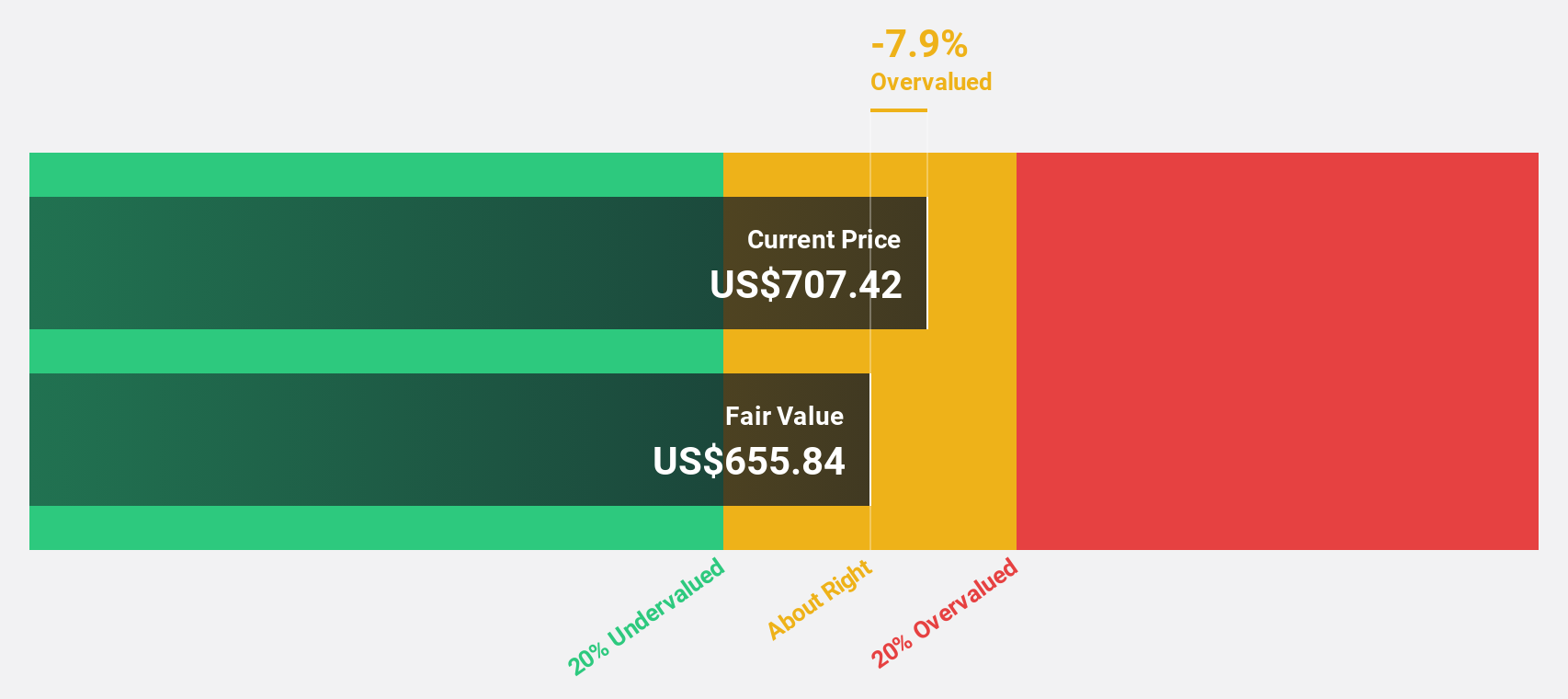

Spotify Technology (NYSE:SPOT)

Overview: Spotify Technology S.A. operates a global audio streaming subscription service and has a market cap of approximately $67.85 billion.

Operations: The company generates revenue through two primary segments: Premium (€12.68 billion) and Ad-Supported (€1.79 billion).

Estimated Discount To Fair Value: 26.2%

Spotify Technology is trading at US$338.83, significantly below its estimated fair value of US$459.22, indicating it may be undervalued based on cash flows. The company’s earnings are forecast to grow 29.88% annually over the next three years, outpacing the broader market's expected growth rate of 15.2%. Recent developments include a partnership with Cineverse Corp., expanding Spotify’s video content offerings and potentially enhancing user engagement and revenue streams.

- Our growth report here indicates Spotify Technology may be poised for an improving outlook.

- Click here to discover the nuances of Spotify Technology with our detailed financial health report.

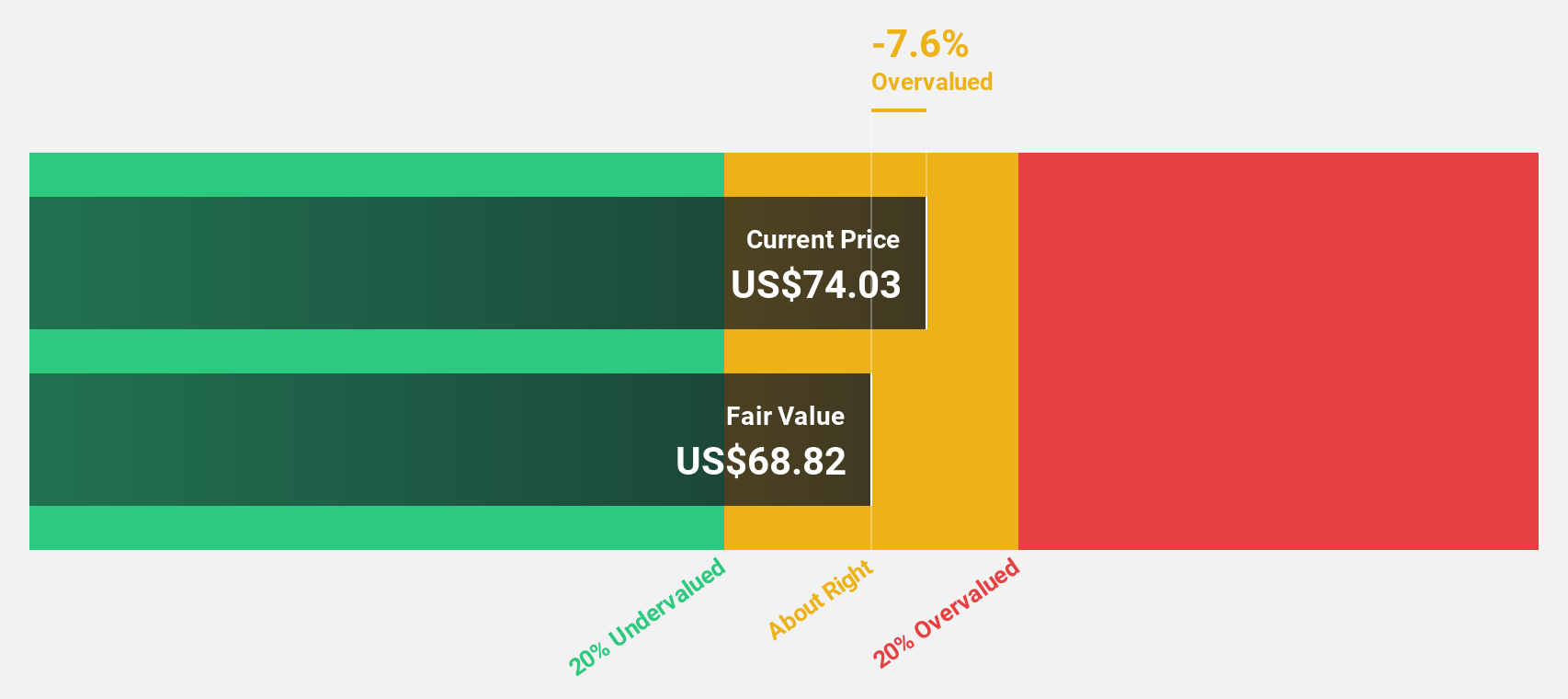

Block (NYSE:SQ)

Overview: Block, Inc., with a market cap of $39.40 billion, develops ecosystems for commerce and financial products and services both in the United States and internationally.

Operations: Block's revenue segments include $7.38 billion from Square and $15.93 billion from Cash App.

Estimated Discount To Fair Value: 10.2%

Block's revenue is forecast to grow 9.6% annually, slightly above the US market average of 8.8%. The company recently reported substantial earnings growth, with net income reaching US$195.27 million for Q2 2024 compared to a loss last year. Trading at $65.78, Block is valued below its estimated fair value of $73.29 and has increased its share buyback plan by $3 billion, indicating confidence in future cash flows and financial stability.

- Our expertly prepared growth report on Block implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Block stock in this financial health report.

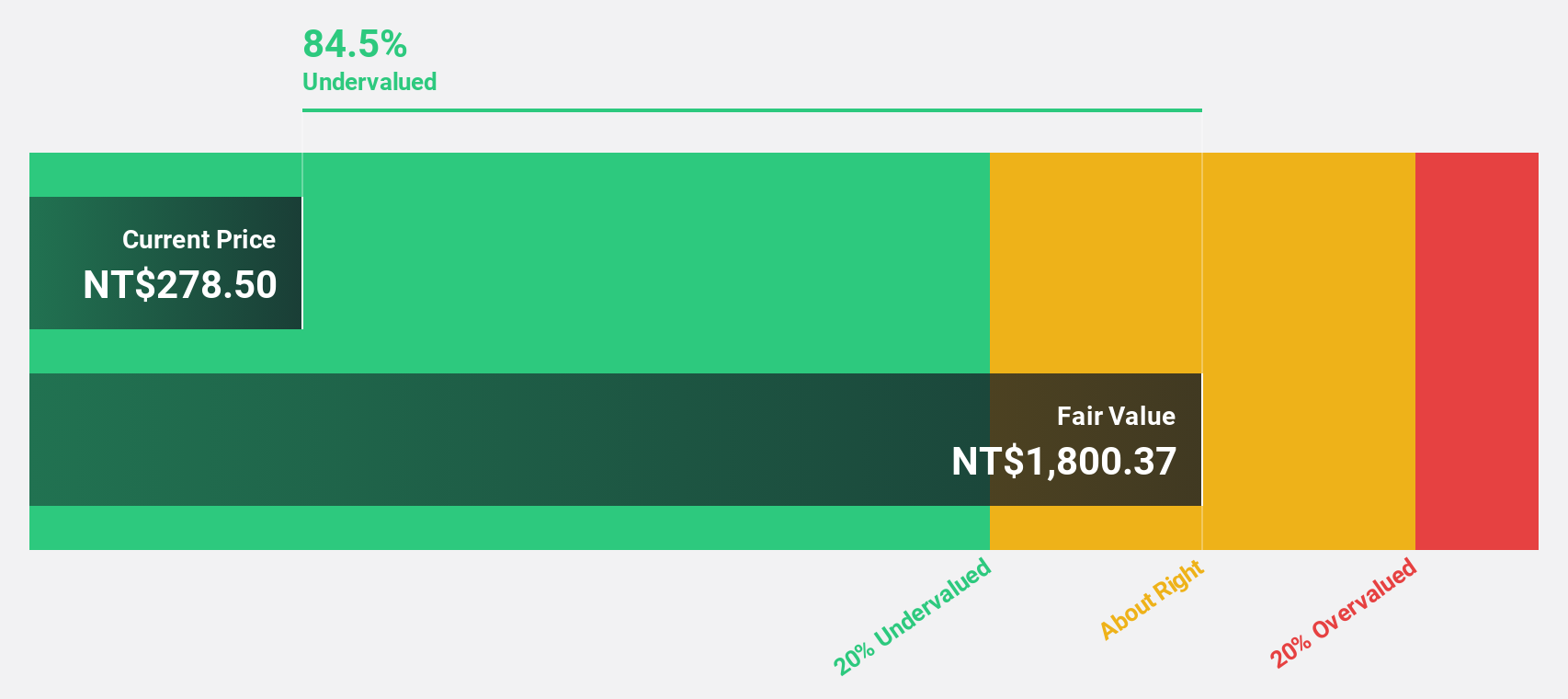

Quanta Computer (TWSE:2382)

Overview: Quanta Computer Inc. manufactures and sells notebook computers across Asia, the Americas, Europe, and internationally, with a market cap of NT$979.05 billion.

Operations: Quanta Computer Inc. generates revenue primarily from its Electronics Sector, amounting to NT$2.50 billion.

Estimated Discount To Fair Value: 26.1%

Quanta Computer's earnings are forecast to grow at 19.3% annually, outpacing the TW market average of 18.4%. The stock trades at NT$254, significantly below its estimated fair value of NT$343.49. Recent earnings show robust growth with net income for Q2 2024 rising to TWD 15.13 billion from TWD 10.12 billion a year ago. Additionally, Quanta announced a $1 billion private placement of unsecured overseas convertible bonds on September 9, 2024, enhancing its financial flexibility.

- According our earnings growth report, there's an indication that Quanta Computer might be ready to expand.

- Click to explore a detailed breakdown of our findings in Quanta Computer's balance sheet health report.

Next Steps

- Explore the 915 names from our Undervalued Stocks Based On Cash Flows screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2382

Quanta Computer

Manufactures and sells notebook computers in Asia, the Americas, Europe, and internationally.

Very undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives