- United States

- /

- Diversified Financial

- /

- NYSE:RKT

Rocket Companies (NYSE:RKT) Surges 23% Following Special Dividend Announcement of US$1

Reviewed by Simply Wall St

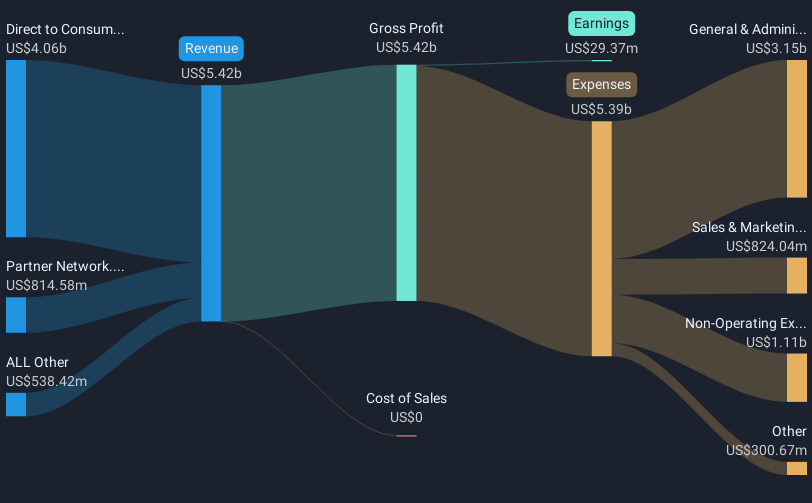

Rocket Companies (NYSE:RKT) experienced notable developments this past quarter, including corporate governance changes, a special dividend announcement, and a significant acquisition move. On March 10, 2025, the announcement of a special dividend of $0.80 per share likely bolstered investor sentiment alongside news of the planned Redfin acquisition, reflecting a proactive approach towards growth. Additionally, the company's improved earnings unveiled on February 27, which reported a positive net income shift from a previous loss, likely added to the optimism. These internal events coincided with a mixed market context, as U.S. equities faced a challenging period marked by a sluggish recovery amidst broader economic uncertainty and varied performances among major indexes. Despite these market conditions, Rocket Companies' strategic decisions and improved financial health appear to have supported its share price, culminating in a significant 23% rise over the last quarter.

Our expertly prepared valuation report Rocket Companies implies its share price may be too high.

Find companies with promising cash flow potential yet trading below their fair value.

Rocket Companies' shares have delivered a total return of 41.48% over the past three years. This performance reflects several key factors beyond recent quarterly announcements. The company's inclusion in the S&P Banks Select Industry Index in mid-September 2024 significantly enhanced its market visibility. Earlier in May 2024, Rocket Companies’ announcement of its intent to pursue acquisitions reinforced its growth strategy, attracting investor attention. Throughout the year, Rocket Companies underwent substantial executive changes, such as appointing Shawn Malhotra as Chief Technology Officer in May and Papanii Okai as Executive Vice President of Product Engineering in October, strengthening its leadership in AI-driven products.

These developments contributed to Rocket Companies' remarkable performance compared to their peers. Over the past year, the company's return exceeded both the US Diversified Financial industry's 17.1% return and the broader US market's 9.6% return, underscoring the effectiveness of its strategic initiatives and solidifying investor confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RKT

Rocket Companies

Provides spanning mortgage, real estate, and personal finance services in the United States and Canada.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives