- United States

- /

- Capital Markets

- /

- NYSE:RJF

Raymond James Secures Sparta Bank Partnership: Does This Signal a Shift in Advisor Strategy for RJF?

Reviewed by Sasha Jovanovic

- Earlier this week, Raymond James announced that the First National Bank of Sparta has selected its Financial Institutions Division to support the bank's investment program, Patton Wealth Management, with approximately US$261 million in client assets managed by advisor Brian Patton.

- This partnership demonstrates Raymond James’s continuing traction in expanding its advisor-focused wealth management services and deepening relationships with regional banks.

- We'll explore how this new alliance signals further momentum in advisor recruitment and strengthens Raymond James Financial’s investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Raymond James Financial Investment Narrative Recap

Shareholders in Raymond James Financial are typically believers in the firm’s ability to grow client assets through recruiting high-producing advisors and forging strong partnerships with regional banks. The recent addition of Patton Wealth Management from First National Bank of Sparta fits this narrative but does not materially alter the main short term catalyst, robust advisor recruitment, or address the key risk of uncertainty in net new asset growth due to shifting client sentiment or macroeconomic headwinds.

Of the various recent developments, the appointment of a Chief AI Officer stands out as particularly relevant. While the bank’s new business win with Patton Wealth Management is a signal of ongoing advisor traction, the focus on AI integration, aimed at supporting advisor productivity and improving operational efficiency, could be a meaningful lever supporting the ongoing advisor recruitment catalyst in future quarters.

However, investors should also keep in mind that, in contrast, rising uncertainty around net new asset inflows remains a critical issue they should be aware of…

Read the full narrative on Raymond James Financial (it's free!)

Raymond James Financial is projected to reach $17.3 billion in revenue and $2.7 billion in earnings by 2028. This outlook assumes an annual revenue growth rate of 8.0% and an increase in earnings of about $0.6 billion from the current $2.1 billion level.

Uncover how Raymond James Financial's forecasts yield a $175.83 fair value, a 8% upside to its current price.

Exploring Other Perspectives

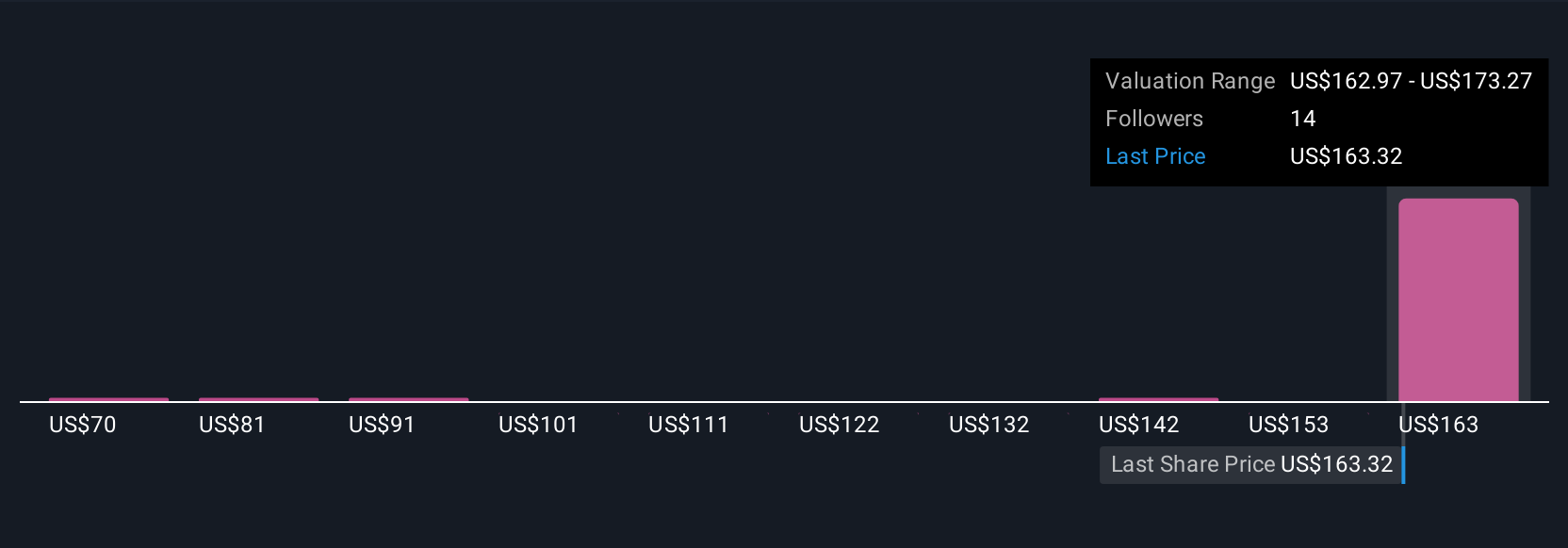

Six fair value estimates from the Simply Wall St Community range from US$70.20 to US$188.52. While many see advisor recruitment as a strong catalyst, opinions on future growth and value diverge markedly, be sure to review several perspectives.

Explore 6 other fair value estimates on Raymond James Financial - why the stock might be worth as much as 16% more than the current price!

Build Your Own Raymond James Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Raymond James Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Raymond James Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Raymond James Financial's overall financial health at a glance.

No Opportunity In Raymond James Financial?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RJF

Raymond James Financial

A diversified financial services company, provides private client group, capital markets, asset management, banking, and other services to individuals, corporations, and municipalities in the United States, Canada, and Europe.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives