- United States

- /

- Capital Markets

- /

- NYSE:RJF

Raymond James Financial (NYSE:RJF) Declares Dividends on Preferred and Common Shares

Reviewed by Simply Wall St

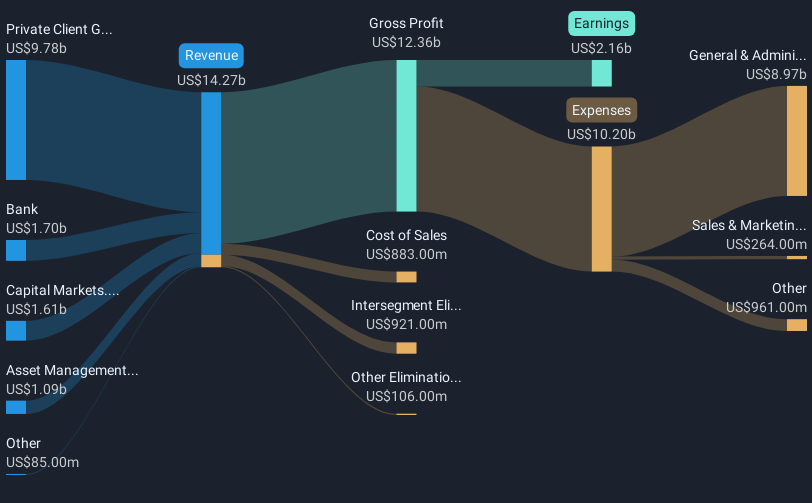

Raymond James Financial (NYSE:RJF) announced a quarterly cash dividend of $0.50 per share on common stock, set for July, which potentially bolstered investor sentiment, contributing to a 13% increase in share price over the last month. Alongside, the company's solid second-quarter earnings report indicating improved revenue and net income over the previous year further supported the upward trajectory. This investor confidence in RJF was seen despite broader market fluctuations influenced by federal deficit concerns and fluctuating bond yields. While the Dow Jones showed a slight rebound, RJF's strategies and financial performance may have provided additional support for the positive price movement.

The recent announcement of a US$0.50 quarterly dividend from Raymond James Financial potentially uplifted investor sentiment, aligning with the company's advantageous short-term share price increase. Over a five-year timeframe ending in May 2025, RJF shares delivered a total return of 229.14%, reflecting long-term resilience and growth. This return includes both share price appreciation and dividend payouts, suggesting a robust investment over that period. Comparatively, the 23.3% earnings growth over the past year surpassed the Capital Markets industry average of 17.8%, highlighting RJF's competitive position.

The company's strategic recruitment of high-net-worth advisors and investment in AI are anticipated to enhance future revenue and efficiency. With analysts forecasting a revenue growth rate of 5.5% annually and a projected earnings expansion to US$2.5 billion by 2028, these initiatives could support long-term growth despite uncertainties from market volatility and tech investment risks. However, interest rate and economic fluctuations present potential challenges to achieving these targets.

As of today's date, RJF's current share price of US$141.12 sits close to the consensus price target of US$152.50, reflecting a modest 7.5% upside potential, indicative of the market's perception that the company is relatively fairly valued at present. The slight discount to price target underscores the importance of these growth forecasts being realized to justify the anticipated valuations. Investors should consider these forecasts and their assumptions against personal insights when evaluating RJF's future prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RJF

Raymond James Financial

A diversified financial services company, provides private client group, capital markets, asset management, banking, and other services to individuals, corporations, and municipalities in the United States, Canada, and Europe.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives