- United States

- /

- Mortgage REITs

- /

- NYSE:RC

Ready Capital (RC): Evaluating Valuation After Sharp Stock Drop Following Quarterly Earnings Miss

Reviewed by Simply Wall St

Ready Capital (RC) shares dropped nearly 30% after the company reported quarterly results that did not meet expectations. This decline came as slower growth in net interest income and falling earnings per share have raised new questions about its long-term profitability.

See our latest analysis for Ready Capital.

After a steep 30% share price drop over the last month, Ready Capital's recent losses have only compounded a tough year. Its year-to-date share price return stands at -54.8%, with a 12-month total shareholder return of -48.9%. With momentum clearly fading, the recent earnings miss and slowing growth have added to investor caution, raising fresh questions about long-term value and stability.

If recent volatility has you thinking beyond traditional dividend payers, now's a smart time to expand your search and discover fast growing stocks with high insider ownership

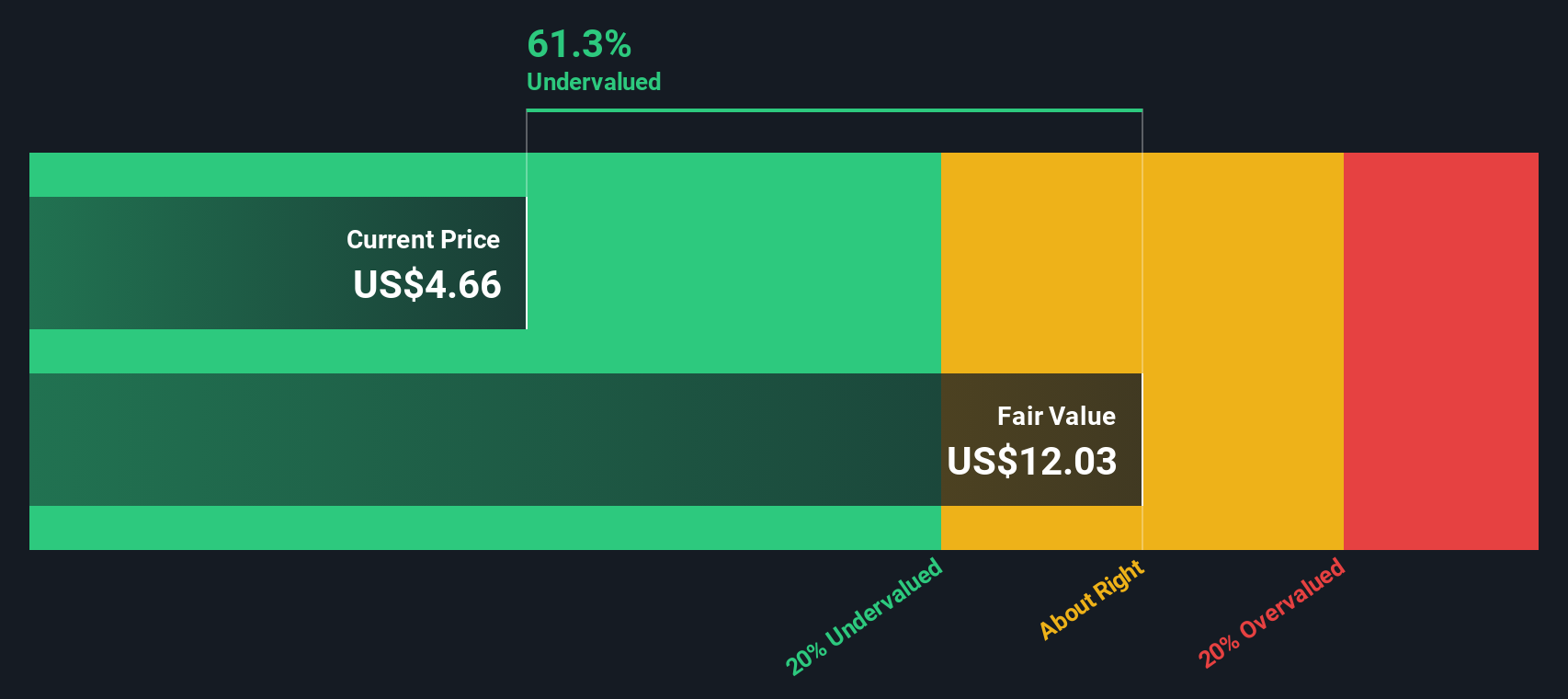

With Ready Capital’s shares now trading significantly below recent analyst targets and sentiment at a low, investors are left to ask whether today’s price reflects future challenges or if an undervalued opportunity is emerging for patient buyers.

Price-to-Book of 0.3x: Is it justified?

Ready Capital trades at a price-to-book multiple of 0.3x, well below both its industry and peer averages. This suggests the market values its assets at a significant discount after recent losses.

The price-to-book ratio compares a company's market capitalization to its book value, essentially showing what investors are willing to pay for each dollar of net assets. For mortgage REITs, which own income-producing real estate assets, this multiple is a key valuation benchmark.

The market is pricing Ready Capital lower than both the US Mortgage REIT industry average of 0.7x and the peer average of 0.6x. This implies expectations for weaker asset returns or higher risks ahead, even as the company navigates profitability challenges. There is insufficient data to determine what the fair ratio should be, but this deep discount could signal an undervalued situation if asset quality or earnings prospects improve.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 0.3x (UNDERVALUED)

However, ongoing net losses and persistent industry headwinds could continue to weigh on sentiment and limit any near-term recovery for Ready Capital shares.

Find out about the key risks to this Ready Capital narrative.

Another View: DCF Model Analysis

Looking beyond asset-based multiples, our DCF model takes a different approach and estimates Ready Capital’s fair value at $4.91 per share. This suggests the stock may be undervalued, with the current price trading about 36.6% below this assessment. Does this gap signal a chance for a turnaround, or does it reflect risks that are not fully captured by the model?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ready Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ready Capital Narrative

If you think there’s more to the story or prefer to dig into the numbers yourself, it’s easy to build a narrative from your own perspective. Do it your way

A great starting point for your Ready Capital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your strategy and give yourself an edge by seeing which stocks stand out in other fast-moving markets. These hand-picked ideas could take your investing to the next level.

- Spot opportunity by reviewing these 877 undervalued stocks based on cash flows that the market may have priced too low. This could set the stage for a potential rebound.

- Tap into innovation by checking out these 27 AI penny stocks driving advancements in artificial intelligence, automation, and tomorrow’s disruptive technologies.

- Strengthen your income stream with these 17 dividend stocks with yields > 3% that regularly deliver solid yields above 3%, rewarding you as these companies grow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RC

Ready Capital

Operates as a real estate finance company in the United States.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)