- United States

- /

- Diversified Financial

- /

- NYSE:PAY

3 US Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

Amid a backdrop of record highs for the S&P 500, with major U.S. indices inching closer to their peaks, investors are keeping a close eye on growth companies that feature high insider ownership. Such companies can be appealing in today's market environment as they often indicate a strong alignment between management and shareholder interests, which is crucial when navigating fluctuating economic conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 25.4% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 27.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Astera Labs (NasdaqGS:ALAB) | 15.7% | 61.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 103.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.2% | 33.8% |

| TruGolf Holdings (NasdaqGM:TRUG) | 30.2% | 58.0% |

Let's review some notable picks from our screened stocks.

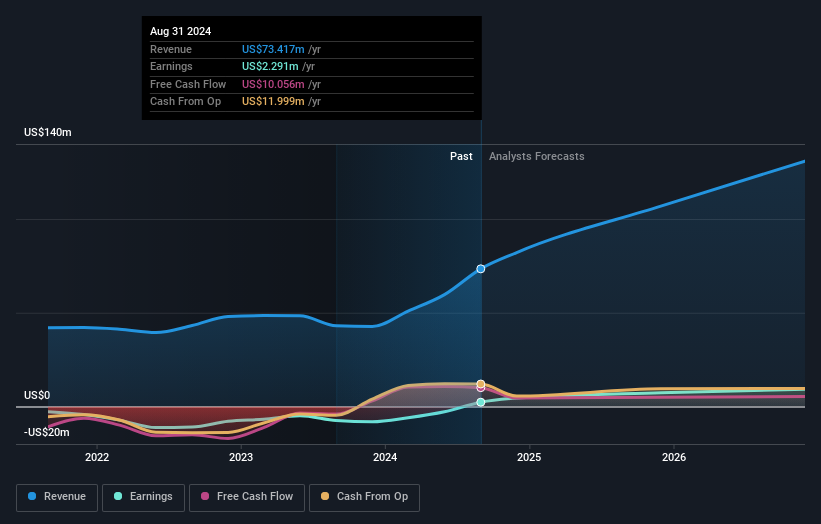

Byrna Technologies (NasdaqCM:BYRN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Byrna Technologies Inc. is a less-lethal self-defense technology company that develops, manufactures, and sells personal security solutions across various regions including the United States, with a market cap of $743.27 million.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, which generated $85.76 million.

Insider Ownership: 20.8%

Byrna Technologies has achieved profitability, with net income of US$12.79 million for 2024, reversing a previous loss. Revenue doubled to US$85.76 million, reflecting strong growth potential with expected annual earnings growth of 22.7%. Despite significant insider selling recently, Byrna's strategic retail expansion and partnership with the USCCA position it well in the less-lethal market. The opening of new stores aims to enhance brand presence and drive demand further in key markets.

- Click to explore a detailed breakdown of our findings in Byrna Technologies' earnings growth report.

- The analysis detailed in our Byrna Technologies valuation report hints at an inflated share price compared to its estimated value.

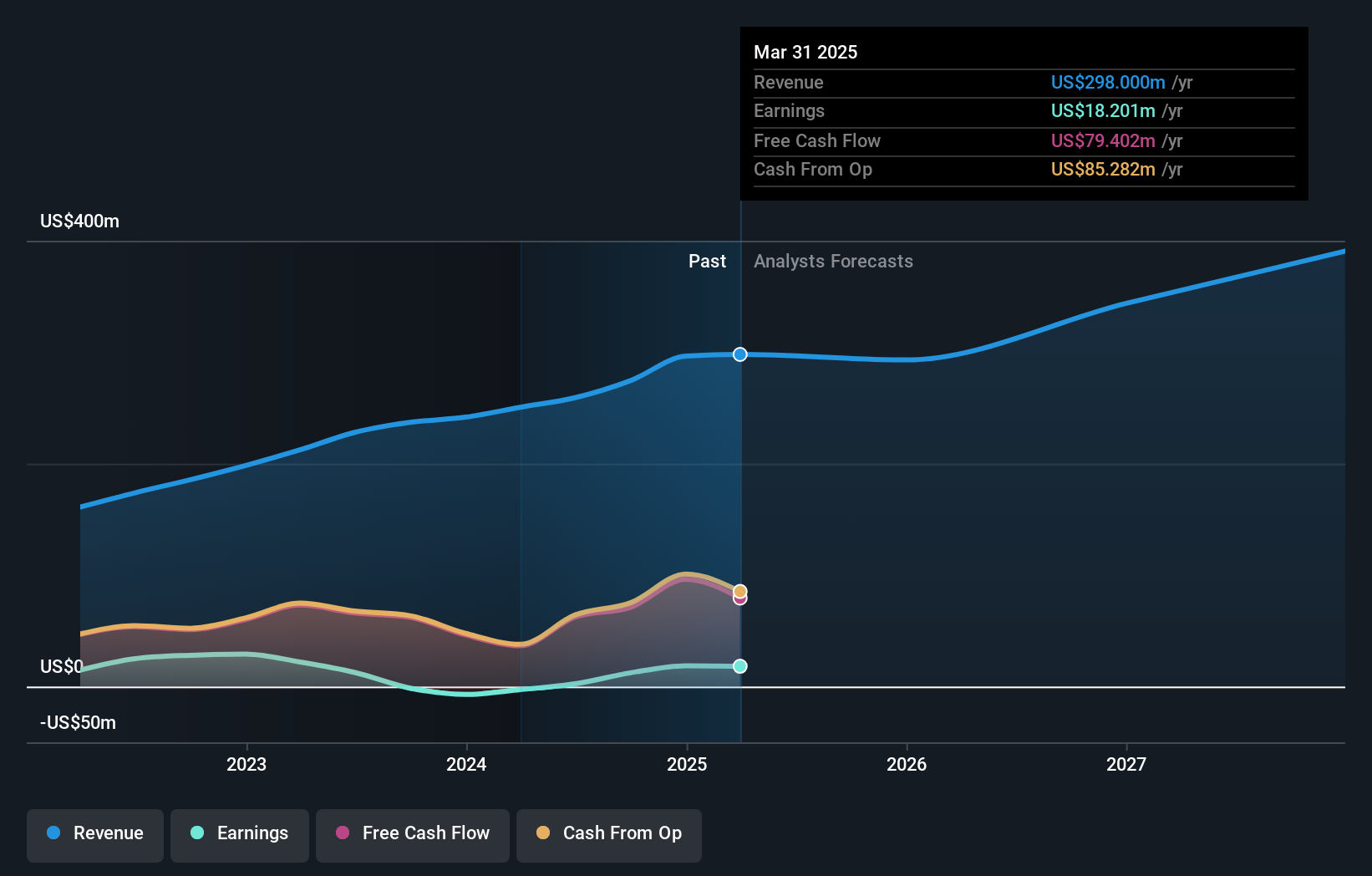

Paymentus Holdings (NYSE:PAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paymentus Holdings, Inc. offers cloud-based bill payment technology and solutions both in the United States and internationally, with a market cap of approximately $4.01 billion.

Operations: The company generates revenue primarily through its services to financial companies, amounting to $778.67 million.

Insider Ownership: 20.1%

Paymentus Holdings is poised for strong growth, with earnings expected to rise significantly at 22.5% annually over the next three years, outpacing the broader US market's growth rate. Revenue is also forecasted to grow robustly at 19.3% per year, surpassing market averages despite being below 20%. Recent conference presentations by top executives underscore strategic visibility but no substantial insider trading activity has been reported recently. Return on equity remains a concern with forecasts indicating it will be low in three years.

- Click here to discover the nuances of Paymentus Holdings with our detailed analytical future growth report.

- Our valuation report here indicates Paymentus Holdings may be overvalued.

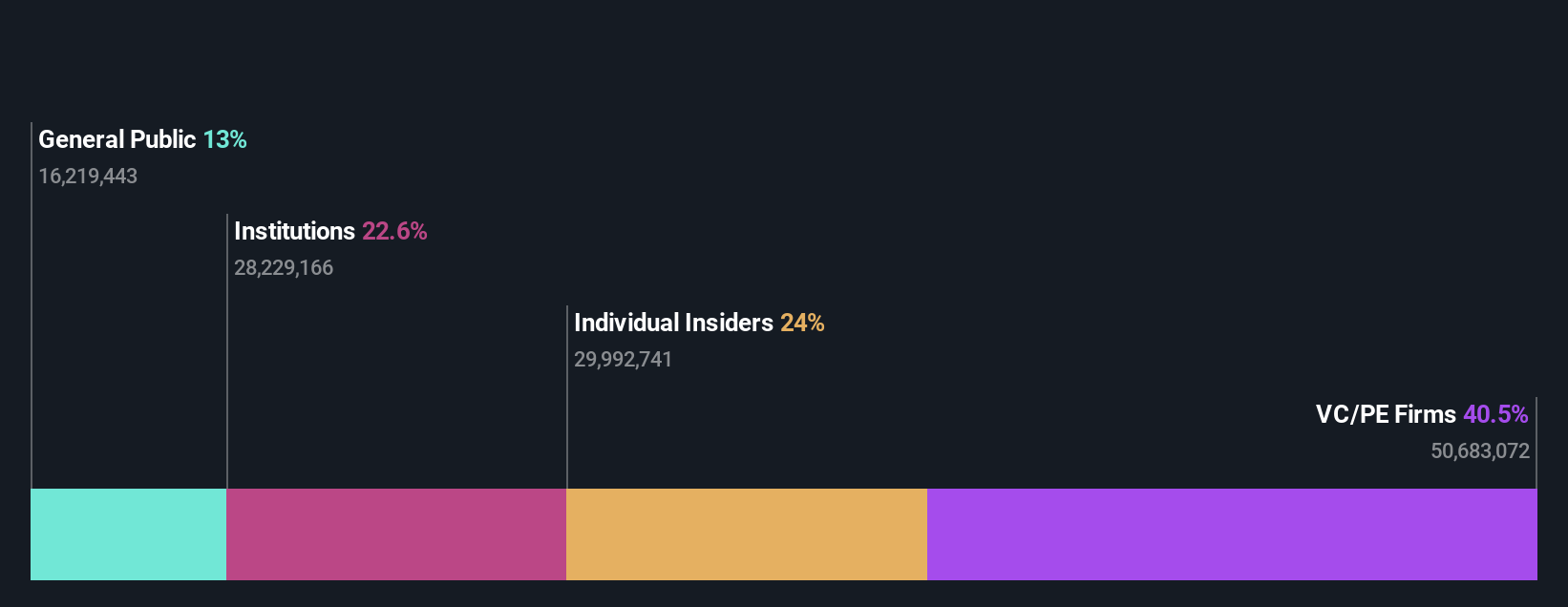

P10 (NYSE:PX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: P10, Inc. operates as a multi-asset class private market solutions provider in the U.S. alternative asset management industry, with a market cap of approximately $1.51 billion.

Operations: The company's revenue is primarily derived from its asset management segment, totaling $296.45 million.

Insider Ownership: 28.8%

P10, Inc. demonstrates significant growth potential with earnings expected to grow at 32.9% annually, outpacing the US market. Recent financial results show a transition to profitability with a net income of US$18.7 million for 2024 compared to a loss in the previous year. Despite slower revenue growth forecasts at 7.8%, insider activity remains positive with substantial share repurchases totaling US$88.46 million, indicating confidence from within the company despite recent insider selling trends.

- Unlock comprehensive insights into our analysis of P10 stock in this growth report.

- According our valuation report, there's an indication that P10's share price might be on the expensive side.

Key Takeaways

- Delve into our full catalog of 198 Fast Growing US Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAY

Paymentus Holdings

Provides cloud-based bill payment technology and solutions in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives