- United States

- /

- Consumer Finance

- /

- NYSE:OMF

Is OneMain’s Q3 Beat and Planned Insider Sale Reframing the Investment Case for OMF?

Reviewed by Sasha Jovanovic

- In the past quarter, OneMain Holdings reported Q3 2025 results that topped expectations, delivering earnings per share of US$1.90 on revenue of US$1.24 billion, while Senior Vice President and Group Controller Michael A. Hedlund sold 652 shares under a pre-arranged Rule 10b5-1 plan.

- This mix of stronger-than-expected operating performance and routine insider selling under a set trading plan offers investors a nuanced view of both business momentum and executive share activity.

- With Q3 earnings surpassing forecasts, we’ll now examine how this stronger profitability shapes OneMain Holdings’ existing investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

OneMain Holdings Investment Narrative Recap

To own OneMain Holdings, you have to believe in the resilience of its nonprime lending model and its ability to balance growth with tight credit discipline. The Q3 2025 beat, with EPS of US$1.90 on US$1.24 billion in revenue, supports the near term profitability story, while the small 652 share sale by an executive under a Rule 10b5-1 plan does not materially change the key near term catalyst or the biggest risk around credit quality and funding costs.

The recent announcement of a new US$1,000 million share repurchase authorization through 2028 is the most relevant backdrop to this earnings beat, because it reinforces how management is pairing higher earnings with ongoing capital returns. For investors focused on catalysts, that combination of stronger profitability, a rising dividend and active buybacks can be powerful, but it sits alongside meaningful exposure to nonprime borrowers and funding market conditions.

Yet behind the strong headline numbers, investors should be aware of how sensitive OneMain’s nonprime portfolio remains to...

Read the full narrative on OneMain Holdings (it's free!)

OneMain Holdings' narrative projects $6.8 billion revenue and $1.3 billion earnings by 2028.

Uncover how OneMain Holdings' forecasts yield a $66.21 fair value, a 5% upside to its current price.

Exploring Other Perspectives

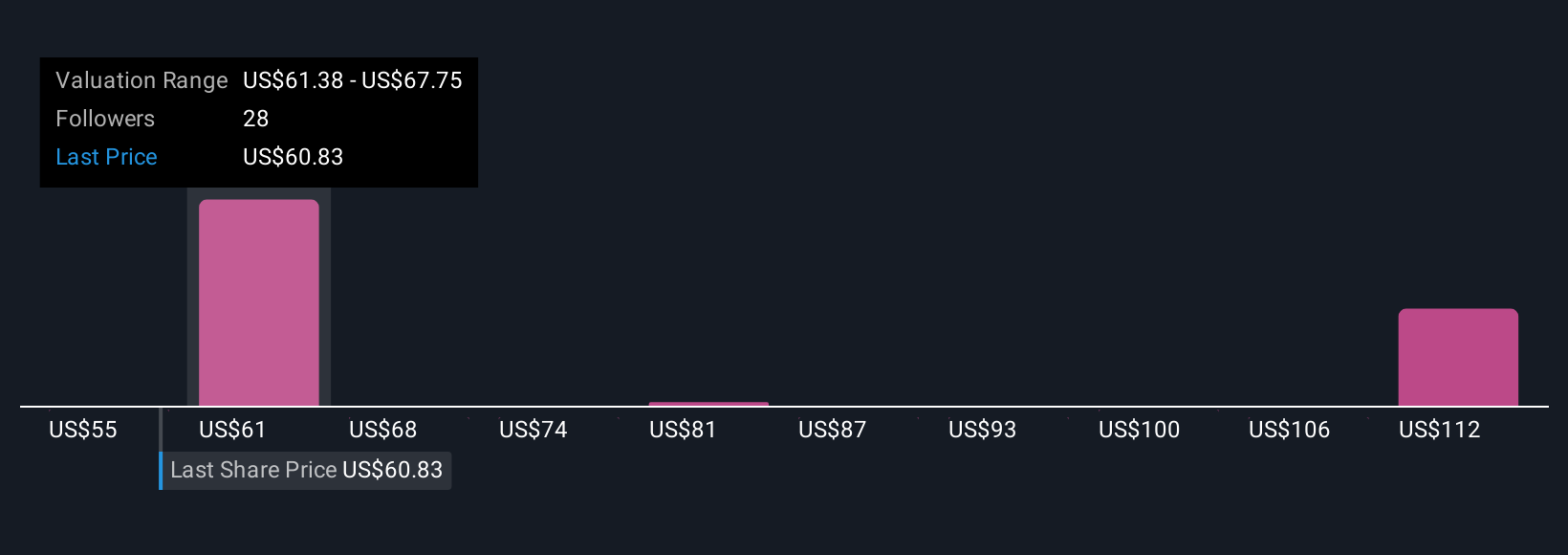

Five Simply Wall St Community valuations span roughly US$55 to about US$112 per share, underscoring how differently retail investors assess OneMain’s prospects. Against that wide range, the core risk around nonprime exposure and funding costs could have very different implications for returns if credit conditions or liquidity were to tighten.

Explore 5 other fair value estimates on OneMain Holdings - why the stock might be worth 13% less than the current price!

Build Your Own OneMain Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OneMain Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free OneMain Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OneMain Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OMF

OneMain Holdings

A financial service holding company, engages in the consumer finance and insurance businesses in the United States.

Exceptional growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026