- United States

- /

- Consumer Finance

- /

- NYSE:OMF

Does OneMain’s Drop Present an Opportunity After Its Strong Five Year Performance?

Reviewed by Bailey Pemberton

If you’re staring at OneMain Holdings and wondering whether now is the right time to buy, sell, or hold, you’re not alone. The story here is about more than just this week’s 2.1% dip or the stock’s modest 5.5% year-to-date advance. OneMain Holdings has carved out an impressive long-term run, with a 28.5% return over the past year and an eye-catching 153.8% gain over five years. That kind of performance doesn’t just happen by accident. It reflects a mix of consumer lending trends, ongoing discipline in a changing rate environment, and market confidence in the company’s ability to deliver steady growth even when volatility rises.

This stock’s appeal becomes even clearer when you look at valuation. By our screening, OneMain currently earns a value score of 5 out of 6, meaning it’s considered undervalued on five key checks. That’s a big signal for anyone seeking bargains in today’s market. But before diving headfirst into a decision, it’s smart to look beyond just the surface numbers and break down how each valuation method measures up for OneMain, and most importantly, reveal one insight that could matter even more than the score itself.

Why OneMain Holdings is lagging behind its peers

Approach 1: OneMain Holdings Excess Returns Analysis

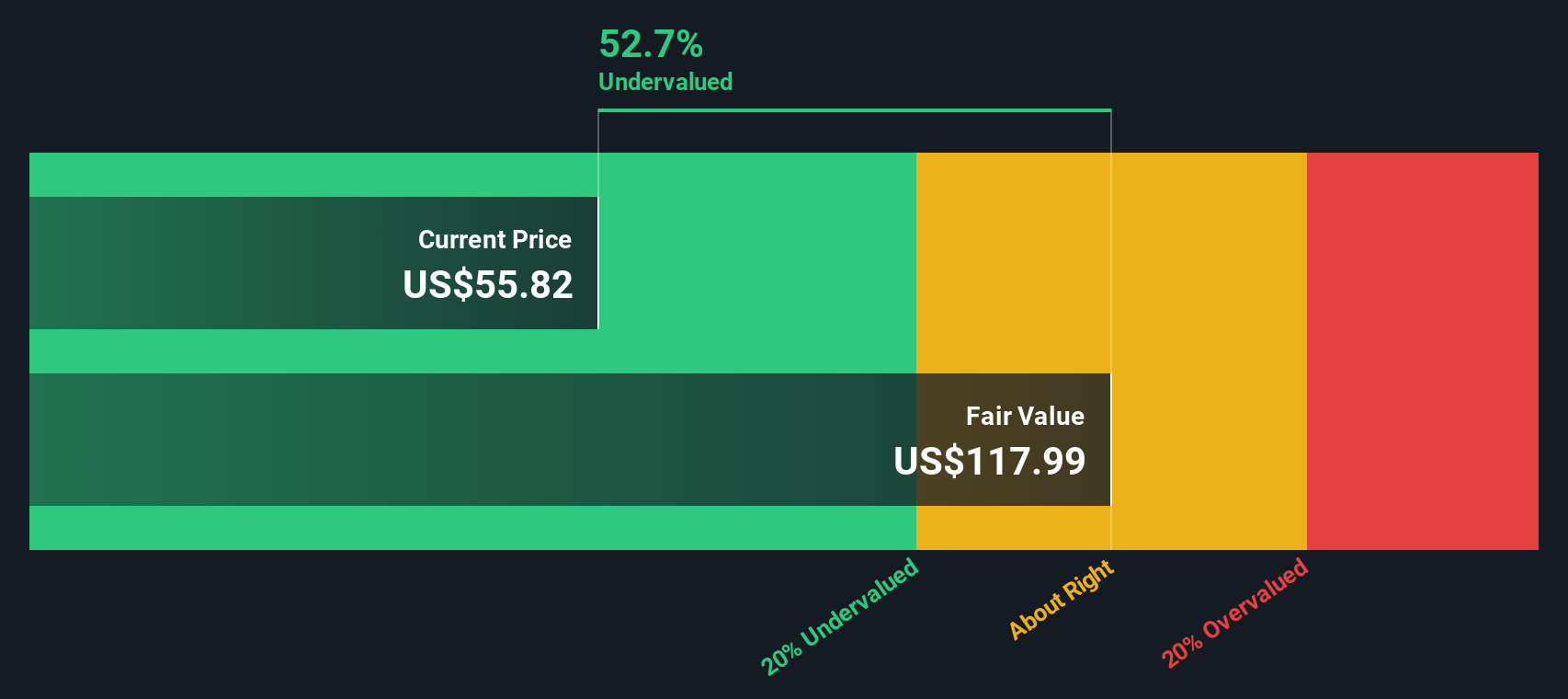

The Excess Returns model focuses on how effectively a company delivers returns above the minimum required rate for its investors. For OneMain Holdings, this means evaluating the profits generated for shareholders versus the cost of equity. This approach provides a clear snapshot of the business’s ability to grow shareholder value over time.

OneMain’s current Book Value stands at $27.98 per share, with a Stable EPS of $11.89 per share. This profitability is driven by an average Return on Equity of 37.49%, far above typical industry benchmarks. The company’s Cost of Equity comes in at $3.91 per share, leaving a sizable annual Excess Return of $7.98 per share. Analysts expect the Stable Book Value to rise to $31.71 per share, indicating ongoing confidence in future growth.

Based on these figures, the Excess Returns model estimates an intrinsic value that is 53.7% higher than the current share price. This suggests the stock is deeply undervalued at today’s levels and adds a layer of conviction for investors seeking attractive entry points.

Result: UNDERVALUED

Our Excess Returns analysis suggests OneMain Holdings is undervalued by 53.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

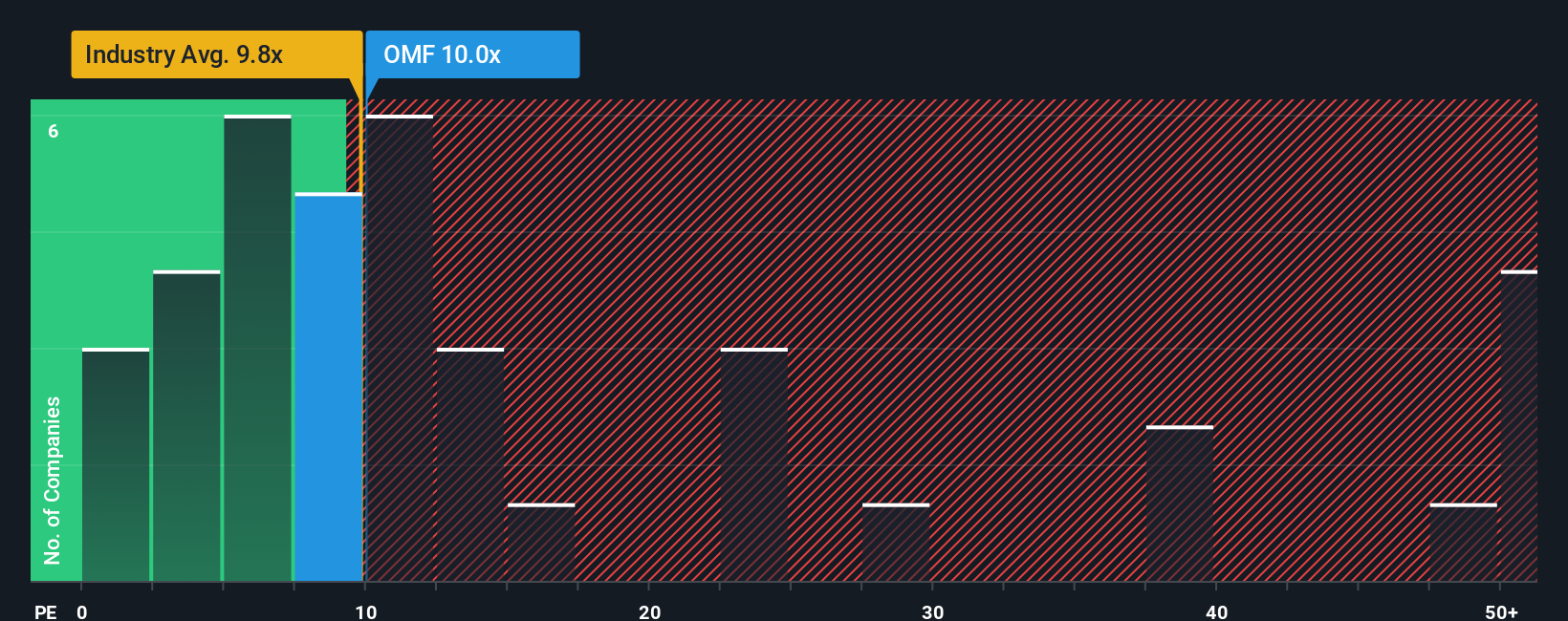

Approach 2: OneMain Holdings Price vs Earnings

For profitable companies like OneMain Holdings, the Price-to-Earnings (PE) ratio is a widely used valuation metric because it directly reflects how much investors are willing to pay for each dollar of earnings. It's straightforward, intuitive, and especially meaningful for companies with a consistent earnings track record.

The “right” PE ratio for any company depends on factors like expected earnings growth, the stability of those profits, and the risks facing the business or its sector. Generally, companies with stronger growth prospects or lower risk profiles deserve higher PE multiples, while slower-growing or riskier firms trade at lower ratios.

OneMain Holdings currently trades at a PE ratio of 9.8x. That’s a discount compared to both the peer average of 16.1x and the wider Consumer Finance industry average of 10.3x. However, looking past simple benchmarks, Simply Wall St’s Fair Ratio for OneMain is 17.9x. This Fair Ratio factors in a blend of important drivers including the company’s earnings growth, profit margin, industry context, market cap, and risk level, offering a more tailored assessment than a blanket comparison with industry peers.

Since OneMain’s actual PE ratio of 9.8x is well below its Fair Ratio of 17.9x, the stock looks significantly undervalued using this approach. This provides another indication of potential upside for investors seeking value.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your OneMain Holdings Narrative

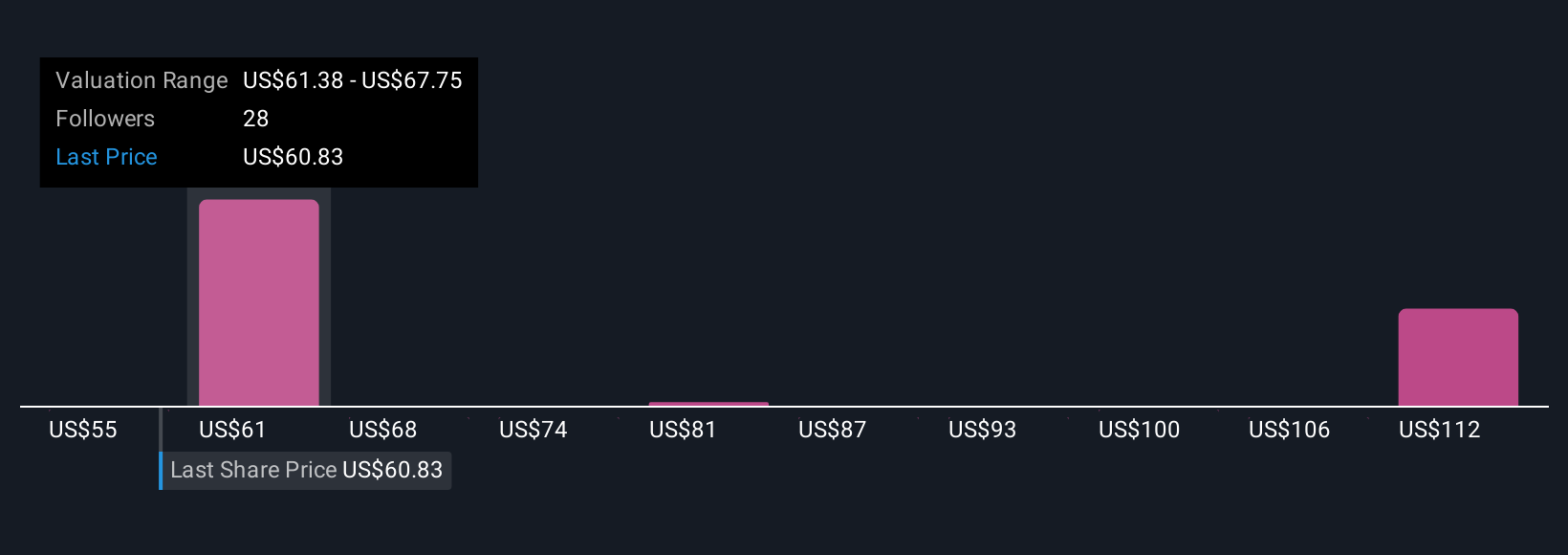

Earlier we mentioned that there is an even better way to understand a company’s value, so let’s introduce you to Narratives. A Narrative is simply the story you believe about a company’s future, your perspective on its prospects and risks, linked directly to your financial forecasts and an estimated fair value. Narratives transform numbers into context, allowing you to connect the company’s recent performance, industry changes, and key news to your own forecast of metrics like revenue growth, earnings, and profit margins.

On Simply Wall St's Community page, creating a Narrative is easy and accessible; millions of investors use this tool to anchor their own investment outlooks in a way that is dynamic and updates automatically when new information, such as earnings or industry news, becomes available. Narratives help you visualize a company’s future and also guide clear decisions. If your fair value is higher than today’s price, it might be a buy. If lower, it may be a sell or hold. This way, your moves reflect your personal view, not just the crowd’s.

For example, some investors expect rapid digital growth and set a bullish fair value as high as $74.00, while others foresee margin pressure and use a more cautious estimate near $56.00. Both are valid Narratives based on different assumptions about OneMain Holdings’ future.

Do you think there's more to the story for OneMain Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OMF

OneMain Holdings

A financial service holding company, engages in the consumer finance and insurance businesses in the United States.

Undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives