- United States

- /

- Capital Markets

- /

- NYSE:MS

Morgan Stanley’s Crypto Expansion: What the Digital Pivot Means for Its Valuation

Reviewed by Kshitija Bhandaru

Morgan Stanley is drawing attention after announcing it will expand cryptocurrency investment access for all its wealth management clients starting October 15. This move signals a major step toward mainstream adoption of digital assets within traditional banking.

See our latest analysis for Morgan Stanley.

Morgan Stanley’s decision to open up crypto investing to all clients comes as momentum builds around the stock, with a surge in M&A and trading activity adding to the buzz. The company’s total shareholder return has been remarkable, rising 42.3% in the past year and an impressive 123% over three years. This suggests investor confidence is on the upswing as earnings season approaches and major business segments stay resilient.

If you’re curious what else is capturing market attention lately, now’s the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares up strongly over the past year and analyst price targets now nearly matched, the critical question is whether Morgan Stanley remains undervalued or if the market has already priced in its next stage of growth.

Most Popular Narrative: Fairly Valued

With Morgan Stanley trading at $155.13 and the narrative’s fair value at $154.75, the market appears closely aligned with analyst expectations, which is a rare occurrence in a fast-moving sector.

*The ongoing increase in global wealth, combined with the accelerating intergenerational transfer of assets, is boosting demand for comprehensive advisory and wealth management solutions. This is evidenced by record net new assets and a growing client base, which should drive higher recurring fee-based revenue and long-term earnings growth.*

What financial engine powers this nearly perfect pricing? The narrative projects future expansion fueled by rising client demand and sharpened efficiency. These are numbers that could surprise even the closest followers. Curious about how profit margins, revenue forecasts, and market share ambitions shape this razor-thin valuation? Dive in to uncover which assumptions really move the fair value needle.

Result: Fair Value of $154.75 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, changes in investor behavior toward low-fee products and any unexpected regulatory shifts could quickly challenge Morgan Stanley's current outlook and growth prospects.

Find out about the key risks to this Morgan Stanley narrative.

Another View: Putting the Numbers to the Test

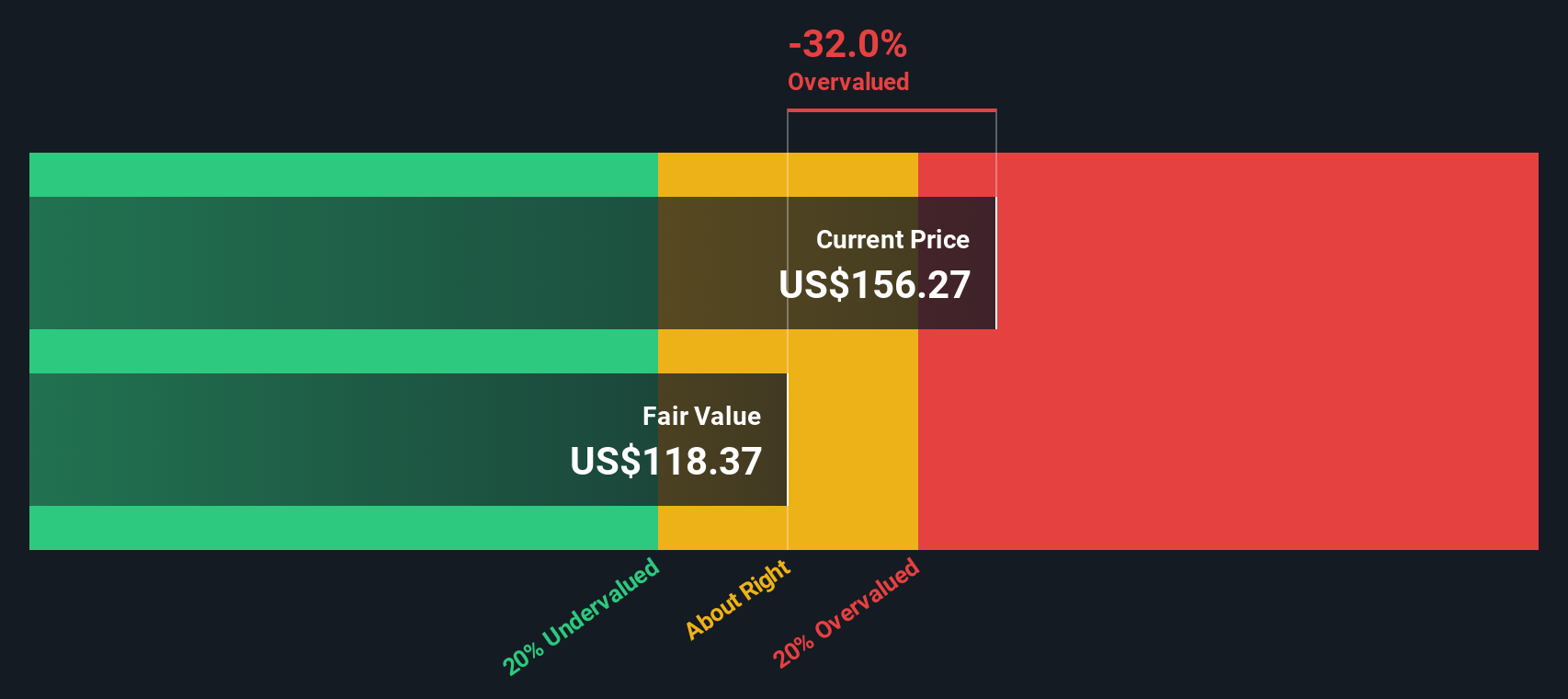

Looking at Morgan Stanley through the lens of our DCF model, we arrive at a fair value that is lower than today’s share price. This suggests the stock may be a bit overvalued based on projected cash flows. Does this mean the current optimism is ahead of itself, or is there more driving momentum than the numbers alone reveal?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Morgan Stanley Narrative

If you see things differently or want to understand the numbers for yourself, it takes just minutes to shape your own story and see where it leads. Do it your way

A great starting point for your Morgan Stanley research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize your edge and get ahead of the pack. With so many unique investment angles, you could uncover market winners before others even notice.

- Unlock the potential of cutting-edge healthcare by seeing which future-focused innovators stand out among these 33 healthcare AI stocks.

- Capture reliable income streams by evaluating high-yield options found within these 18 dividend stocks with yields > 3%.

- Tap opportunities in emerging technology with these 26 quantum computing stocks to bring tomorrow’s breakthroughs to today’s portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives