- United States

- /

- Capital Markets

- /

- NYSE:MS

Morgan Stanley (NYSE:MS) Sees 13% Weekly Dip; Deputy CFO Resigns

Reviewed by Simply Wall St

Morgan Stanley (NYSE:MS) experienced a share price decline of 13% over the past week. This may be partly linked to the resignation of Raja Akram, Deputy Chief Financial Officer, and strategic discussions about selling a stake in PNE AG, a German renewable developer. The company's stock price was also caught in the broader market downturn, as major indexes like the Dow Jones, S&P 500, and Nasdaq saw substantial declines due to escalating trade tensions and new tariffs. The overall market volatility contributed significantly to Morgan Stanley's share price movement during the week.

We've identified 2 warning signs for Morgan Stanley that you should be aware of.

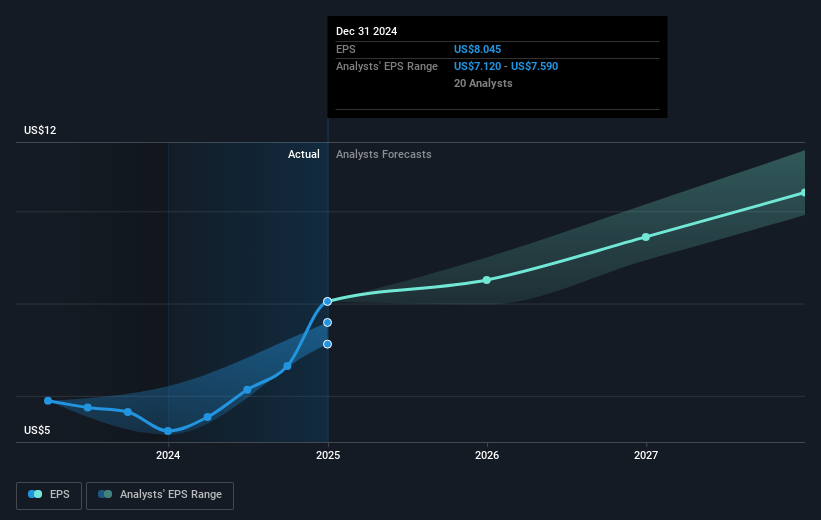

Over the past five years, Morgan Stanley's total shareholder return reached 185.66%, reflecting significant growth and resilience amidst a fluctuating market climate. This performance is partly attributable to its strategic initiatives, including the integration of firms such as E*TRADE and Parametric, which bolstered client acquisition and revenue growth. The firm's Investments in technology have supported these efforts, enhancing operational efficiencies and infrastructure. Addressing geopolitical uncertainties and rising interest rates also emerged as a challenge, yet Morgan Stanley's leadership in global institutional securities and robust M&A advisory activities facilitated a steady revenue stream. Dividend increases, aligned with fee-based earnings growth, further exemplified the company's commitment to rewarding shareholders.

Despite recent executive and board changes, such as the resignation of Raja Akram, Morgan Stanley maintained momentum by successfully navigating complex financial landscapes. A consistent dividend policy and substantial buybacks, including a US$749.94 million repurchase of shares in Q4 2024, underscored its robust capital return strategy. Its emphasis on expanding Wealth and Investment Management has translated into material growth in assets, supporting sustainable earnings and enhancing shareholder value. Over the last year, Morgan Stanley outperformed the US market, which experienced a 3.3% decline.

Understand Morgan Stanley's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Morgan Stanley, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives