- United States

- /

- Capital Markets

- /

- NYSE:MS

Morgan Stanley (NYSE:MS) Explores Sale Of EUR 543M Stake In PNE AG

Reviewed by Simply Wall St

Morgan Stanley (NYSE:MS) has been making headlines due to its discussions with Goldman Sachs to potentially sell its majority stake in German renewable project developer PNE AG. Despite this, the company's stock experienced a price move of 1.22% last week. This change in share price occurred amidst broader market challenges, including concerns over inflation and weak consumer sentiment that led to a selloff affecting financial markets. The market's reaction to higher-than-expected inflation data and reduced consumer confidence may have overshadowed Morgan Stanley's specific corporate developments in influencing its stock price.

Be aware that Morgan Stanley is showing 2 weaknesses in our investment analysis.

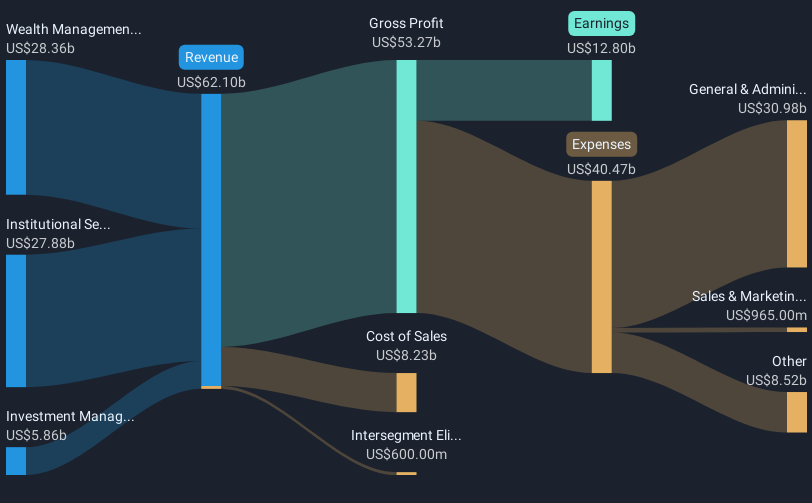

Morgan Stanley's total shareholder returns over the last five years amounted to 312.63%, reflecting substantial gains from both share price appreciation and dividends. This performance contrasts with the past year, where the company surpassed both the US market, which returned 7.8%, and the US Capital Markets industry at 17.8%. Several key factors have underpinned its longer-term performance. Notably, substantial investments in E*TRADE and Parametric have aimed to boost client acquisition and infrastructure, contributing to durable earnings growth. The firm's leadership in global institutional securities has also positioned it well to capitalize on a rebound in capital markets activity.

Morgan Stanley's commitment to capital return policies, including dividends aligned with fee-based earnings growth, has further enhanced shareholder value. The company's aggressive buyback programs, including the repurchase of millions of shares in late 2024, have also played a role. Executive changes, such as the election of a new Chairman and the appointment of numerous Managing Directors, have brought renewed focus on strengthening its leadership structure. These initiatives, coupled with ongoing integration efforts across key segments, have helped sustain growth and strengthen the company's market position.

Dive into the specifics of Morgan Stanley here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives