Stock Analysis

- United States

- /

- Consumer Finance

- /

- NYSE:ML

High Insider Ownership Marks These US Growth Companies For July 2024

Reviewed by Simply Wall St

As of July 2024, major U.S. stock indexes like the Dow Jones, S&P 500, and Nasdaq have been experiencing fluctuations, reflecting a mix of investor reactions to corporate earnings and economic indicators. In this context, examining growth companies with high insider ownership can offer valuable insights, as such ownership might suggest confidence from those who know the company best amidst current market volatilities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 25.2% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 34% |

| Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.5% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Let's dive into some prime choices out of from the screener.

Liquidia (NasdaqCM:LQDA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liquidia Corporation is a biopharmaceutical company based in the United States that focuses on developing, manufacturing, and commercializing products aimed at addressing unmet patient needs, with a market capitalization of approximately $839.02 million.

Operations: The company generates revenue primarily from its pharmaceuticals segment, totaling $15.97 million.

Insider Ownership: 11.2%

Revenue Growth Forecast: 40% p.a.

Liquidia, despite recent index drops, shows robust potential with a forecasted revenue growth of 40% per year, significantly outpacing the US market average of 8.6%. The company is trading at 67.3% below its estimated fair value and is expected to become profitable within three years. Recent legal victories further solidify its market position, enhancing prospects for its YUTREPIA™ product line despite a substantial net loss in Q1 2024 and shareholder dilution over the past year.

- Dive into the specifics of Liquidia here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Liquidia is trading behind its estimated value.

MoneyLion (NYSE:ML)

Simply Wall St Growth Rating: ★★★★☆☆

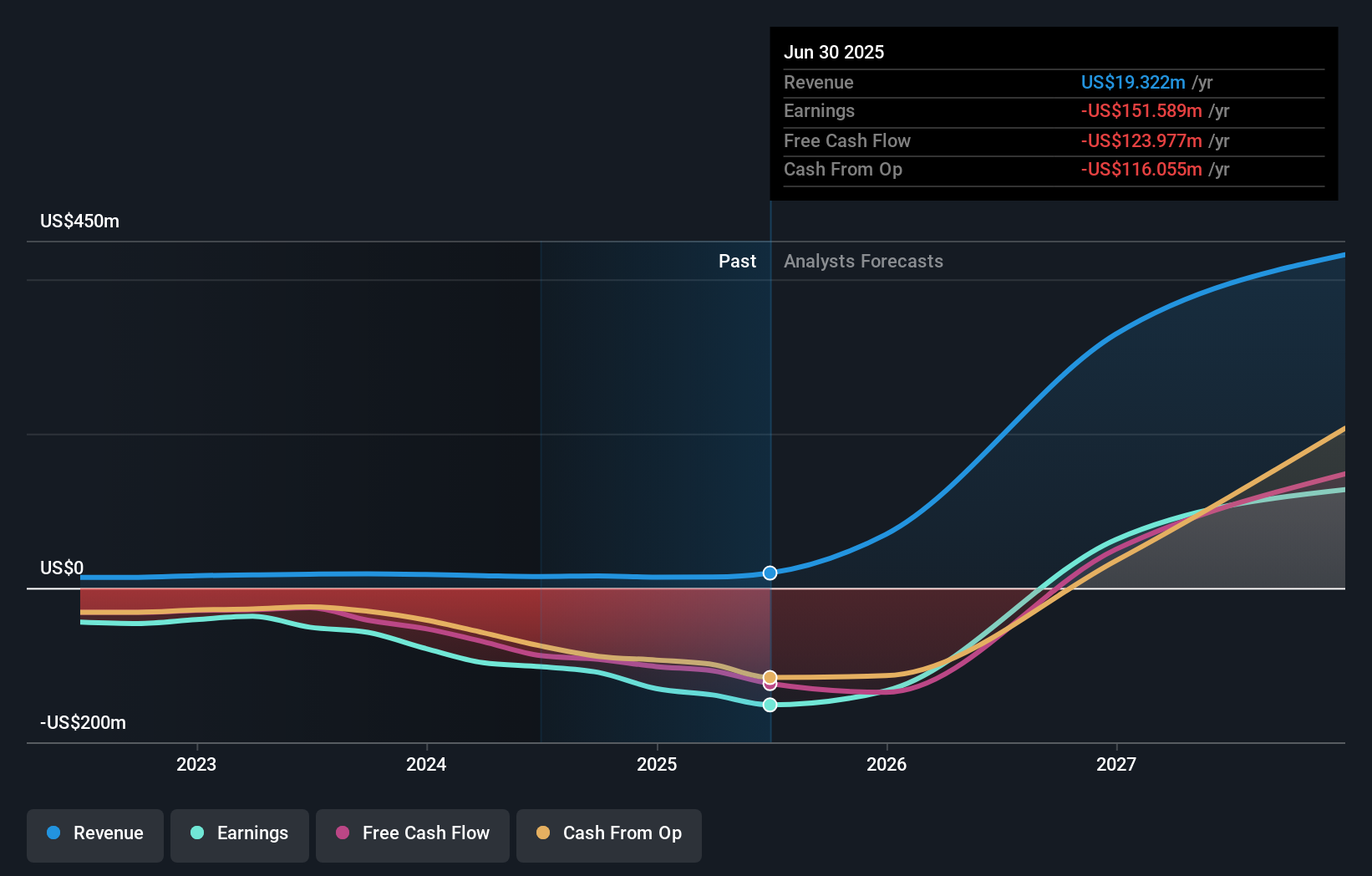

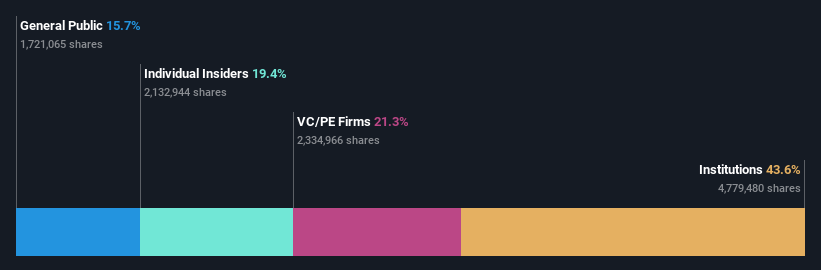

Overview: MoneyLion Inc., a financial technology company, offers customized financial products and content to American consumers, with a market capitalization of approximately $893.71 million.

Operations: The company generates its revenue primarily from data processing, amounting to $450.77 million.

Insider Ownership: 19.9%

Revenue Growth Forecast: 19.5% p.a.

MoneyLion, a fintech company, has experienced significant changes and growth. Recently, Brad Hanson joined its Board of Directors, enhancing governance with his extensive financial services experience. The company reported a notable improvement in Q1 2024 earnings with US$121.01 million revenue and US$7.08 million net income, reversing previous losses. MoneyLion's inclusion in multiple Russell indexes reflects its expanding market presence despite some shareholder dilution over the past year and high share price volatility.

- Click to explore a detailed breakdown of our findings in MoneyLion's earnings growth report.

- Our valuation report unveils the possibility MoneyLion's shares may be trading at a premium.

XPeng (NYSE:XPEV)

Simply Wall St Growth Rating: ★★★★★☆

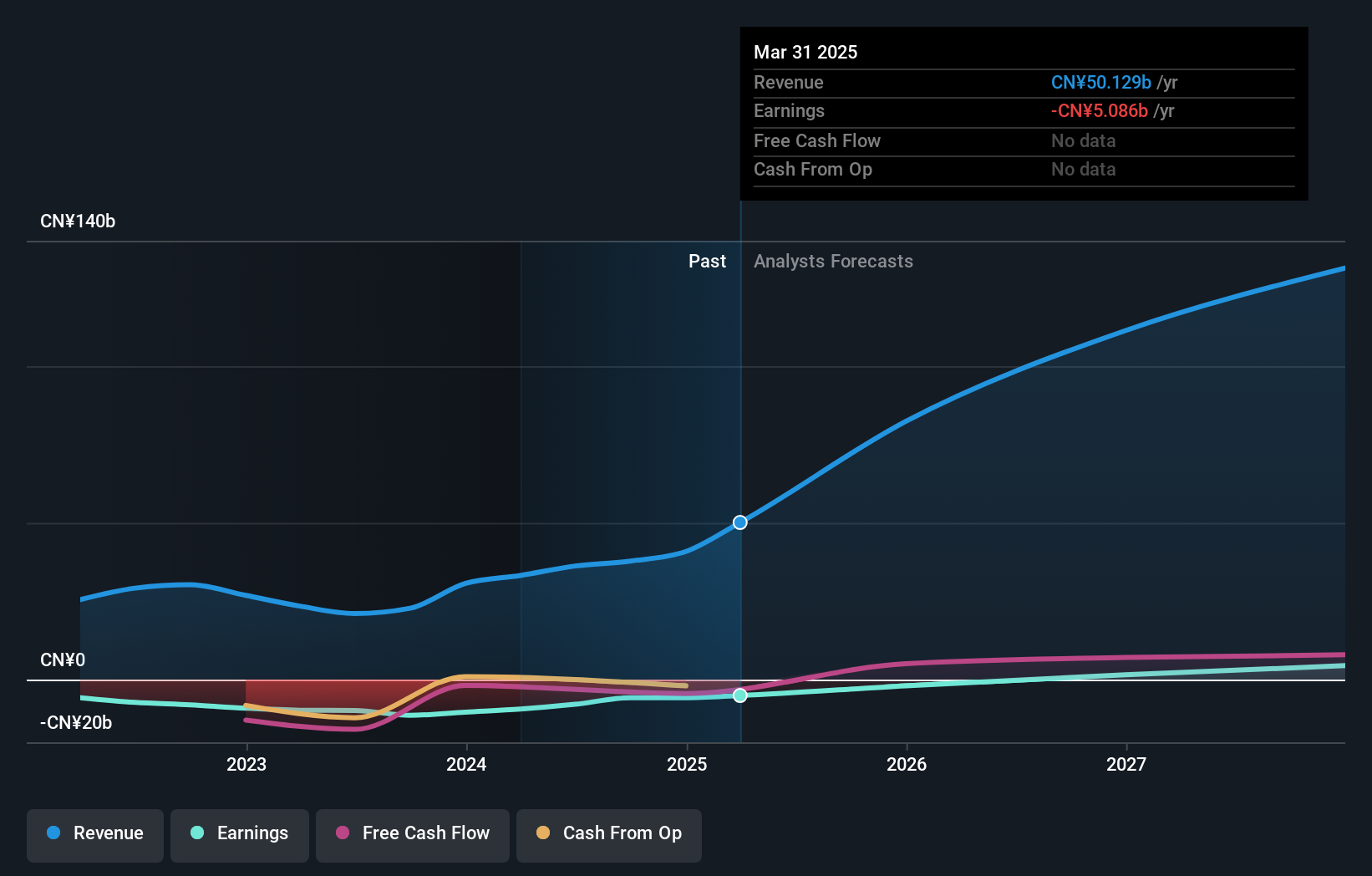

Overview: XPeng Inc., operating in the People’s Republic of China, focuses on designing, developing, manufacturing, and marketing smart electric vehicles (EVs), with a market capitalization of approximately $8.13 billion.

Operations: The company generates its revenue primarily from the auto manufacturing segment, totaling CN¥33.19 billion.

Insider Ownership: 23.3%

Revenue Growth Forecast: 26.2% p.a.

XPeng, a key player in the EV market, is demonstrating robust growth with a 26.2% annual revenue increase, outpacing the US market's 8.6%. Despite recent executive changes and high share price volatility, XPeng maintains strong delivery numbers and innovative AI advancements in smart vehicles. Insider ownership remains significant, aligning leadership interests with shareholders. Expected to turn profitable within three years, XPeng's strategic focus on AI and smart technologies positions it well for future growth.

- Take a closer look at XPeng's potential here in our earnings growth report.

- According our valuation report, there's an indication that XPeng's share price might be on the cheaper side.

Taking Advantage

- Unlock our comprehensive list of 183 Fast Growing US Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether MoneyLion is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ML

MoneyLion

A financial technology company, provides personalized products and financial content for American consumers.

Excellent balance sheet with reasonable growth potential.