- United States

- /

- Real Estate

- /

- NYSE:FPH

Discovering 3 Undiscovered Gems in the US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 3.6% drop, yet it remains up by 17% over the past year with earnings anticipated to grow by 14% annually in coming years. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering hidden opportunities in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Willdan Group (NasdaqGM:WLDN)

Simply Wall St Value Rating: ★★★★★★

Overview: Willdan Group, Inc. offers professional, technical, and consulting services mainly in the United States with a market capitalization of $460.61 million.

Operations: Willdan Group generates revenue primarily from its Energy segment, contributing $487.28 million, and its Engineering and Consulting segment, which adds $90.13 million.

Willdan Group, a smaller player in the professional services sector, has seen its earnings skyrocket by 840% over the past year, outpacing industry growth of 11.5%. The company's debt to equity ratio improved significantly from 67% to 41.3% over five years, with interest payments well-covered at a multiple of 3.9x EBIT. Recent projects like an $11 million energy modernization initiative in South Lake Tahoe underscore Willdan's strategic focus on energy efficiency and infrastructure enhancements. Despite trading at a notable discount to estimated fair value, potential policy shifts pose risks due to reliance on utility and government clients.

Five Point Holdings (NYSE:FPH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Five Point Holdings, LLC, operates through its subsidiary to own and develop mixed-use and planned communities in Orange County, Los Angeles County, and San Francisco County with a market capitalization of approximately $807.63 million.

Operations: Five Point Holdings generates revenue primarily from its Valencia and Great Park segments, with Great Park contributing $708.76 million and Valencia $140.84 million. The company recorded a negative adjustment of $612.81 million related to the removal of the Great Park Venture, impacting overall revenue figures significantly.

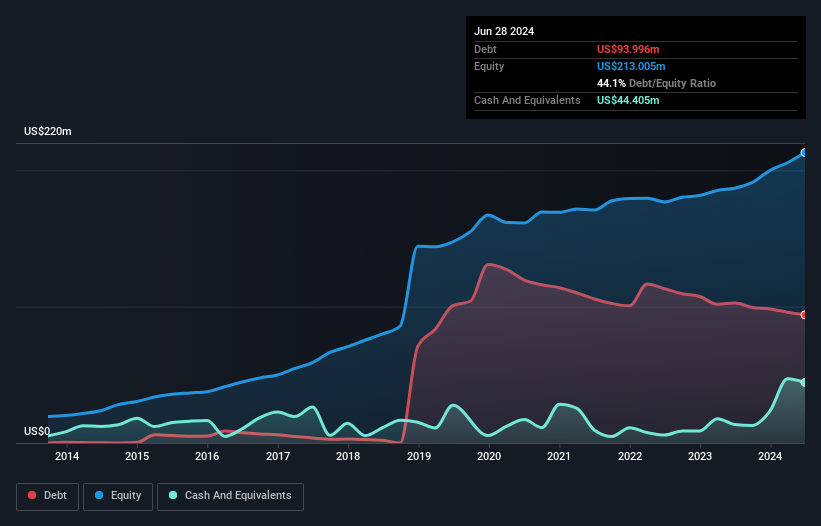

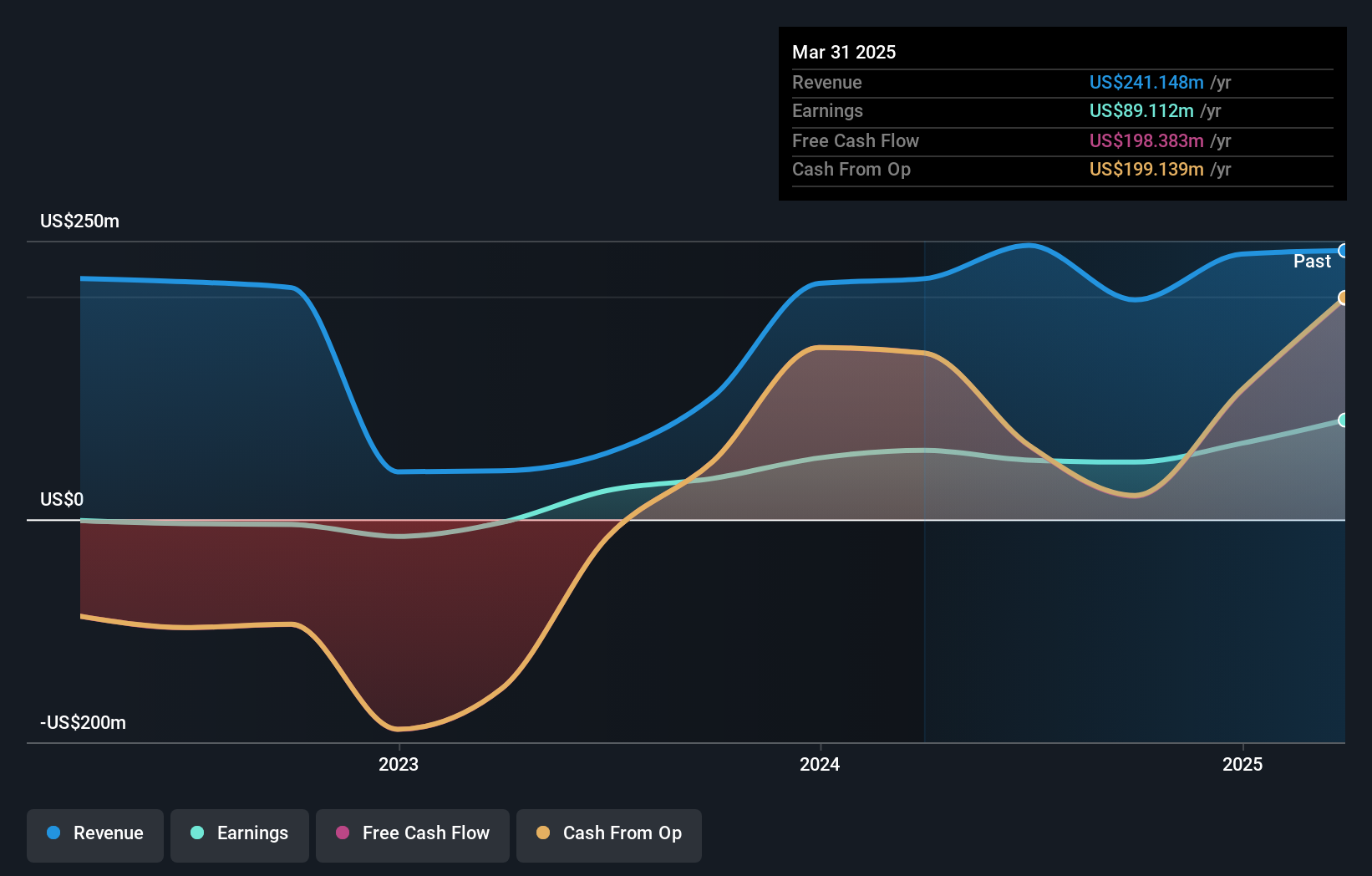

Five Point Holdings, a notable player in the real estate sector, has shown impressive financial performance with earnings growth of 23.7% over the past year, surpassing industry averages. The company's net debt to equity ratio stands at a satisfactory 7.2%, reflecting sound financial health as it reduced its debt from 37.6% to 27% over five years. Despite recent share price volatility, FPH trades at a value estimated to be 12% below fair market value and boasts high-quality earnings. Recent reports indicate net income surged to US$68.3 million in 2024 from US$55.39 million the previous year, with expectations for further growth in 2025 reaching close to US$200 million if operational conditions remain favorable in Los Angeles County.

- Click here and access our complete health analysis report to understand the dynamics of Five Point Holdings.

Explore historical data to track Five Point Holdings' performance over time in our Past section.

MoneyLion (NYSE:ML)

Simply Wall St Value Rating: ★★★★★☆

Overview: MoneyLion Inc. is a financial technology company that offers personalized financial products and content to American consumers, with a market cap of $973.08 million.

Operations: MoneyLion generates revenue through personalized financial products and services for consumers. The company has a market cap of $973.08 million.

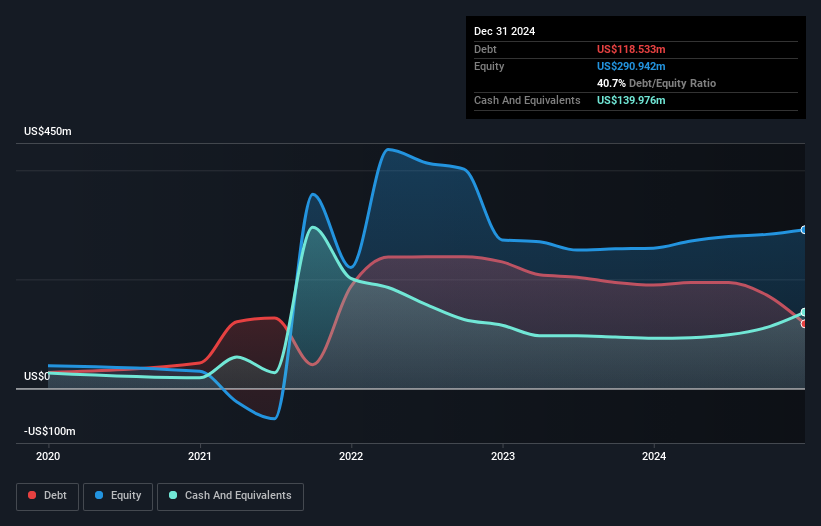

MoneyLion, a financial technology firm, has recently become profitable with net income reaching US$9.15 million from a previous loss of US$45.25 million, highlighting its turnaround. The company's debt-to-equity ratio improved significantly from 70% to 40.7% over five years, and it now boasts more cash than total debt, indicating financial resilience. Despite high customer acquisition costs and significant insider selling in the past quarter, MoneyLion's strategic expansion into new verticals like credit cards and mortgages suggests promising growth potential as it continues to enhance its market reach through innovative solutions such as MoneyLion Checkout.

Where To Now?

- Get an in-depth perspective on all 286 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FPH

Five Point Holdings

Through its subsidiary, Five Point Operating Company, LP, owns and develops mixed-use and planned communities in Orange County, Los Angeles County, and San Francisco County.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives