- United States

- /

- Consumer Finance

- /

- NYSE:LC

LendingClub (LC): Exploring Valuation After Strong Growth, Profit Surge, and Major Investor Partnerships

Reviewed by Kshitija Bhandaru

LendingClub (NYSE:LC) is drawing attention after reporting over 30% growth year-over-year in both loan originations and revenue, with accelerating profitability. Fresh partnerships with investors such as Blue Owl and BlackRock are also in the spotlight.

See our latest analysis for LendingClub.

LendingClub’s year has been anything but dull, with high-profile investor partnerships and impressive operational gains drawing fresh attention. The share price recently posted a 17.9% climb over the past 90 days, even though short-term ups and downs persist. Its total shareholder return for the past 12 months stands at a robust 20.4%. Long-term holders continue to see meaningful rewards, suggesting that market momentum is building as confidence grows in LendingClub’s evolving strategy.

If this fintech story has sparked your curiosity, it could be the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With these gains and analyst targets above its current price, the key question remains: is LendingClub still trading at a discount, or have investors already factored in all the future growth potential?

Most Popular Narrative: 16.6% Undervalued

Compared to LendingClub's last close at $14.97, the most popular narrative estimates a fair value nearly $3 higher, signaling real upside.

The hybrid digital marketplace/bank model continues to scale. Marketplace originations and balance sheet loans are growing in tandem, with the former providing high-margin, capital-light revenue, and the latter building durable recurring net interest income. This dual engine offers operating leverage for sustained growth in earnings and tangible book value.

What fuels this bullish narrative? Behind the impressive upside is a striking shift in profit margins and a bold forecast for recurring earnings escalation. Think the growth story is over? Think again; the assumptions for LendingClub’s future profitability will make you rethink what’s possible for a digital lender.

Result: Fair Value of $17.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased competition and LendingClub’s reliance on personal loans could put pressure on margins and introduce volatility in future earnings growth.

Find out about the key risks to this LendingClub narrative.

Another View: What About Multiples?

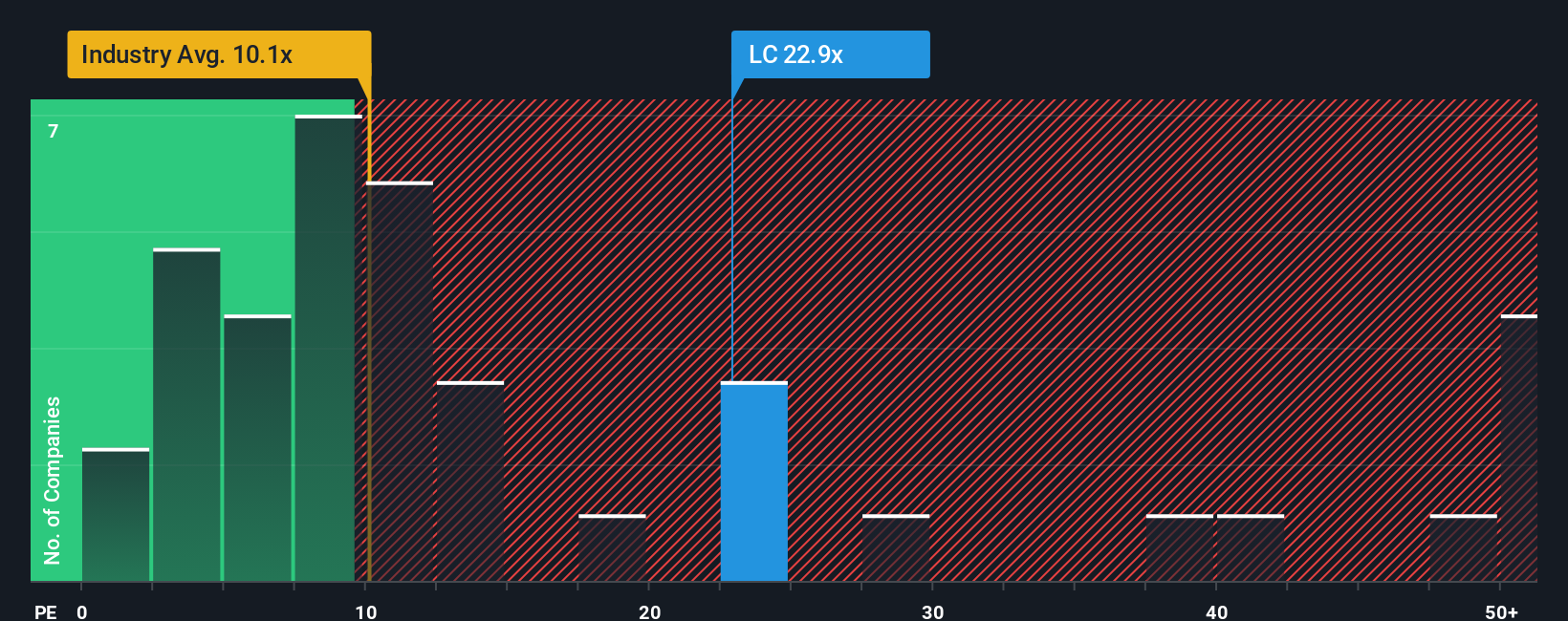

While the fair value estimate appears promising, a look through the lens of price-to-earnings gives a different story. LendingClub trades at 23.2 times earnings, noticeably higher than its peer group average of 6.1 times and the industry average of 9.5 times. Even compared to our calculated fair ratio of 21.3, the stock stands out as relatively expensive. This raises the possibility that investors already expect a lot of future growth. Could this premium signal added risk if the company falls short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LendingClub Narrative

If you want to dig deeper or come to your own conclusions, you can build a fresh LendingClub story yourself in just a few minutes, so why not Do it your way

A great starting point for your LendingClub research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep their options open. Don’t wait until others spot the next big winners. Leverage these hand-picked screens to find fresh opportunities right now:

- Tap into booming long-term growth by checking out these 891 undervalued stocks based on cash flows, packed with companies trading below intrinsic value and primed for rebound.

- Unlock the future of healthcare by exploring these 33 healthcare AI stocks, spotlighting trailblazing companies using artificial intelligence to transform medical technology.

- Start building passive income streams by reviewing these 19 dividend stocks with yields > 3%, featuring stocks offering yields over 3% for reliable cash flow and stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LC

LendingClub

Operates as a bank holding company, that provides range of financial products and services in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives