- United States

- /

- Capital Markets

- /

- NYSE:JEF

SEC Probe and Long-Dated Debt Issuance Could Be A Game Changer For Jefferies (JEF)

Reviewed by Sasha Jovanovic

- Jefferies Financial Group recently expanded its long-term funding stack with several fixed-rate, callable senior unsecured notes maturing between 2031 and 2055, alongside smaller completed issues in 2035 and 2045 maturities.

- At the same time, the SEC is probing whether Jefferies properly informed investors about a fund’s exposure to bankrupt First Brands Group and is reviewing its internal controls and inter-divisional conflicts.

- We’ll now examine how the SEC’s focus on Jefferies’ investor communications and internal controls could influence the company’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Jefferies Financial Group's Investment Narrative?

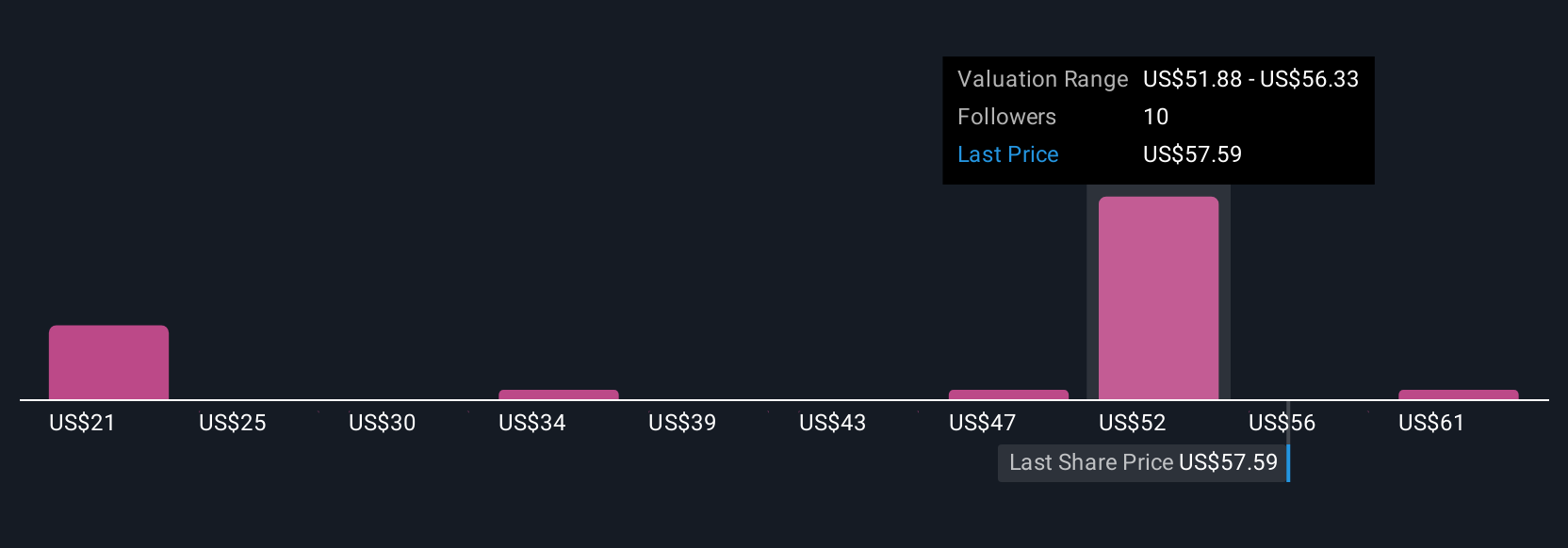

For Jefferies, the core investment story still hinges on believing in its ability to convert a diversified capital markets and merchant banking platform into consistent earnings, while returning cash through dividends and buybacks. Recent quarters showed modest revenue growth and improved margins, but also some lumpiness in profits and underperformance versus the broader market. The new long-dated, fixed-rate senior notes strengthen and extend Jefferies’ funding profile, which can support that earnings engine rather than change it. By contrast, the SEC probe into disclosures around the Point Bonita fund and First Brands exposure goes right to the heart of Jefferies’ biggest current risk: regulatory scrutiny of how it communicates with investors and manages conflicts. For now, the share price reaction suggests the market does not see this as a thesis-breaking event, but it has the potential to influence near term sentiment and any re-rating around governance and control quality.

However, one risk around Jefferies’ regulatory and disclosure practices may be easier to miss at first glance. Jefferies Financial Group's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 6 other fair value estimates on Jefferies Financial Group - why the stock might be worth less than half the current price!

Build Your Own Jefferies Financial Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jefferies Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Jefferies Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jefferies Financial Group's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JEF

Jefferies Financial Group

Operates as an investment banking and capital markets firm in the Americas, Europe, the Middle East, and the Asia-Pacific.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026