- United States

- /

- Capital Markets

- /

- NYSE:HLI

Did New Sponsor-Driven Deals and Commentary Just Reframe Houlihan Lokey's (HLI) Cycle Sensitivity?

Reviewed by Sasha Jovanovic

- In recent days, 1st Choice Delivery announced that it has been acquired by Lanter Delivery Systems, a portfolio company of Audax Private Equity, with Houlihan Lokey serving as financial advisor and facilitating Northern Pacific Group’s exit from its 2017 investment.

- Alongside this client milestone, fresh Morgan Stanley commentary highlighting Houlihan Lokey’s potential to benefit from a faster-than-expected rebound in sponsor activity has drawn investor attention to the firm’s role in sponsor-driven deal cycles.

- Next, we’ll examine how Morgan Stanley’s expectations for a 2026 sponsor activity rebound intersect with Houlihan Lokey’s existing growth-focused investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Houlihan Lokey Investment Narrative Recap

To own Houlihan Lokey, you generally need to believe that its advisory model can convert cycles in sponsor activity and credit markets into steady fee earnings, while managing high compensation costs. The latest 1st Choice Delivery transaction and Morgan Stanley’s commentary on a quicker sponsor rebound support the near term deal-flow catalyst, but do not materially change the biggest risk, which is still a prolonged slowdown in global M&A activity and sponsor-led deals.

The recent 1st Choice Delivery sale to Lanter Delivery Systems, with Houlihan Lokey advising Northern Pacific Group’s exit, underscores the firm’s embedded role in sponsor and mid market deal cycles. That real time evidence of sponsor engagement aligns with Morgan Stanley’s focus on a potential 2026 pickup, and sits alongside other developments, such as new senior hires in Europe, that may matter more for addressing the risk of slower growth outside the U.S.

Yet investors should also be aware that if sponsor activity disappoints again, the firm’s high cost base could start to...

Read the full narrative on Houlihan Lokey (it's free!)

Houlihan Lokey's narrative projects $3.5 billion revenue and $654.6 million earnings by 2028. This requires 12.5% yearly revenue growth and a $246.3 million earnings increase from $408.3 million.

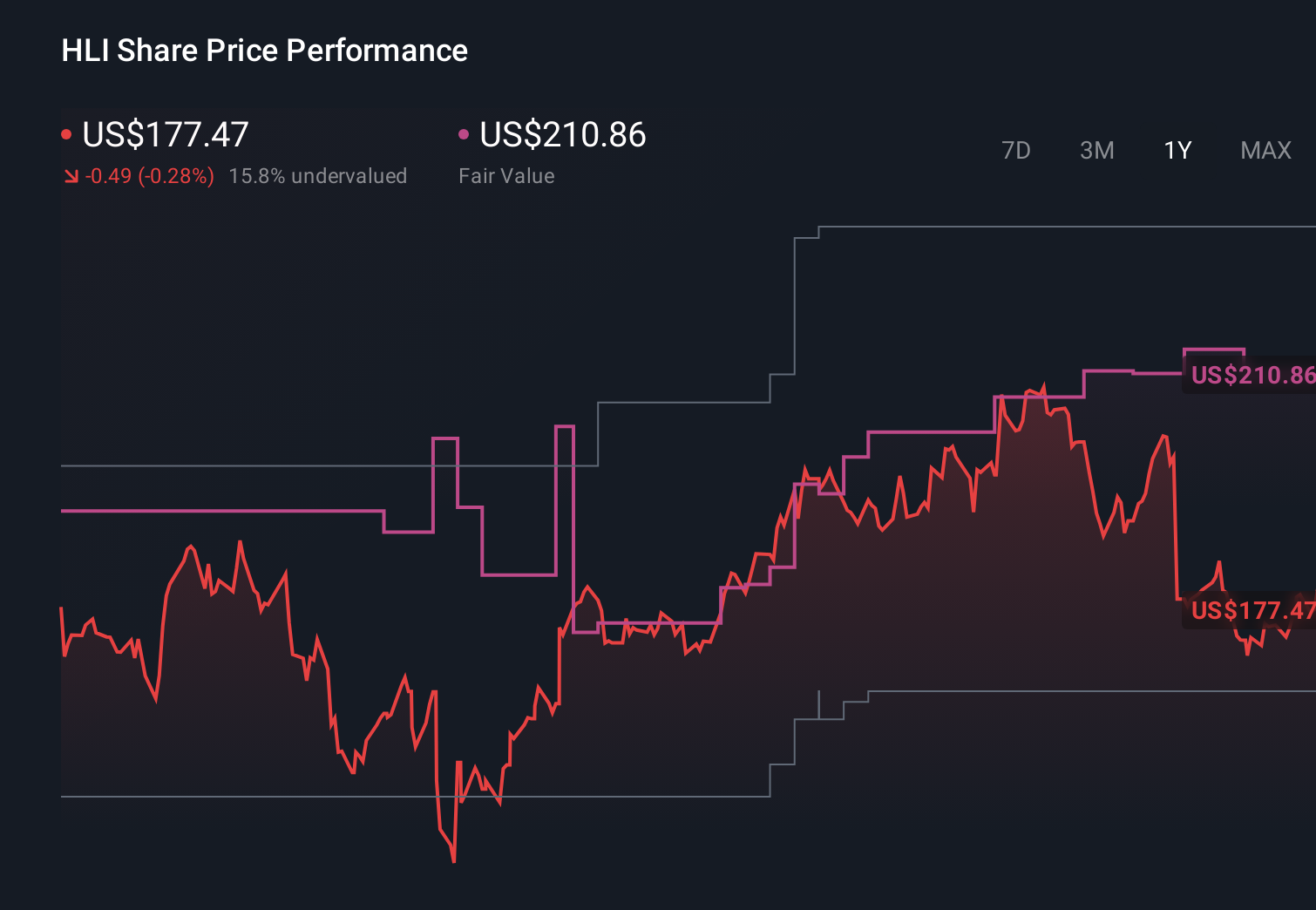

Uncover how Houlihan Lokey's forecasts yield a $210.86 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Houlihan Lokey range widely, from about US$98 to over US$210, highlighting very different expectations. When you set those views against the current reliance on a sponsor activity rebound to support earnings, it underlines why examining several risk and reward scenarios can be useful before forming your own opinion.

Explore 3 other fair value estimates on Houlihan Lokey - why the stock might be worth as much as 19% more than the current price!

Build Your Own Houlihan Lokey Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Houlihan Lokey research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Houlihan Lokey research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Houlihan Lokey's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Houlihan Lokey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLI

Houlihan Lokey

An investment banking company, provides merger and acquisition (M&A), capital market, financial restructurings and liability management, and financial and valuation advisory services worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)