- United States

- /

- Capital Markets

- /

- NYSE:GS

Goldman Sachs (GS): How the Elevation Point Partnership Shapes Its Latest Valuation Narrative

Reviewed by Simply Wall St

Goldman Sachs Group (GS) just announced a strategic collaboration with Elevation Point, aiming to expand access to its banking, lending, trading, asset management and capital markets capabilities for independent advisors and partner firms. For investors, this move signals a meaningful step in Goldman’s ongoing push to strengthen its wealth management footprint and deepen its reach in the fast-evolving Registered Investment Advisor (RIA) and family office sectors. The partnership enhances Goldman’s ability to deliver custom solutions and capital to entrepreneurial advisors, which could influence how markets view its long-term growth potential.

In the bigger picture, Goldman Sachs has seen momentum build over the past year, with its stock delivering a 55% total return and climbing nearly 21% in the past 3 months alone. This upward swing comes on the heels of a range of activity, including a flurry of recent fixed-income offerings and visible participation at sector conferences. Fresh investor attention is likely being driven by the combination of strong stock performance and moves like this Elevation Point partnership, which sharpen Goldman's competitive edge across both traditional and emerging advisory channels.

With shares climbing this year and new strategic initiatives underway, some may be asking whether Goldman Sachs is offering a real buying opportunity or if the market is already factoring in the next stage of growth.

Most Popular Narrative: 4.4% Overvalued

The most widely followed narrative sees Goldman Sachs Group as slightly overvalued, with the current share price trading above the consensus fair value model.

Record growth and momentum in Asset & Wealth Management, including strong fee-based net inflows for 30 consecutive quarters and rising demand for alternative assets from high-net-worth and institutional clients, are shifting the revenue mix toward less volatile, high-margin streams. This supports higher and more durable net margins.

Want to know what’s fueling this bold valuation? The narrative hints at a quietly transforming revenue engine, stronger margins and ambitious future earnings assumptions. Intrigued by which quantitative drivers set this fair value price? Prepare for details—the numbers behind these forecasts may shift how you see Goldman’s next chapter.

Result: Fair Value of $710.58 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory uncertainty and persistent geopolitical risks could disrupt forecasts. These factors pose real challenges to Goldman's projected stability and growth trajectory.

Find out about the key risks to this Goldman Sachs Group narrative.Another View: Market Multiples Tell a Different Story

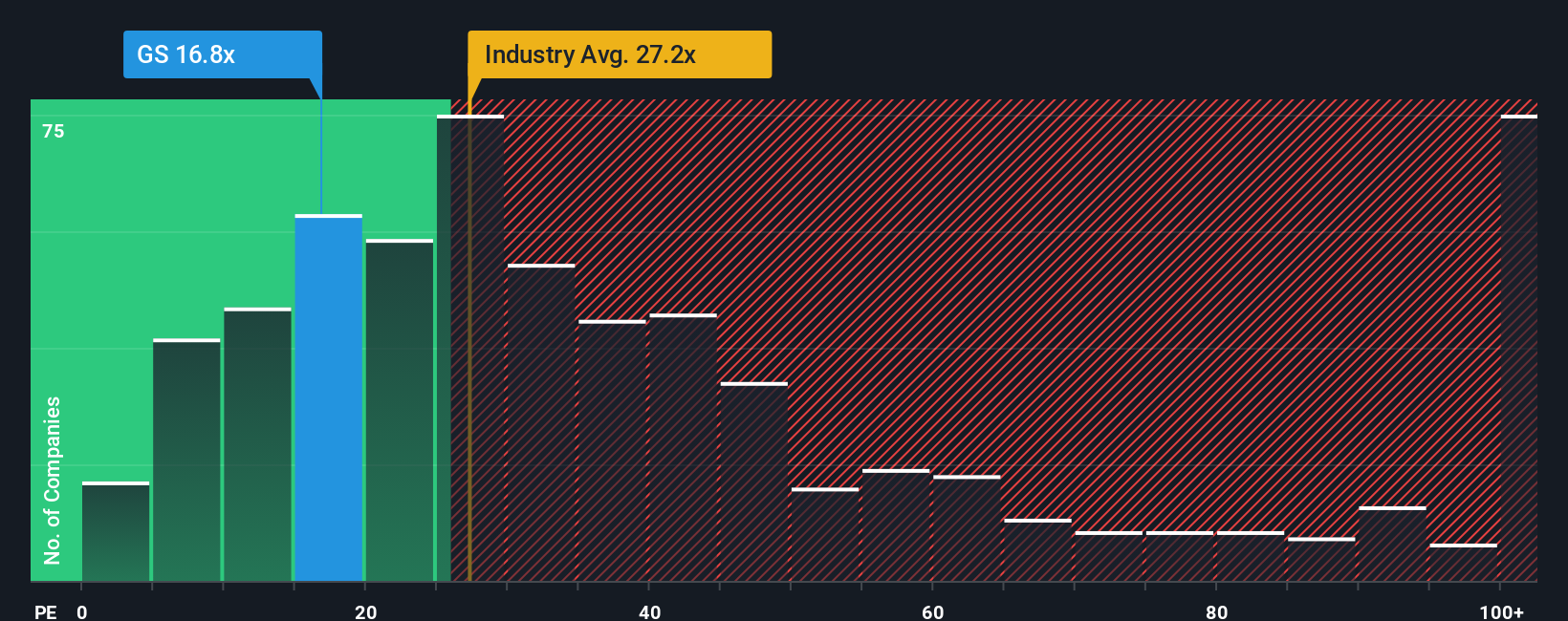

While some models see Goldman Sachs Group as slightly overpriced, a look at its price-to-earnings ratio compared to the wider US industry shows it trading at a significant discount. Could market sentiment be undervaluing its future prospects?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Goldman Sachs Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Goldman Sachs Group Narrative

If you have a different perspective or enjoy digging into the details yourself, you can craft your own story from the data. Do it your way.

A great starting point for your Goldman Sachs Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step ahead of the crowd and energize your portfolio by checking out powerful stock ideas on Simply Wall Street before others catch on.

- Unearth income potential by focusing on reliable payers offering attractive returns with our list of dividend stocks with yields > 3%.

- Ride the next technology wave by targeting companies at the forefront of quantum breakthroughs using our curated opportunities for quantum computing stocks.

- Expand your search for value by scanning compelling stocks trading below their intrinsic worth, all found in our set of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)