- United States

- /

- Insurance

- /

- NasdaqGS:ITIC

Undiscovered Gems In The US Featuring Three Promising Stocks

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 5.7%, contributing to a remarkable 37% climb over the past year, with earnings expected to grow by 16% annually. In this thriving environment, identifying undiscovered gems involves finding stocks that not only align with current growth trends but also possess unique qualities that set them apart from more widely recognized options.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Nanophase Technologies | 40.87% | 24.19% | -9.71% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Diamond Hill Investment Group (NasdaqGS:DHIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Diamond Hill Investment Group, Inc., through its subsidiary Diamond Hill Capital Management, Inc., offers investment advisory and fund administration services in the United States with a market cap of $458.16 million.

Operations: Diamond Hill generates revenue primarily from investment advisory and related services, amounting to $145.80 million.

Diamond Hill Investment Group, a financial firm, is trading at 44.1% below its estimated fair value and has maintained a debt-free status for the past five years. Despite earnings declining by 1.1% annually over the last five years, the company reported robust third-quarter results with revenue of US$39 million and net income of US$14.64 million, nearly doubling from the previous year. The company repurchased 22,376 shares in Q3 for US$3.34 million as part of a broader buyback initiative totaling US$45.21 million since May 2023, indicating confidence in its valuation strategy and future prospects within the industry context.

- Delve into the full analysis health report here for a deeper understanding of Diamond Hill Investment Group.

Learn about Diamond Hill Investment Group's historical performance.

Investors Title (NasdaqGS:ITIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Investors Title Company specializes in providing title insurance for residential, institutional, commercial, and industrial properties with a market capitalization of $473.79 million.

Operations: The primary revenue stream for Investors Title Company comes from its title insurance segment, generating $234.89 million. Exchange services contribute an additional $11.67 million to the company's revenues.

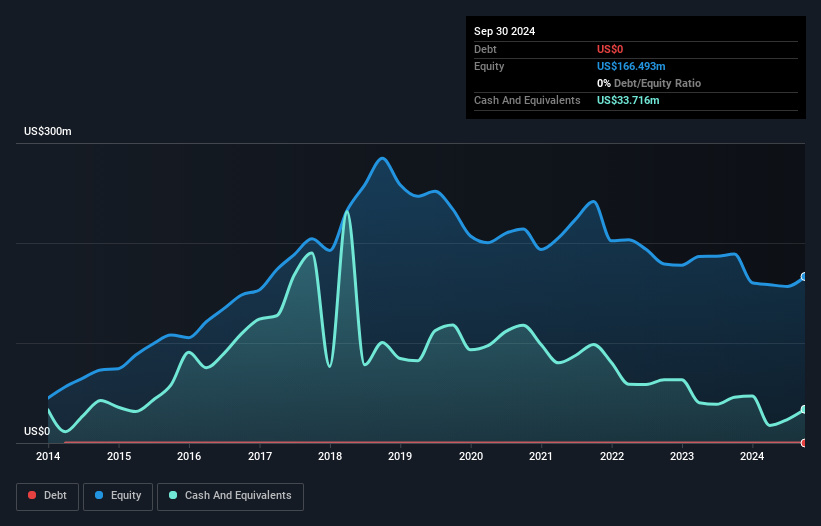

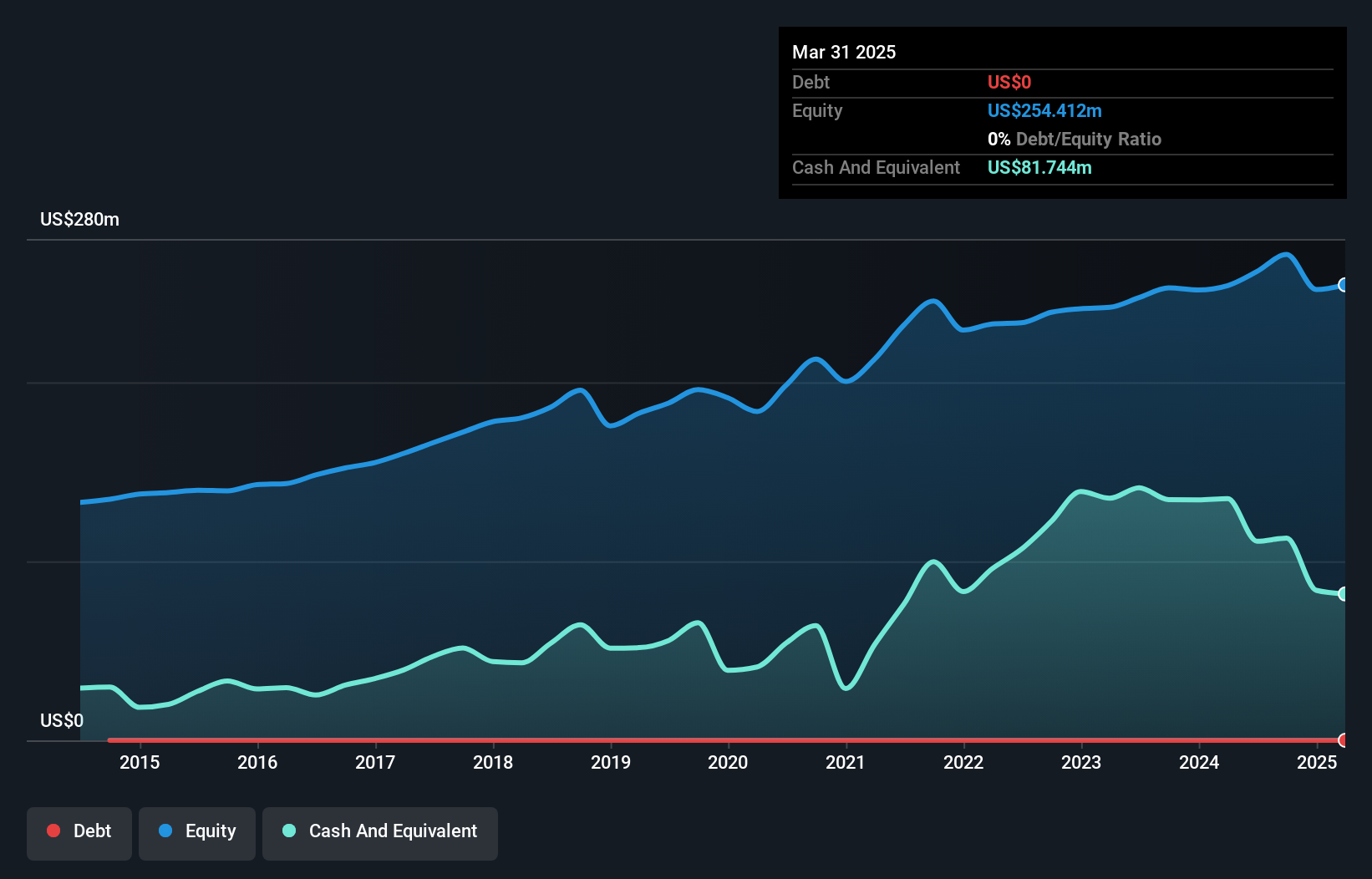

Investors Title, a smaller player in the insurance sector, showcases a blend of strengths and challenges. Recently, it reported third-quarter earnings with revenue at US$68.83 million and net income of US$9.32 million, both improved from last year. The company declared a regular dividend of $0.46 per share and a special dividend of $14 per share for December 2024 payouts, reflecting strong cash flow management as it remains debt-free for five years. Despite high-quality earnings and trading below estimated fair value by 18.6%, its annual earnings have fallen by 6.6% over five years, lagging behind industry growth rates.

- Dive into the specifics of Investors Title here with our thorough health report.

Gain insights into Investors Title's past trends and performance with our Past report.

General American Investors Company (NYSE:GAM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: General American Investors Company, Inc. is a publicly owned investment manager with a market cap of $1.28 billion.

Operations: Revenue for General American Investors primarily stems from its financial services segment, specifically closed-end funds, amounting to $26.75 million.

General American Investors Company, a small-cap entity in the capital markets sector, has demonstrated robust performance with earnings growth of 25.7% over the past year, surpassing the industry's 13.6%. The company is trading at a significant discount, approximately 61.6% below its estimated fair value, suggesting potential undervaluation. Notably debt-free for five years, GAM's financial health appears solid despite a $285.6 million one-off gain affecting recent results as of June 2024. Recent announcements include a $4.50 per share dividend and distribution on common stock and preferred dividends payable in December 2024, reflecting shareholder returns focus amidst high-quality earnings challenges.

Key Takeaways

- Get an in-depth perspective on all 224 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ITIC

Investors Title

Engages in the issuance of residential and commercial title insurance for residential, institutional, commercial, and industrial properties.

Flawless balance sheet average dividend payer.