3 Stocks Estimated To Be Trading At Discounts Of Up To 29.5%

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with indices like the S&P 500 retreating from record highs despite strong corporate earnings, investors are navigating a landscape marked by optimism and caution. In this environment, identifying undervalued stocks becomes crucial for those looking to capitalize on potential discounts, as these opportunities can offer significant value when companies are trading below their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| StoneCo (STNE) | $14.91 | $29.21 | 49% |

| Robert Half (RHI) | $42.15 | $82.67 | 49% |

| Rapid7 (RPD) | $22.33 | $43.63 | 48.8% |

| Definitive Healthcare (DH) | $4.02 | $7.84 | 48.7% |

| Carter Bankshares (CARE) | $18.22 | $35.50 | 48.7% |

| Camden National (CAC) | $42.43 | $83.98 | 49.5% |

| BioLife Solutions (BLFS) | $21.42 | $42.44 | 49.5% |

| Atlantic Union Bankshares (AUB) | $33.40 | $65.45 | 49% |

| ACNB (ACNB) | $43.47 | $85.43 | 49.1% |

| Acadia Realty Trust (AKR) | $18.80 | $36.84 | 49% |

Let's take a closer look at a couple of our picks from the screened companies.

Fidelity National Information Services (FIS)

Overview: Fidelity National Information Services, Inc. (FIS) provides technology solutions for merchants, banks, and capital markets firms worldwide with a market cap of approximately $41.54 billion.

Operations: The company's revenue is primarily derived from Banking Solutions at $6.93 billion and Capital Market Solutions at $3.04 billion.

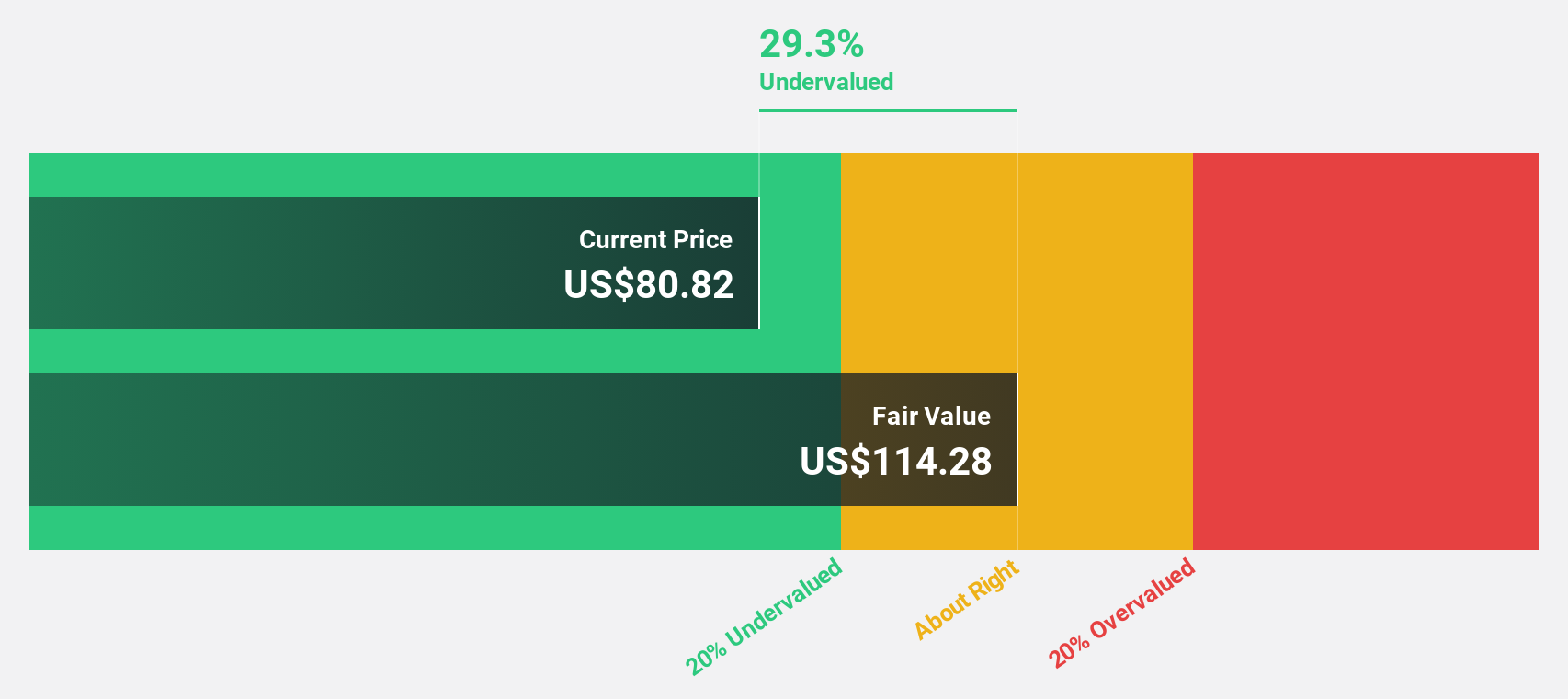

Estimated Discount To Fair Value: 29.5%

Fidelity National Information Services is trading at US$80.74, significantly below its estimated fair value of US$114.59, suggesting potential undervaluation based on cash flows. Despite a high debt level and a dividend not well covered by earnings, the company's earnings are forecast to grow significantly faster than the market at 24.22% annually over the next three years. Recent strategic partnerships with Visa and others aim to enhance revenue growth through innovative payment solutions and expanded capabilities for financial institutions.

- Insights from our recent growth report point to a promising forecast for Fidelity National Information Services' business outlook.

- Get an in-depth perspective on Fidelity National Information Services' balance sheet by reading our health report here.

Shift4 Payments (FOUR)

Overview: Shift4 Payments, Inc. provides software and payment processing solutions both in the United States and internationally, with a market cap of $9.04 billion.

Operations: The company generates revenue primarily from data processing, amounting to $3.47 billion.

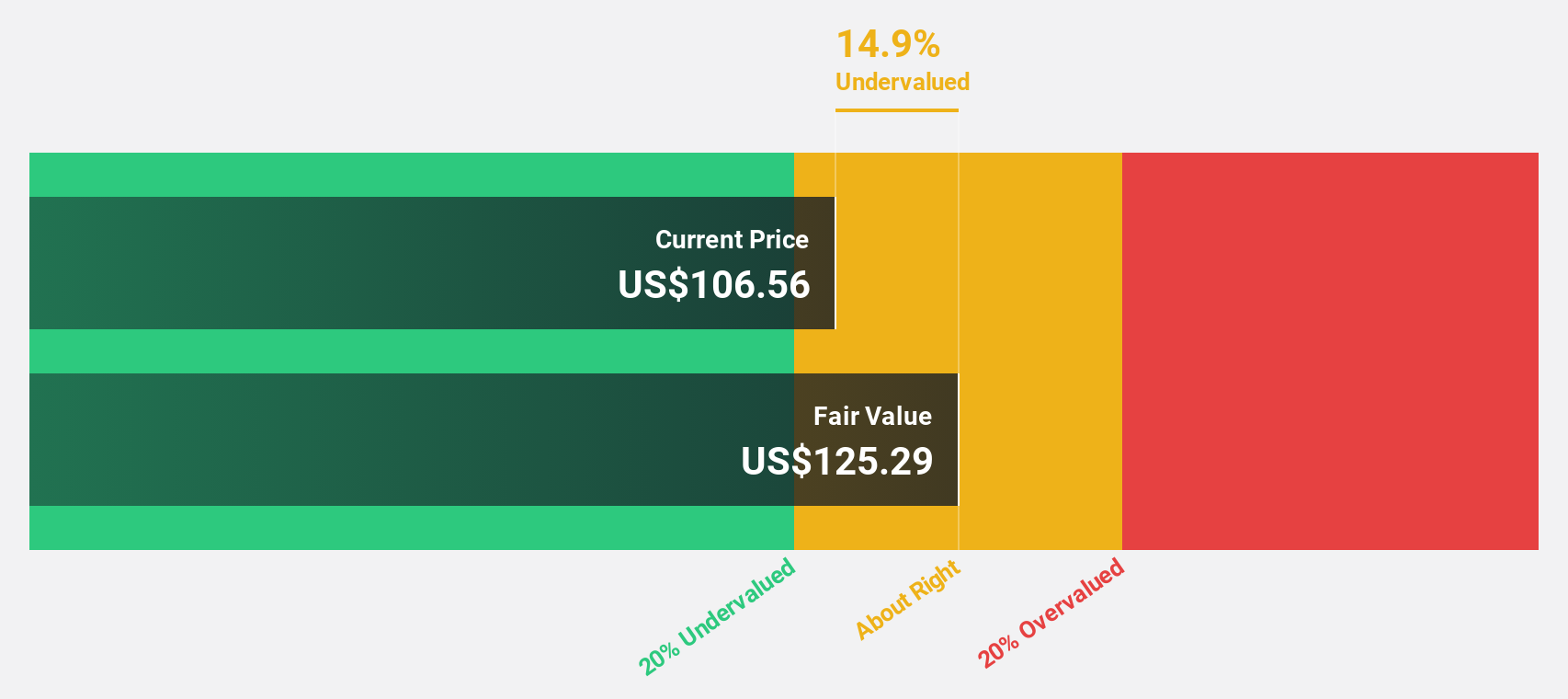

Estimated Discount To Fair Value: 15.1%

Shift4 Payments, trading at $106.11, is undervalued relative to its estimated fair value of $124.98 based on discounted cash flow analysis. Despite recent executive changes and a follow-on equity offering, the company maintains strong growth prospects with earnings projected to grow significantly faster than the market at 23.8% annually over the next three years. However, its debt coverage by operating cash flow remains a concern amidst strategic initiatives like acquiring Global Blue Group Holding AG to bolster its market position.

- The growth report we've compiled suggests that Shift4 Payments' future prospects could be on the up.

- Click here to discover the nuances of Shift4 Payments with our detailed financial health report.

Jabil (JBL)

Overview: Jabil Inc. offers manufacturing services and solutions globally, with a market cap of $23.43 billion.

Operations: Jabil Inc.'s revenue is derived from its diversified manufacturing services and solutions offered worldwide.

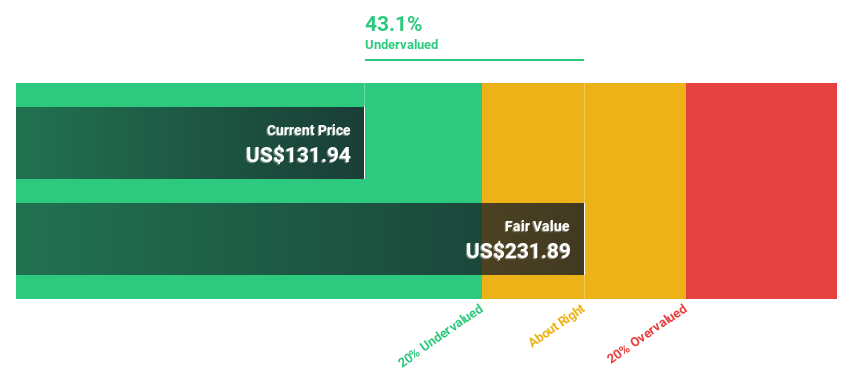

Estimated Discount To Fair Value: 21.6%

Jabil, trading at $222.23, is undervalued compared to its estimated fair value of $283.38 based on discounted cash flow analysis. Despite a lower profit margin of 2% from last year’s 4.6%, Jabil's earnings are forecasted to grow significantly at 23.3% annually, surpassing market expectations. Recent strategic moves include a $1 billion share repurchase program and an expanded collaboration with Endeavour Energy LLC for AI infrastructure, enhancing its growth potential despite high debt levels.

- The analysis detailed in our Jabil growth report hints at robust future financial performance.

- Navigate through the intricacies of Jabil with our comprehensive financial health report here.

Key Takeaways

- Gain an insight into the universe of 170 Undervalued US Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives