- United States

- /

- Capital Markets

- /

- NYSE:FHI

Could Federated Hermes’ (FHI) New Income-Focused ETF Reflect a Shifting Product Strategy?

Reviewed by Sasha Jovanovic

- Federated Hermes recently introduced the Federated Hermes Enhanced Income ETF (CBOE: PAYR), designed to provide monthly cash flow via high-dividend equities combined with a call spread options strategy.

- This launch highlights Federated Hermes' continued innovation and active expansion in the income-oriented ETF market segment.

- We'll examine how the new income-focused ETF could influence Federated Hermes' investment narrative and product diversification outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Federated Hermes Investment Narrative Recap

Federated Hermes shareholders are generally betting on the firm’s ability to balance consistent income opportunities, product innovation, and careful risk management, despite ongoing fee compression and competition in asset management. The recent launch of the Federated Hermes Enhanced Income ETF (CBOE: PAYR) reinforces the focus on income products and could support diversification, but it does not have a material impact on the biggest immediate risk: pressure from lower-cost passive products possibly affecting active management revenue.

The recently announced dividend from the Federated Hermes Premier Municipal Income Fund (NYSE: FMN) is also relevant for income-focused investors and reflects the company’s continued emphasis on tax-advantaged and regular distributions, core elements underpinning investor expectations for steady cash flow despite competitive challenges.

In contrast, investors should be aware of the risk that ongoing margin pressure from fee competition could impact...

Read the full narrative on Federated Hermes (it's free!)

Federated Hermes' outlook anticipates $1.9 billion in revenue and $379.7 million in earnings by 2028. This projection is based on a 3.3% annual revenue growth rate and a $29.8 million increase in earnings from the current level of $349.9 million.

Uncover how Federated Hermes' forecasts yield a $51.86 fair value, in line with its current price.

Exploring Other Perspectives

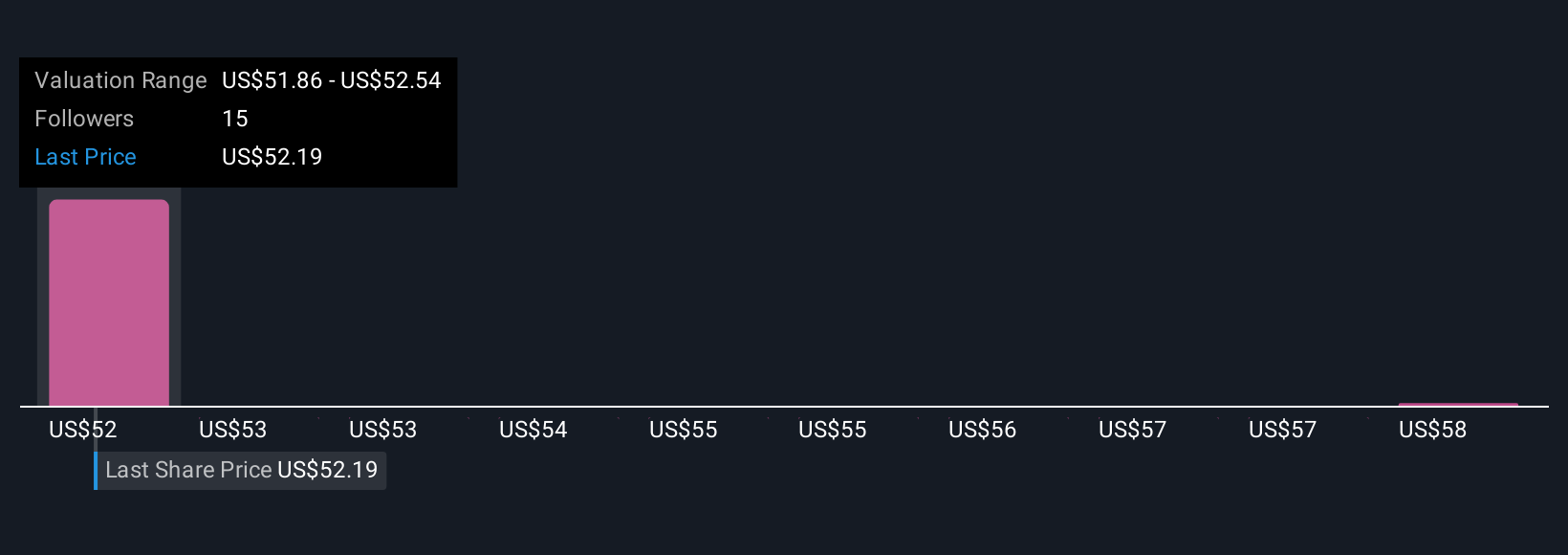

Four fair value estimates from the Simply Wall St Community range between US$51.86 and US$58.69, reflecting diverse individual views. While opinions differ, ongoing competition from passive strategies may hold broader implications for Federated Hermes’ future revenue generation.

Explore 4 other fair value estimates on Federated Hermes - why the stock might be worth as much as 13% more than the current price!

Build Your Own Federated Hermes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federated Hermes research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Federated Hermes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federated Hermes' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FHI

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives