- United States

- /

- Diversified Financial

- /

- NYSE:ESNT

Does Essent Group Offer Strong Value After Share Price Drop in 2025?

Reviewed by Bailey Pemberton

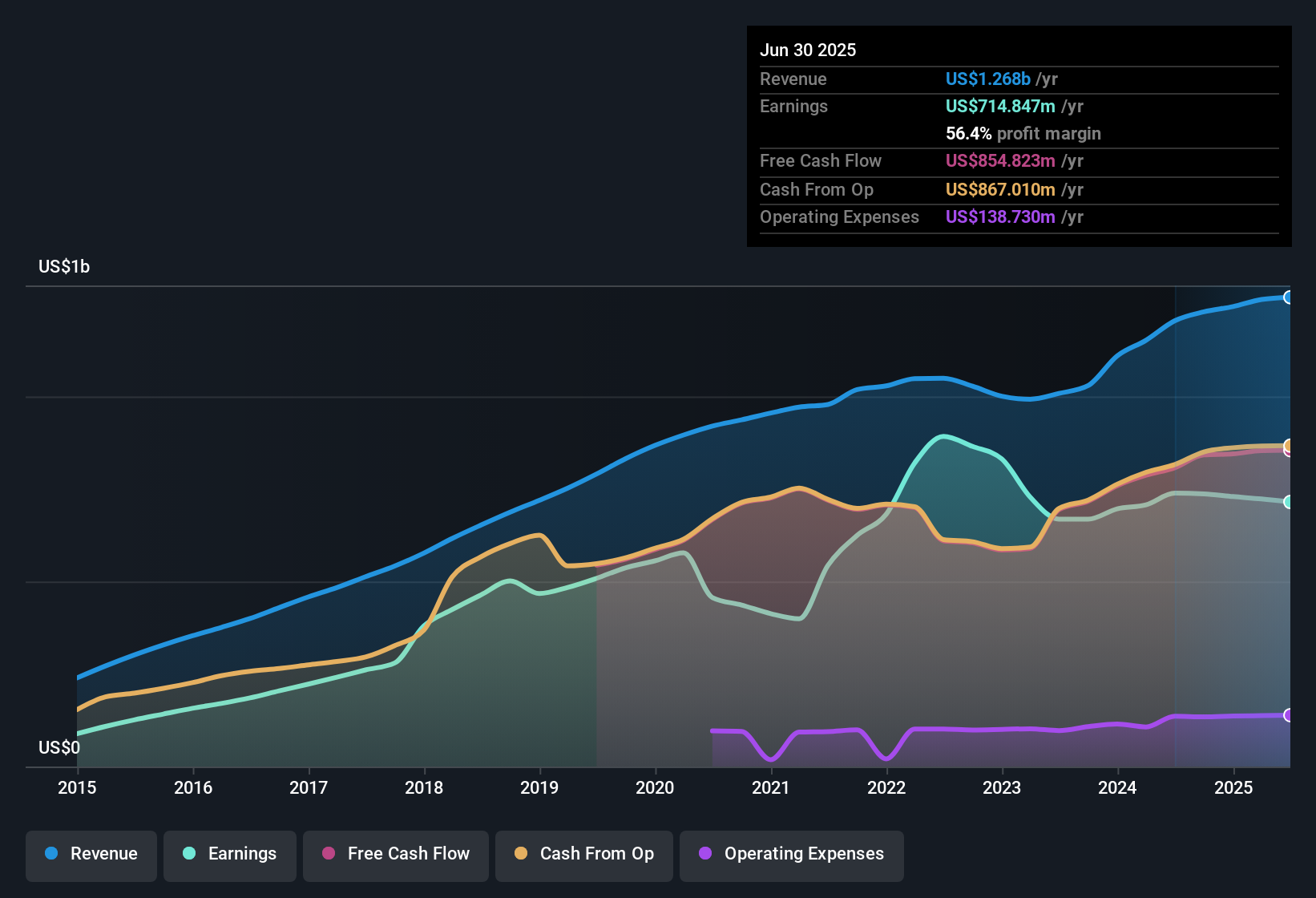

If you hold Essent Group shares or are eyeing the stock for your portfolio, you are probably asking the same question that’s on a lot of investors’ minds: is this the right time to buy, sell, or hold? The stock has delivered a mixed performance recently, offering both plenty of promise and reasons for caution. Over the last week, shares edged up by 0.4%, but the past month has seen a drop of nearly 9%. Still, if we take a longer view, Essent Group’s three-year return of 72.4% and five-year gain of 56.5% reflect a strong trajectory, even as the past year dipped by 2.6%.

What’s driving this roller coaster? Investors have become more discerning as market sentiment shifts around mortgage insurers, with changes in the housing and credit markets influencing risk appetite. Some recent optimism in the sector is fueling growth hopes, while occasional pullbacks highlight perceived uncertainties. Through that lens, Essent Group is particularly interesting for one big reason: it currently boasts a valuation score of 5 out of 6. In other words, based on standard valuation checks, it appears undervalued in nearly every way that matters.

We are going to dive into the specifics of these valuation methods in a moment. If you really want to know whether Essent Group is a bargain or a trap, stick around for a smarter approach at the end of this article.

Why Essent Group is lagging behind its peers

Approach 1: Essent Group Excess Returns Analysis

The Excess Returns model evaluates how much a company earns over its true cost of capital, focusing on the profitability of reinvested earnings rather than just topline or bottom-line growth. For Essent Group, this model suggests the company’s ability to generate value above and beyond what investors could earn elsewhere is particularly strong.

According to current projections, Essent Group’s Book Value sits at $56.98 per share, with analysts estimating a Stable Book Value of $66.91 per share based on aggregated forecasts. Notably, the company’s Stable Earnings Per Share are expected to reach $7.97, supported by an average Return on Equity of 11.92 percent, which is a robust figure for the financial sector. The estimated Cost of Equity is $5.04 per share, leading to an Excess Return of $2.93 per share. This signals the company is well-positioned to reward shareholders beyond the basic opportunity cost. These stable, long-term figures are derived from consensus estimates by three to five analysts.

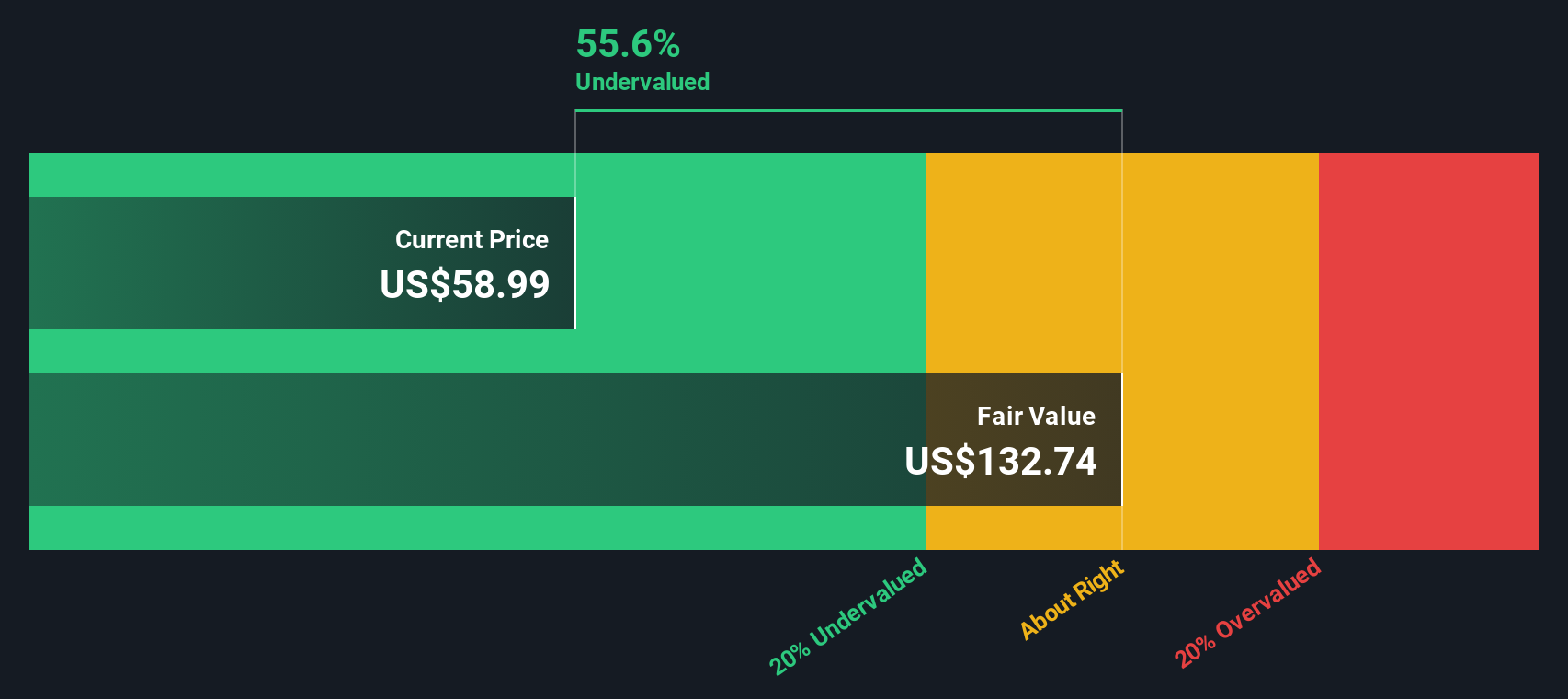

Applying these inputs, the Excess Returns model estimates Essent Group’s intrinsic value at $132.80 per share. This means the stock is currently trading at a 55.2 percent discount to its fair value. This significant undervaluation highlights meaningful upside potential for long-term investors seeking a fundamentally strong, well-capitalized company in the diversified financial industry.

Result: UNDERVALUED

Our Excess Returns analysis suggests Essent Group is undervalued by 55.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Essent Group Price vs Earnings

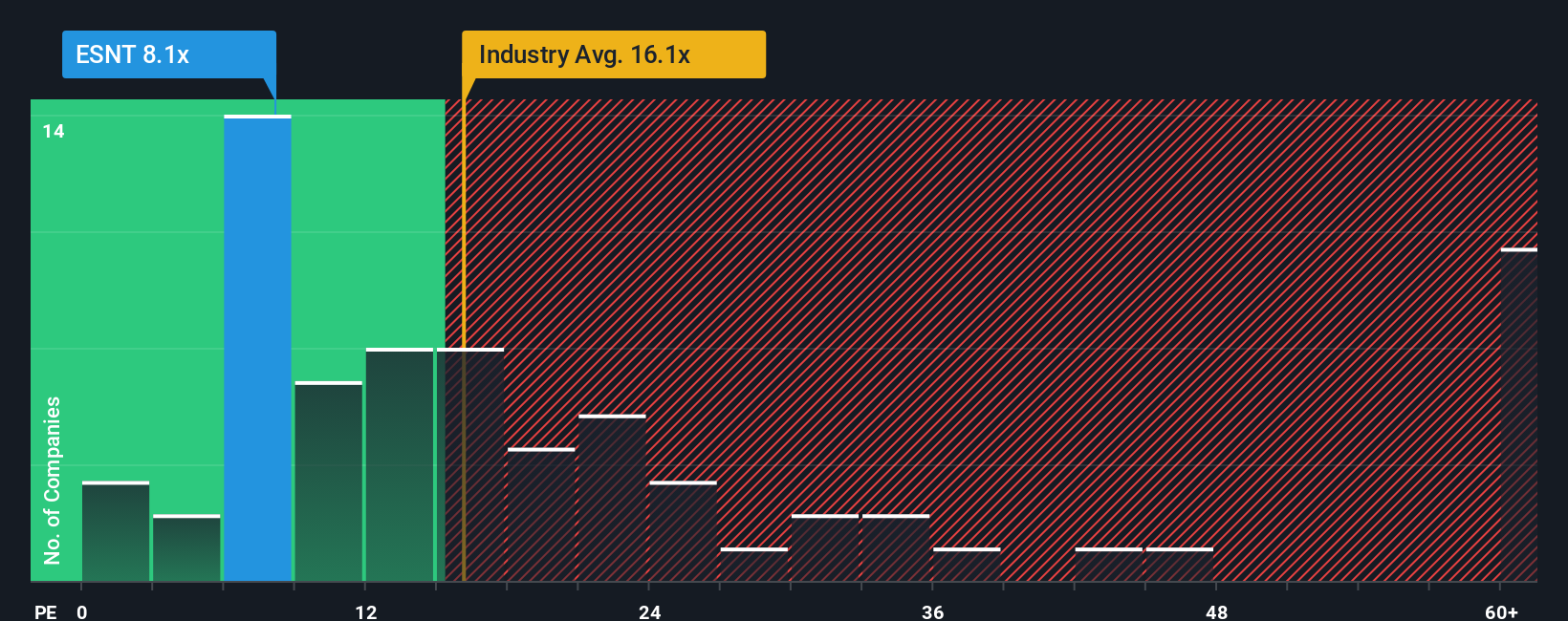

For companies like Essent Group that are solidly profitable, the Price-to-Earnings (PE) ratio is often the most useful single metric to quickly gauge valuation. The PE ratio compares a company’s current share price to its per-share earnings, giving investors a sense of how much they are paying for each dollar of profit. A higher PE often implies expectations for stronger growth or lower risk. A lower PE can sometimes indicate concerns about future prospects or higher perceived risk.

Essent Group’s current PE ratio stands at 8.20x. To put this in perspective, the industry average for diversified financials sits at 16.43x, and key peers are trading around 9.89x. At face value, Essent shares are priced meaningfully below both their peer group and the broader industry.

Simply Wall St’s proprietary “Fair Ratio” takes this analysis a step further. Unlike simple industry or peer comparisons, the Fair Ratio customizes the valuation benchmark by factoring in the company’s earnings growth, profit margins, risk profile, market capitalization, and sector dynamics. For Essent Group, the Fair Ratio works out to 12.98x, suggesting a multiple that is more tailored to its own company fundamentals rather than general market trends.

Since Essent Group’s actual PE ratio of 8.20x is well below its Fair Ratio of 12.98x, the stock looks notably undervalued on this metric. This supports the view that there may be a margin of safety for investors considering Essent Group at current prices.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Essent Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Simply put, a Narrative is your story and perspective about a company, showing why you believe Essent Group is worth more or less than its current price by tying together your forecasts for growth, margins, and risks. It links the big picture, such as homeownership trends or technology investments, directly to a financial model and then translates that into a fair value. On Simply Wall St’s Community page, millions of investors use Narratives as an easy, interactive tool to voice, track, and compare their investment thesis with others.

Narratives help you decide when to buy or sell by constantly updating your fair value as new news or results roll in, ensuring your beliefs remain in sync with the facts. For example, some Essent Group investors are bullish, seeing digital transformation as a driver for margin growth and setting price targets as high as $70.00. More cautious views, wary of regulatory changes or housing cycles, peg fair value nearer $59.00. Narratives empower investors with different outlooks to share, compare, and refine their strategies in real time.

Do you think there's more to the story for Essent Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Essent Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESNT

Essent Group

Through its subsidiaries, provides private mortgage insurance and reinsurance for mortgages secured by residential properties located in the United States.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)