- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

Top US Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As November 2024 comes to a close, the U.S. stock market is experiencing a remarkable surge, with the S&P 500 and Dow Jones Industrial Average reaching record highs and posting their largest monthly gains of the year. In this buoyant environment, dividend stocks can offer investors not only potential capital appreciation but also steady income streams, making them an attractive consideration for those looking to balance growth with stability in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.19% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.28% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.64% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.50% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.74% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.42% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.38% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.47% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

First Capital (NasdaqCM:FCAP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Capital, Inc. is a bank holding company for First Harrison Bank, offering a range of banking services to individuals and businesses, with a market cap of $111.02 million.

Operations: First Capital, Inc. generates revenue of $41.07 million from its banking services provided to individual and business customers through First Harrison Bank.

Dividend Yield: 3.5%

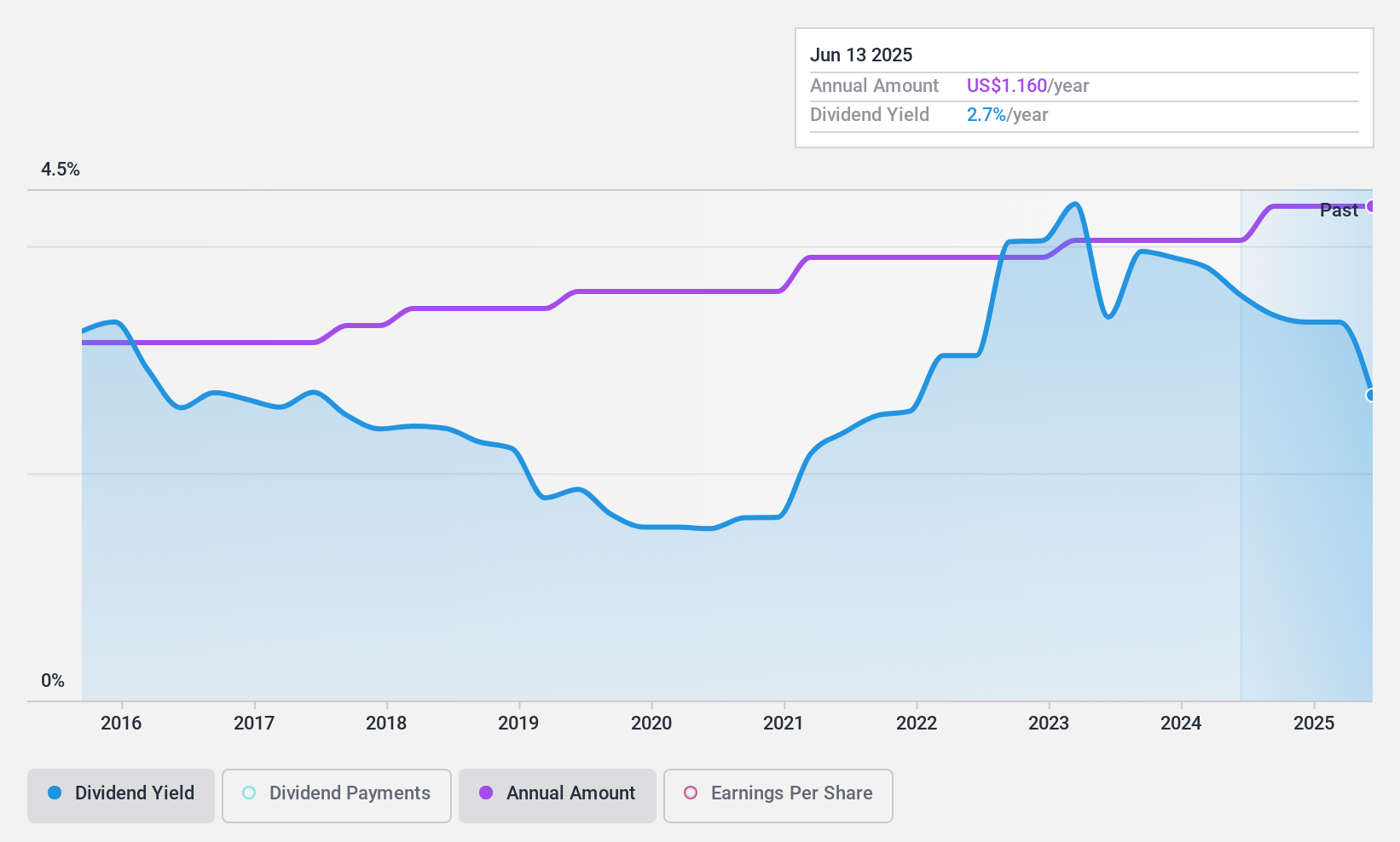

First Capital offers a stable dividend yield of 3.5%, supported by a low payout ratio of 31.2%, indicating strong coverage by earnings. Although its yield is below the top quartile in the US, dividends have grown steadily over the past decade with minimal volatility. Recent financials show slight declines in net income and EPS year-over-year, but dividend reliability remains intact as affirmed by recent board declarations for upcoming payouts.

- Unlock comprehensive insights into our analysis of First Capital stock in this dividend report.

- Our valuation report unveils the possibility First Capital's shares may be trading at a discount.

Himax Technologies (NasdaqGS:HIMX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Himax Technologies, Inc. is a fabless semiconductor company specializing in display imaging processing technologies across regions including China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States with a market cap of $943.51 million.

Operations: Himax Technologies, Inc. generates revenue from its semiconductor solutions that cater to display imaging processing technologies across various regions including China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States.

Dividend Yield: 5.4%

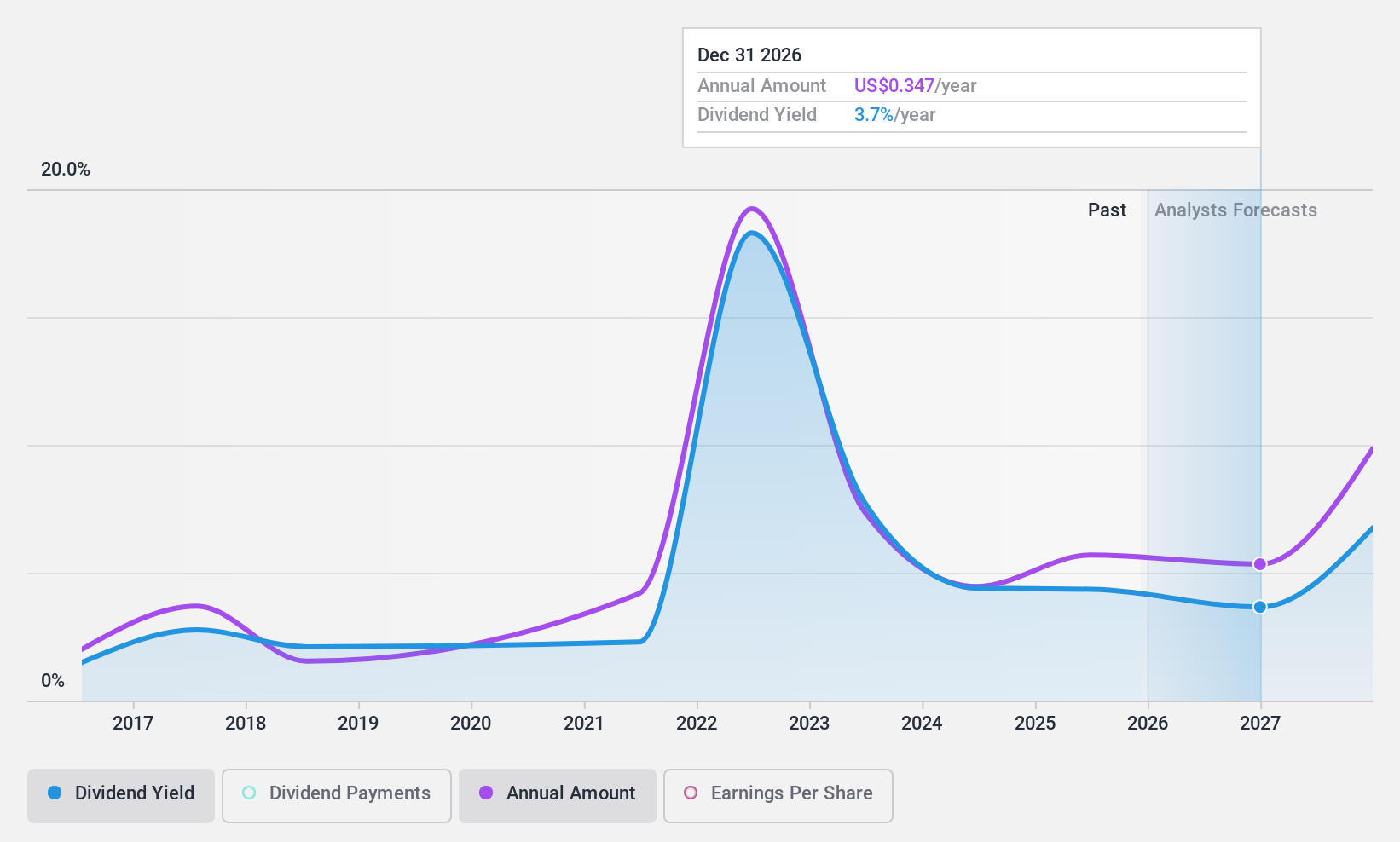

Himax Technologies' dividend yield of 5.37% ranks in the top 25% of US payers, yet its high payout ratio (100%) indicates dividends aren't well covered by earnings, though cash flows provide better coverage with a lower cash payout ratio of 40.8%. Despite earnings growth and recent product innovations strengthening market position, dividends have been volatile over the past decade without consistent growth, raising concerns about reliability and sustainability for investors seeking stable income.

- Navigate through the intricacies of Himax Technologies with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Himax Technologies is priced lower than what may be justified by its financials.

Banco Latinoamericano de Comercio Exterior S. A (NYSE:BLX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco Latinoamericano de Comercio Exterior S.A. (NYSE:BLX) is a financial institution that provides trade financing to commercial banks and corporations in Latin America, with a market cap of approximately $1.24 billion.

Operations: Banco Latinoamericano de Comercio Exterior S.A. generates its revenue primarily from two segments: Treasury, contributing $29.70 million, and Commercial, accounting for $250.08 million.

Dividend Yield: 5.9%

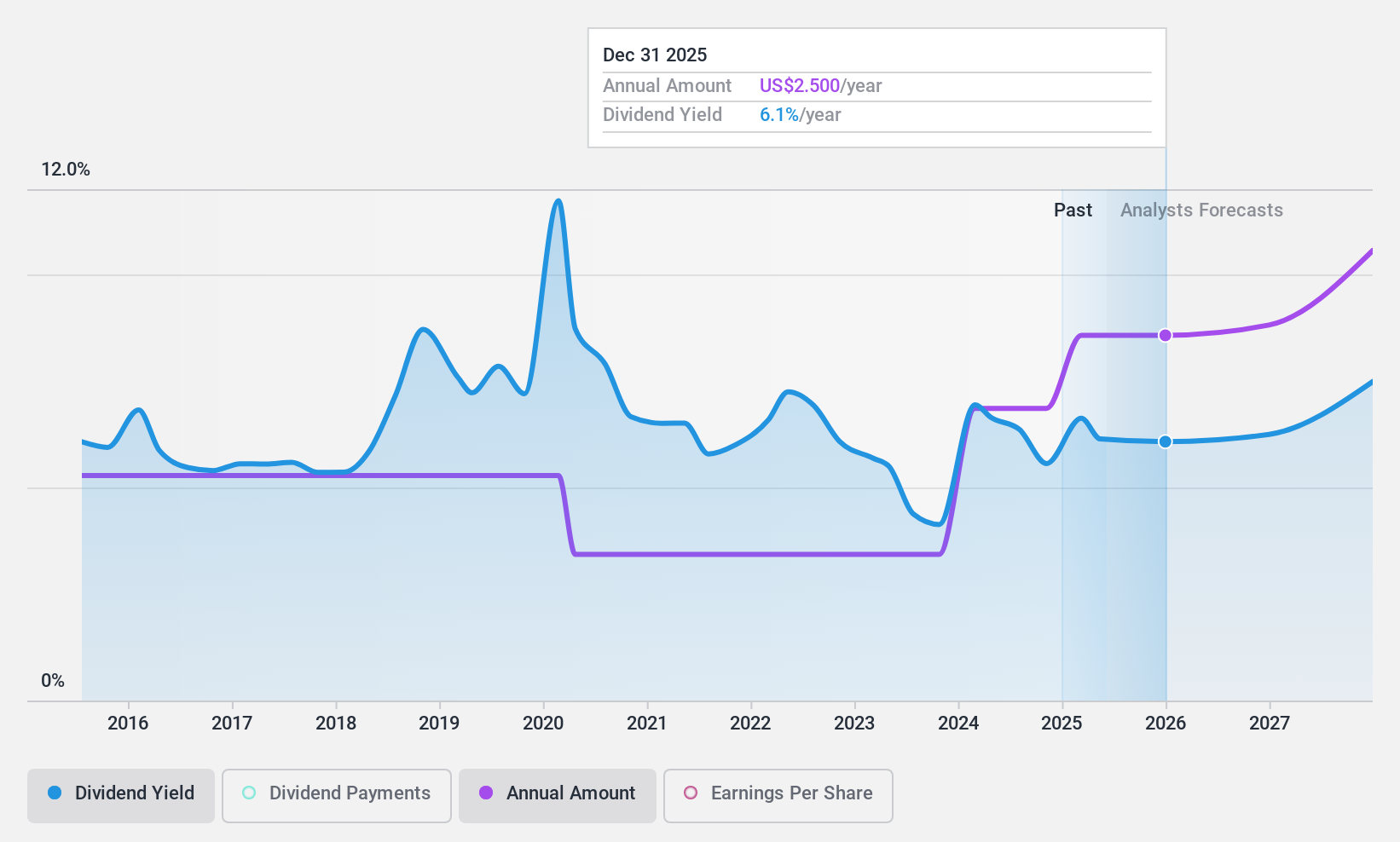

Banco Latinoamericano de Comercio Exterior's dividend yield of 5.87% places it in the top 25% of US payers, supported by a low payout ratio of 36.5%, indicating dividends are well covered by earnings. However, the dividend history has been volatile over the past decade, raising concerns about its reliability and sustainability for income-focused investors. Recent executive changes may impact strategic direction but have not yet affected financial stability or value metrics like its favorable price-to-earnings ratio of 6.2x.

- Get an in-depth perspective on Banco Latinoamericano de Comercio Exterior S. A's performance by reading our dividend report here.

- According our valuation report, there's an indication that Banco Latinoamericano de Comercio Exterior S. A's share price might be on the cheaper side.

Seize The Opportunity

- Click through to start exploring the rest of the 132 Top US Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Himax Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, Korea, Japan, the United States, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives