- United States

- /

- Capital Markets

- /

- NYSE:VRTS

Top 3 Dividend Stocks Featuring Banco Latinoamericano de Comercio Exterior S A

Reviewed by Simply Wall St

As the U.S. stock market navigates a complex landscape marked by record highs in major indices and ongoing government shutdowns, investors are increasingly drawn to dividend stocks for their potential to provide steady income amid uncertainty. In this context, selecting dividend stocks with strong fundamentals and consistent payout histories can be a prudent strategy for navigating current market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 11.01% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.53% | ★★★★★☆ |

| PACCAR (PCAR) | 4.54% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.79% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.00% | ★★★★★★ |

| Ennis (EBF) | 5.71% | ★★★★★★ |

| Employers Holdings (EIG) | 3.07% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.90% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.61% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.75% | ★★★★★☆ |

Click here to see the full list of 132 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Banco Latinoamericano de Comercio Exterior S. A (BLX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banco Latinoamericano de Comercio Exterior S.A. (BLX) is a financial institution that specializes in providing trade financing solutions across Latin America, with a market cap of approximately $1.66 billion.

Operations: Banco Latinoamericano de Comercio Exterior S.A. (BLX) generates its revenue primarily from two segments: $31.33 million from Treasury and $274.85 million from Commercial activities.

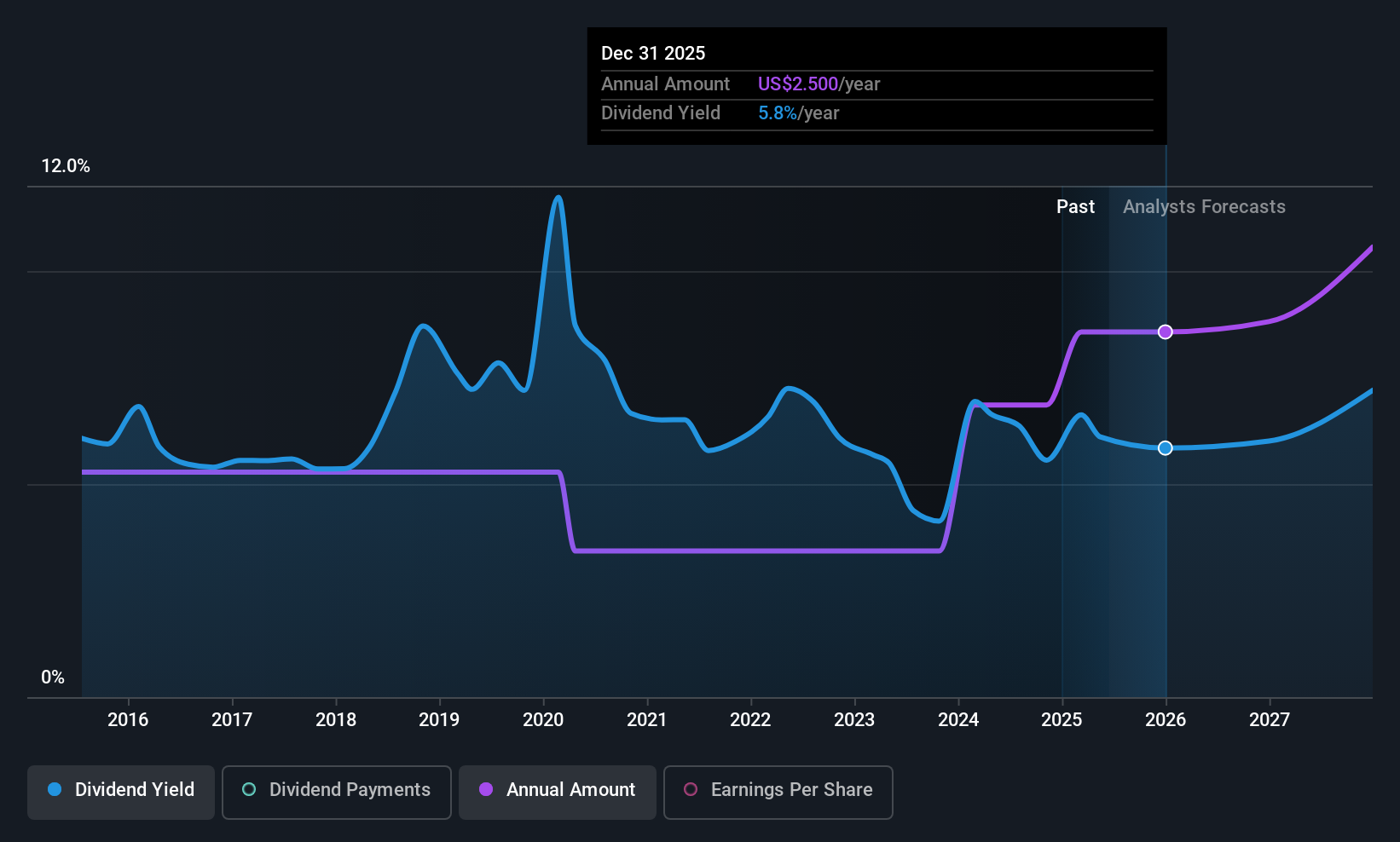

Dividend Yield: 5.6%

Banco Latinoamericano de Comercio Exterior, S.A. offers a compelling dividend yield of 5.58%, placing it among the top 25% of U.S. dividend payers. Despite past volatility in its dividend payments, recent earnings growth and a low payout ratio of 39.8% suggest dividends are well-covered by earnings and expected to remain so in three years (40.7%). The bank's recent US$200 million AT1 capital offering further strengthens its financial position, supporting future stability and growth potential for dividends.

- Click to explore a detailed breakdown of our findings in Banco Latinoamericano de Comercio Exterior S. A's dividend report.

- Our expertly prepared valuation report Banco Latinoamericano de Comercio Exterior S. A implies its share price may be lower than expected.

EOG Resources (EOG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EOG Resources, Inc. is engaged in the exploration, development, production, and marketing of crude oil, natural gas liquids, and natural gas across various producing basins in the United States, Trinidad and Tobago, and internationally, with a market cap of $60.33 billion.

Operations: EOG Resources generates revenue primarily from its crude oil and natural gas exploration and production activities, amounting to $22.80 billion.

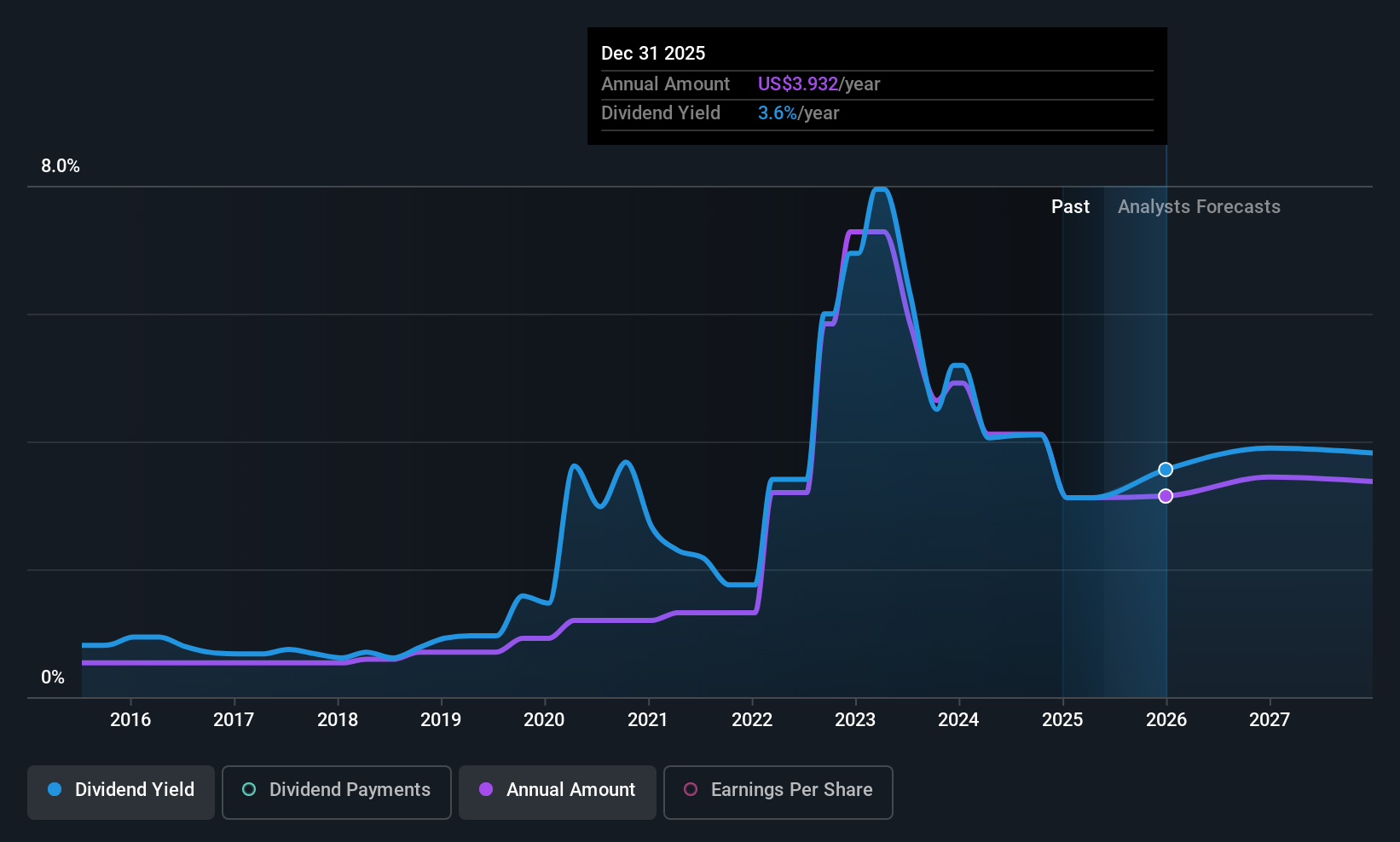

Dividend Yield: 3.6%

EOG Resources' dividend is covered by earnings and cash flows, with payout ratios of 37% and 49.2%, respectively, though past payments have been volatile. Trading at a significant discount to estimated fair value, it offers good relative value compared to peers. Recent financials show a decline in revenue and net income for the second quarter of 2025 but maintain a stable dividend increase over ten years. A recent share buyback reflects confidence in long-term prospects.

- Unlock comprehensive insights into our analysis of EOG Resources stock in this dividend report.

- Upon reviewing our latest valuation report, EOG Resources' share price might be too pessimistic.

Virtus Investment Partners (VRTS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Virtus Investment Partners, Inc. is a publicly owned investment manager with a market cap of approximately $1.30 billion.

Operations: Virtus Investment Partners generates its revenue primarily from providing investment management and related services, amounting to $888.98 million.

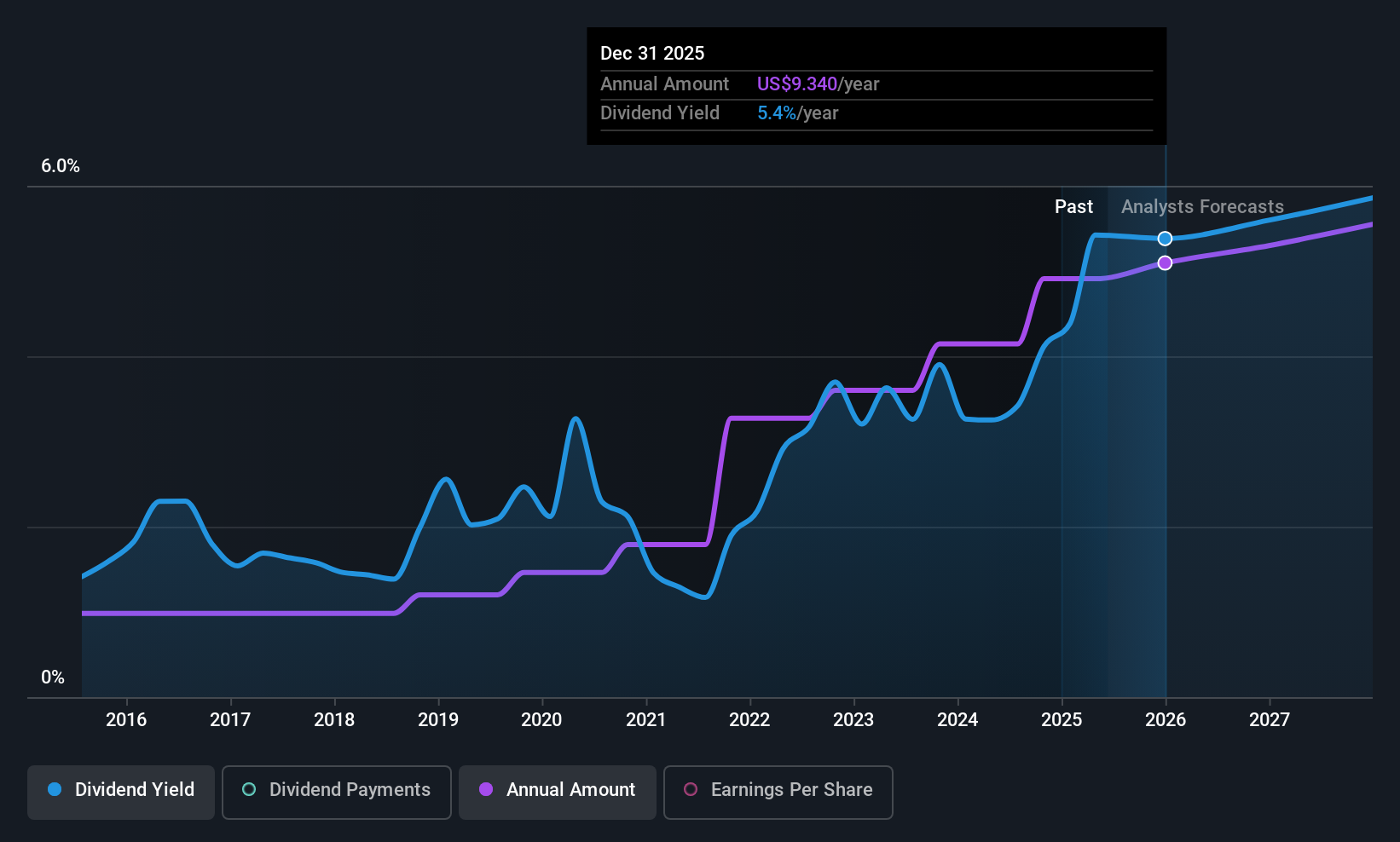

Dividend Yield: 4.6%

Virtus Investment Partners has increased its quarterly dividend to US$2.40 per share, marking a 7% rise, yet its high cash payout ratio indicates dividends aren't well-covered by cash flows. Despite stable and growing dividends over the past decade, sustainability concerns persist due to insufficient coverage by earnings or cash flows. The recent refinancing with a US$400 million term loan and US$250 million revolving credit facility may impact future financial flexibility but supports current operations and obligations.

- Dive into the specifics of Virtus Investment Partners here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Virtus Investment Partners shares in the market.

Seize The Opportunity

- Access the full spectrum of 132 Top US Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRTS

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives