- United States

- /

- Capital Markets

- /

- NYSE:BKKT

Does Bakkt (BKKT) Sharpening Its Digital Asset Focus Hint at a New Growth Strategy?

Reviewed by Sasha Jovanovic

- Bakkt Holdings recently completed the sale of its loyalty business and appointed fintech veteran Mike Alfred to its board, marking a shift to a focused digital asset infrastructure platform.

- This transformation is underscored by renewed emphasis on Bitcoin, tokenized payments, and zero debt, signaling a significant realignment toward crypto and digital finance services.

- We'll explore how the company’s sharpened focus on digital assets and new leadership shapes Bakkt Holdings' investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Bakkt Holdings' Investment Narrative?

To be a shareholder in Bakkt Holdings now, you need to be convinced that its transition to a digital asset infrastructure business, with an exclusive focus on Bitcoin custody, tokenized payments, and AI-driven finance, can ultimately deliver a competitive advantage. The appointment of fintech veteran Mike Alfred to the board signals deeper sector alignment and could help provide crucial strategic direction after a period of major leadership change. The recent surge in Bakkt’s share price, acceleration in capital raising, and the sale of its loyalty business all point to a company eager to refocus and strengthen its capital position. However, the business remains unprofitable, faces ongoing revenue decline forecasts, and has a history of shareholder dilution and volatility. This news event sharpens Bakkt’s core narrative but doesn’t erase the risk of continued unprofitability and uncertain top-line growth, making short-term catalysts more closely tied to crypto market momentum rather than company fundamentals.

By contrast, shareholder dilution risk remains an important issue investors should note.

Exploring Other Perspectives

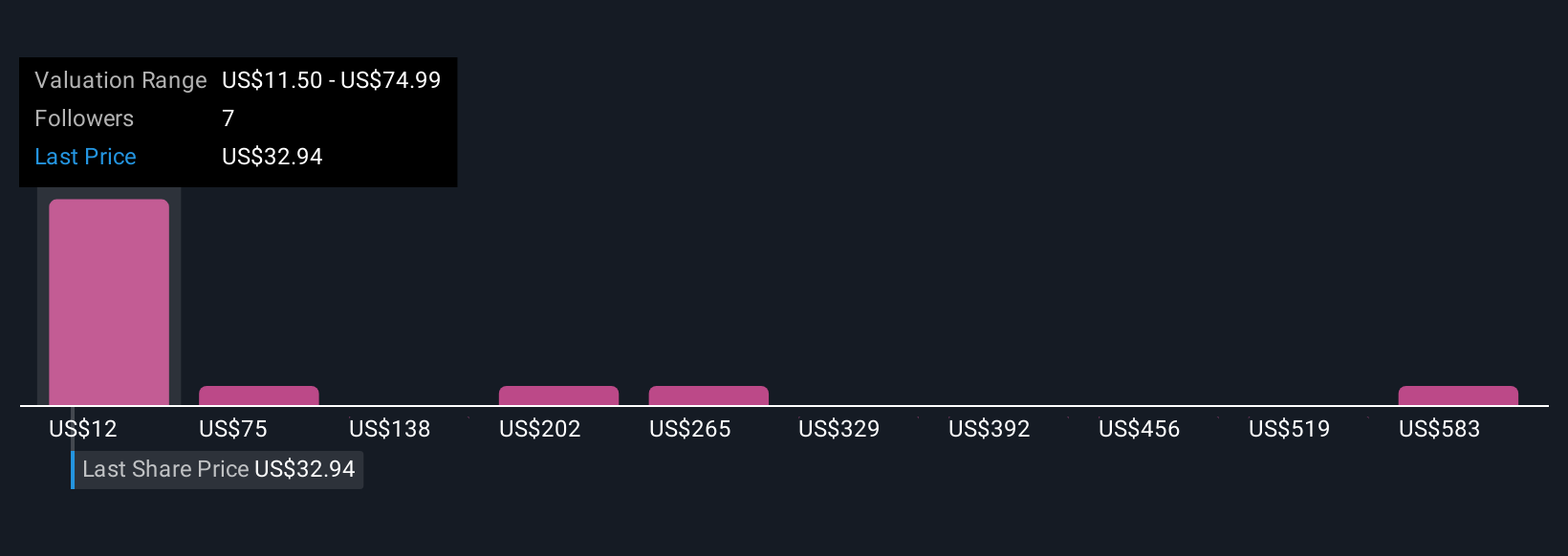

Explore 6 other fair value estimates on Bakkt Holdings - why the stock might be a potential multi-bagger!

Build Your Own Bakkt Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bakkt Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bakkt Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bakkt Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bakkt Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKKT

Bakkt Holdings

Offers software as a service and application programming interface solutions for crypto trading capabilities and loyalty for clients and customers.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)