- United States

- /

- Consumer Finance

- /

- NYSE:AXP

Assessing American Express (AXP) Valuation After Recent Share Price Dip

Reviewed by Kshitija Bhandaru

American Express (AXP) shares have come under some pressure recently, dropping roughly 2% in the past week. Investors appear to be weighing the company's current valuation in comparison to its strong year-to-date and one-year returns.

See our latest analysis for American Express.

Despite a choppy week for American Express, momentum has generally been strong. While the share price dipped recently, the past year's total shareholder return stands at an impressive 15.75%, and the long-term trajectory is even more pronounced.

If you're weighing other opportunities, this could be an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With recent gains still fresh in memory, the question for investors is whether American Express is attractively priced for further upside, or if the market has already factored in its growth potential, leaving little room for surprise.

Most Popular Narrative: 4.1% Undervalued

With American Express closing at $316.26 and the most widely followed narrative assigning a fair value of $329.62, the stock sits below this mark. This implies potential for upside, provided the narrative's assumptions hold true. This sets the stage for a valuation heavily geared toward both premium positioning and future international expansion.

The company's ongoing focus on premium cardmembers and product refreshes, especially the upcoming U.S. Platinum Card relaunch, positions American Express to benefit from consumers' growing demand for personalized experiences and value-added rewards, likely boosting net card fee growth and retention, which supports long-term revenue and fee income expansion.

Want to know what’s driving this punchy price target? The narrative hinges on bold revenue growth ambitions, aggressive margin preservation, and a future profit multiple that stands out next to industry standards. What are the exact forecasts and financial bets at stake? The answer may surprise you. Unlock the full story to see the numbers that fuel this outlook.

Result: Fair Value of $329.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in the premium card space and shifting consumer preferences toward digital payments could present challenges for American Express's growth narrative.

Find out about the key risks to this American Express narrative.

Another View: Comparing Against Market Multiples

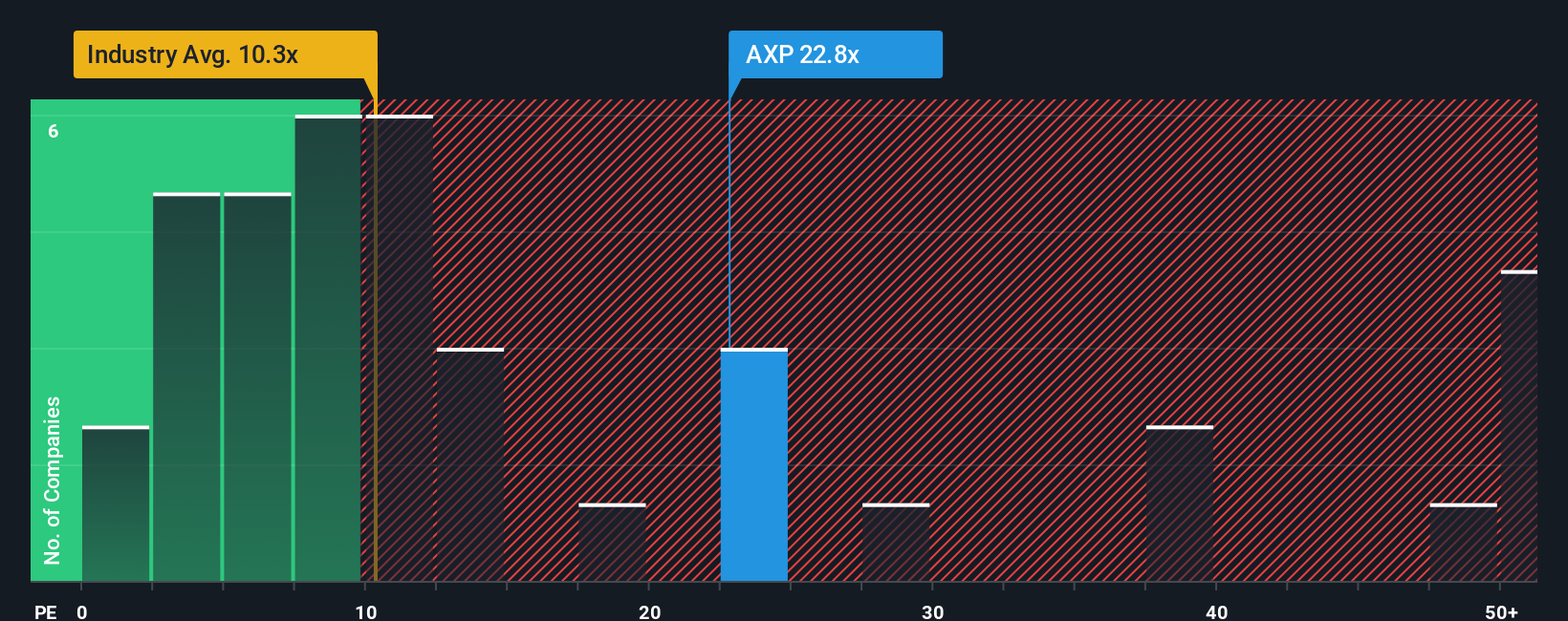

Looking at American Express through the lens of its price-to-earnings ratio, the stock trades at 22x earnings. This is noticeably higher than the industry average of 10.4x and even above the fair ratio of 21.3x. This suggests investors may be accepting more valuation risk today. Can the premium be justified as growth slows, or is the stock vulnerable if sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Express Narrative

If you see things differently or want to dig into the details yourself, you can create your own American Express narrative in just a few minutes. Do it your way.

A great starting point for your American Express research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make moves that set you ahead of the market by acting on fresh opportunities other investors might miss. Check out these handpicked stock ideas you won’t want to overlook:

- Boost your portfolio with impressive yields and climb above the crowd by targeting these 19 dividend stocks with yields > 3% offering strong income potential and reliable growth.

- Ride the AI wave early and gain exposure to the latest advancements by choosing these 24 AI penny stocks that drive innovation in automation and analytics.

- Tap into undervalued gems before the market catches on by scanning these 898 undervalued stocks based on cash flows, where hidden potential and strong fundamentals align for smart investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives