- United States

- /

- Consumer Finance

- /

- NYSE:AXP

American Express (NYSE:AXP) Faces 11% Drop Despite Dividend Increase

Reviewed by Simply Wall St

Following recent strategic moves, including a substantial dividend increase and the addition of a new board member, American Express (NYSE:AXP) has faced a challenging week with its share price declining 12%. While the company's focus on shareholder value was underscored by these initiatives, market volatility stemming from broader economic concerns and recent tariff hikes by the U.S. may have overshadowed these positive changes. Investor sentiment was further strained amid a downturn in the wider market, with the Dow Jones and S&P 500 declining by over 1% as political and economic uncertainties heightened recession fears. Amid these pressures, American Express's collaboration with Alipay to improve customer experiences abroad signals its strategic priorities. However, the ongoing market malaise, reflected in the 5% week-long drop in the Nasdaq, may have contributed to AXP's negative performance, suggesting that external economic conditions played a significant role in its recent stock price movements.

Navigate through the intricacies of American Express with our comprehensive report here.

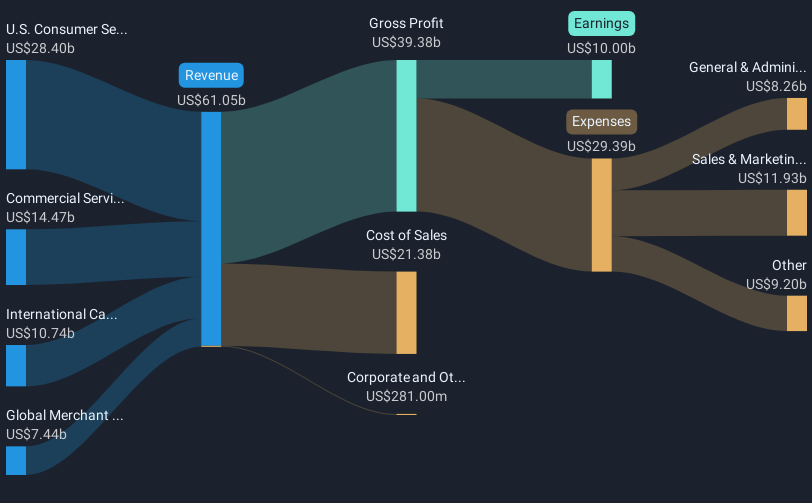

Over the past five years, American Express has delivered a substantial total return of 225.62%. This positive trajectory reflects several key factors that have driven the company’s performance. Notably, American Express experienced strong profit growth, with earnings increasing at an annual rate of 14.8%. The company's strategic partnerships have bolstered its market presence, such as the collaboration with Alipay announced in February 2025, enhancing its services for international travelers.

Moreover, American Express outperformed the US market with an annualized return exceeding the market's one-year return of 8.8%. In the financial landscape, the company has maintained a competitive edge, reflected in its favorable pricing compared to peers. Additionally, dividend enhancements, including the March 2025 increase, indicate a continued commitment to shareholder value. Through prudent debt management and targeted client partnerships, American Express has positioned itself effectively in the ever-evolving consumer finance sector.

- Analyze American Express' fair value against its market price in our detailed valuation report—access it here.

- Explore the potential challenges for American Express in our thorough risk analysis report.

- Hold shares in American Express? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives