- United States

- /

- Consumer Finance

- /

- NYSE:AXP

American Express (AXP) Valuation Update Following High-Profile Sports and Entertainment Partnership Expansion

Reviewed by Simply Wall St

American Express (AXP) just announced new multi-year partnerships with iconic names in sports and entertainment, including Hard Rock Stadium, the Formula 1 Miami Grand Prix, and the Miami Dolphins. Card Members in South Florida and beyond can look forward to an array of new perks, such as presale ticket access, exclusive lounges, and special fan experiences. This move not only expands Amex’s sponsorship footprint but also signals a clear strategy to deepen customer engagement in an increasingly competitive space for premium card brands.

Following this announcement, American Express shares have continued their steady climb. The stock is up nearly 27% over the last year, with upward momentum supported by an 8% gain in the past three months. This adds to a longer-term period during which the company has more than doubled investors’ money in three years, all amid healthy revenue and profit growth and increasing relevance in the lifestyle perks landscape.

As the company secures new partnerships and the stock continues to perform well, investors may be considering whether this represents a noteworthy opportunity for the long term, or if the market has already priced in the benefits of Amex’s recent moves.

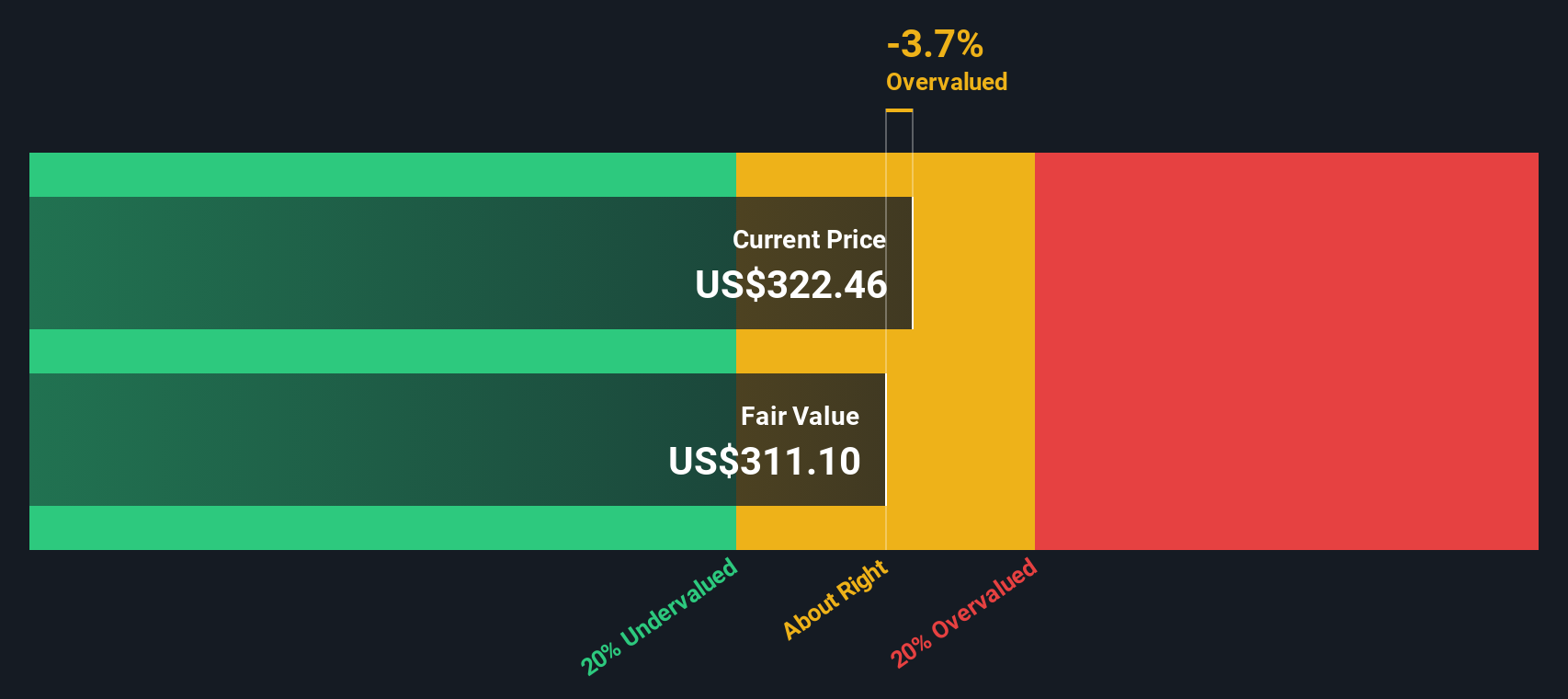

Most Popular Narrative: 3.6% Overvalued

According to the narrative by WallStreetWontons, American Express is currently considered overvalued by 3.6%, based on detailed projections for revenue and earnings growth.

American Express has been actively enhancing its product offerings and making strategic acquisitions to drive sales and earnings growth. Here are some key points from recent earnings calls and reports: Product Innovations and Refreshes: American Express is on track to refresh approximately 40 products globally by the end of the year, including a refreshed US consumer gold card.

How exactly do these bold product moves and aggressive acquisitions shape such a high price? The narrative builds its fair value on rapid expansions, membership changes, and the promise of increasing profit margins. Interested in which financial levers and growth assumptions are contributing to this premium? The numbers behind the story may be surprising.

Result: Fair Value of $308.19 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, international challenges, such as license cancellations and potential disruptions in overseas markets, could weaken American Express's growth trajectory in coming quarters.

Find out about the key risks to this American Express narrative.Another View: Discounted Cash Flow Model

Looking from another angle, our DCF model suggests American Express might be trading above its intrinsic value. Instead of relying on market vibes or projections, this approach uses future cash flows to estimate worth and raises the question: could current optimism be ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Express Narrative

If you want a different perspective or prefer to dig into the numbers yourself, creating your own narrative is quick and easy. Just do it your way.

A great starting point for your American Express research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock more opportunities with the Simply Wall Street Screener. If you want to put your cash to work beyond American Express, don’t let these compelling stock trends pass you by:

- Boost your portfolio’s income potential by checking out stocks offering impressive yields and consistent payouts. You can find promising opportunities in dividend stocks with yields > 3%.

- Tap into the explosive world of AI by seeking out standout companies transforming the healthcare sector with cutting-edge technology through healthcare AI stocks.

- Catch undervalued gems before the crowd does and capitalize on companies trading below their intrinsic value via undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives