- United States

- /

- Consumer Finance

- /

- NYSE:AXP

American Express (AXP) Unveils Innovative Travel Tools for Enhanced Card Member Experience

Reviewed by Simply Wall St

American Express (AXP) recently introduced new digital travel tools aimed at enhancing the travel experience for Card Members, launching its app for iOS users. Within the last quarter, AXP's share price increased by 11%, amidst several company developments, including a partnership with UPS, the opening of an Aspire Executive Lounge, and dividend declarations. While the company's initiatives, including reaffirmed earnings guidance and the introduction of enhanced travel services, align with broader market trends, the strength of the general market, with indices reaching record highs, likely added weight to AXP's performance.

American Express's recent introduction of digital travel tools and the iOS app could serve as a significant catalyst for its travel-related revenue streams. This development aligns with broader market trends in enhancing customer experiences, which may bolster customer engagement and potentially drive revenue growth. However, given the narrative's mention of decelerating airline and entertainment spending, the timing might affect the company's ability to fully capitalize on these initiatives. While such enhancements offer competitive advantages, the pressures from macroeconomic factors and spending challenges remain pertinent risks to revenue forecasts.

In terms of long-term performance, American Express shares have exhibited a total return of 253.07% over the past five years. This substantial return highlights resilience, even as recent one-year performance records a slight underperformance in comparison to the US Consumer Finance industry return of 37.6%. This discrepancy suggests that despite strong long-term returns, short-term challenges may have affected its comparative position within its industry peers.

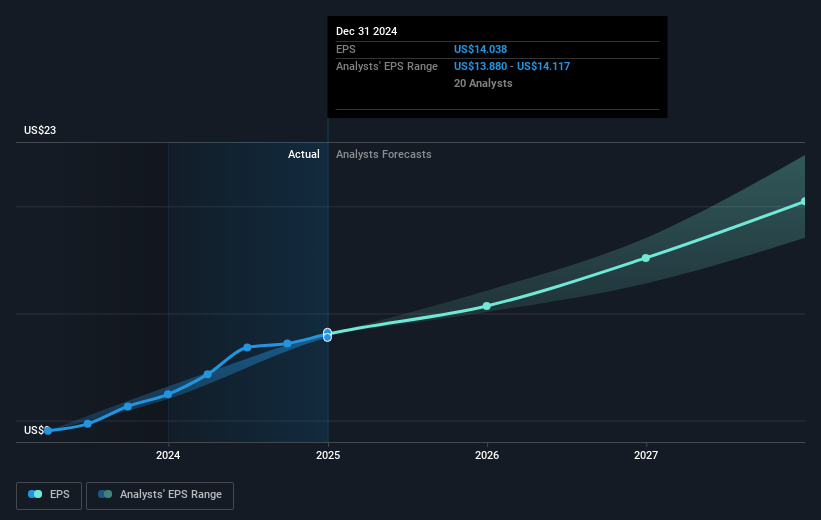

With a current share price of US$325.31, there's a slight deviation from the consensus price target of US$323.31, indicating the stock is trading at a tiny premium to the target. The recent price increase of 11% in the last quarter amidst these company developments points towards market optimism around American Express’s new initiatives and strategic partnerships. However, as earnings forecasts indicate a conservative growth trajectory, especially in light of the bearish expectations, this price movement might not significantly influence the long-term valuation outlook. The company's diversified revenue base and strong consumer spending trends could provide necessary support to its earnings as it navigates upcoming challenges in maintaining stable revenue growth.

Dive into the specifics of American Express here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives