- United States

- /

- Consumer Finance

- /

- NYSE:ALLY

Did Ally Financial's (ALLY) Shelf Registration Signal a New Approach to Funding Its Digital Banking Ambitions?

Reviewed by Sasha Jovanovic

- In early October 2025, Ally Financial filed a mixed shelf registration, enabling the company to issue senior subordinated notes, preferred stock, and depositary shares as needed in the future.

- This move gives Ally Financial increased flexibility to access capital markets and adjust its funding mix, which may influence future growth initiatives and balance sheet structure.

- We'll examine how this expanded capital-raising flexibility could influence Ally Financial's ability to support its digital banking and auto finance growth strategy.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

Ally Financial Investment Narrative Recap

If you’re considering Ally Financial, you’ll want to believe in the continued growth of digital banking and the company’s ability to maintain a leading position in auto finance. The recent shelf registration gives Ally added short-term financial flexibility, but it is not expected to materially impact the most important upcoming catalyst, the company’s Q3 results, or address the largest risk: ongoing customer credit quality and loan loss provisions in a potentially volatile economy.

One relevant announcement is the upcoming Q3 2025 earnings release, scheduled for October 17, which will provide the first look at whether balance sheet moves, including potential capital raises, are translating into improved profitability. Investors should pay close attention, as surprise results could quickly shift views on the value of the new capital-raising capacity.

However, before getting too comfortable with Ally’s capital flexibility, investors should be aware that increased regulatory compliance and consumer credit risk still remain critical issues...

Read the full narrative on Ally Financial (it's free!)

Ally Financial's narrative projects $9.6 billion in revenue and $1.8 billion in earnings by 2028. This requires 12.0% yearly revenue growth and a $1.48 billion earnings increase from current earnings of $324.0 million.

Uncover how Ally Financial's forecasts yield a $47.12 fair value, a 19% upside to its current price.

Exploring Other Perspectives

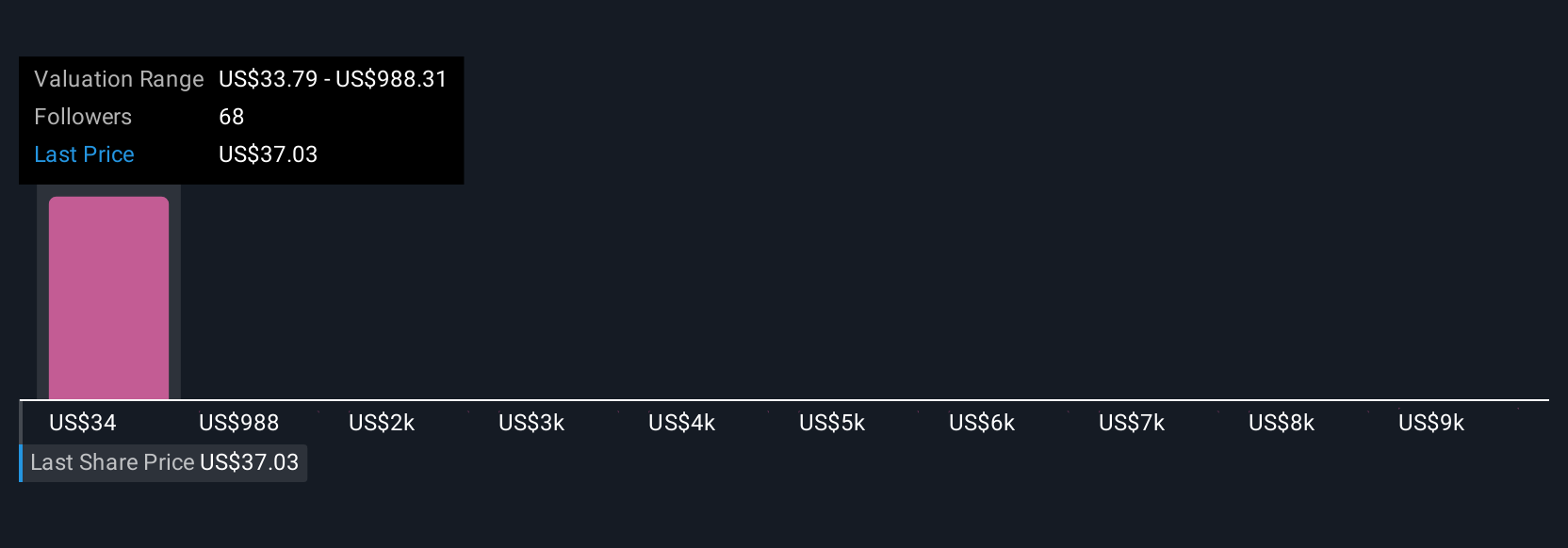

Eleven members of the Simply Wall St Community peg Ally’s fair value from US$33.79 to US$9,578.94. Despite these wide-ranging views, keep in mind that rising digital banking demand is central to management’s growth expectations and could shape future results in unexpected ways.

Explore 11 other fair value estimates on Ally Financial - why the stock might be worth 15% less than the current price!

Build Your Own Ally Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ally Financial research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Ally Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ally Financial's overall financial health at a glance.

No Opportunity In Ally Financial?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALLY

Ally Financial

A digital financial-services company, provides various digital financial products and services in the United States, Canada, and Bermuda.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives