- United States

- /

- Diversified Financial

- /

- NYSE:AGM

Here's Why We Think Federal Agricultural Mortgage (NYSE:AGM) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Federal Agricultural Mortgage (NYSE:AGM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Federal Agricultural Mortgage with the means to add long-term value to shareholders.

See our latest analysis for Federal Agricultural Mortgage

How Fast Is Federal Agricultural Mortgage Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Federal Agricultural Mortgage grew its EPS by 17% per year. That's a good rate of growth, if it can be sustained.

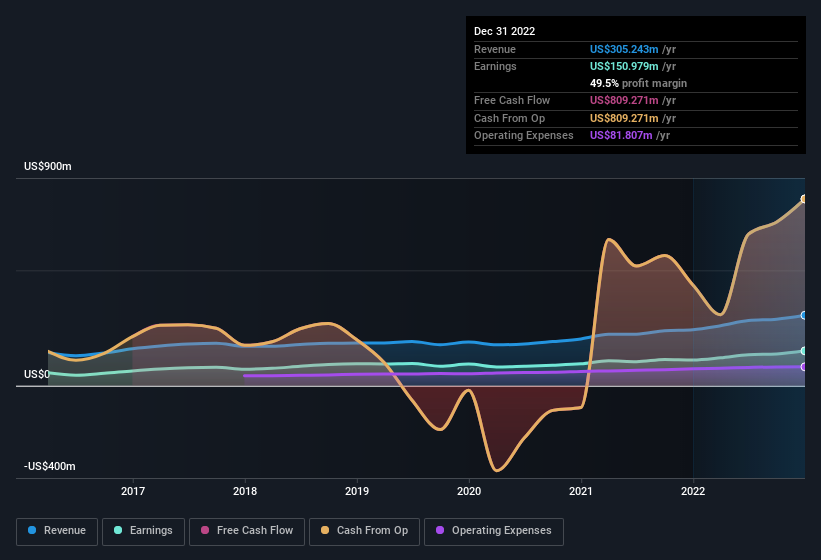

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that Federal Agricultural Mortgage's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While we note Federal Agricultural Mortgage achieved similar EBIT margins to last year, revenue grew by a solid 26% to US$305m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Federal Agricultural Mortgage's future profits.

Are Federal Agricultural Mortgage Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insiders in Federal Agricultural Mortgage both added to and reduced their holdings over the preceding 12 months. All in all though, their acquisitions outweighed the amount of shares they sold off. At face value we can consider this a fairly encouraging sign for the company. It is also worth noting that it was Independent Director Robert Sexton who made the biggest single purchase, worth US$250k, paying US$125 per share.

Along with the insider buying, another encouraging sign for Federal Agricultural Mortgage is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at US$18m. That's a lot of money, and no small incentive to work hard. Despite being just 1.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Brad Nordholm is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Federal Agricultural Mortgage with market caps between US$1.0b and US$3.2b is about US$5.4m.

The Federal Agricultural Mortgage CEO received US$3.2m in compensation for the year ending December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Federal Agricultural Mortgage Worth Keeping An Eye On?

One important encouraging feature of Federal Agricultural Mortgage is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Even so, be aware that Federal Agricultural Mortgage is showing 2 warning signs in our investment analysis , you should know about...

The good news is that Federal Agricultural Mortgage is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Federal Agricultural Mortgage, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AGM

Federal Agricultural Mortgage

Provides a secondary market for various loans made to borrowers in the United States.

Established dividend payer and fair value.

Market Insights

Community Narratives