- United States

- /

- Oil and Gas

- /

- NasdaqCM:PNRG

Unearthing Hidden Gems PrimeEnergy Resources and Two Promising Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.7% drop, yet it has risen by 23% over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying stocks with strong growth potential and unique value propositions can uncover opportunities like PrimeEnergy Resources and two other promising small caps that may not yet be on every investor's radar.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

PrimeEnergy Resources (NasdaqCM:PNRG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: PrimeEnergy Resources Corporation, with a market cap of $296.17 million, is involved in the acquisition, development, and production of oil and natural gas properties in the United States through its subsidiaries.

Operations: PrimeEnergy Resources generates revenue primarily from its oil and gas exploration, development, operation, and servicing activities, amounting to $210.06 million.

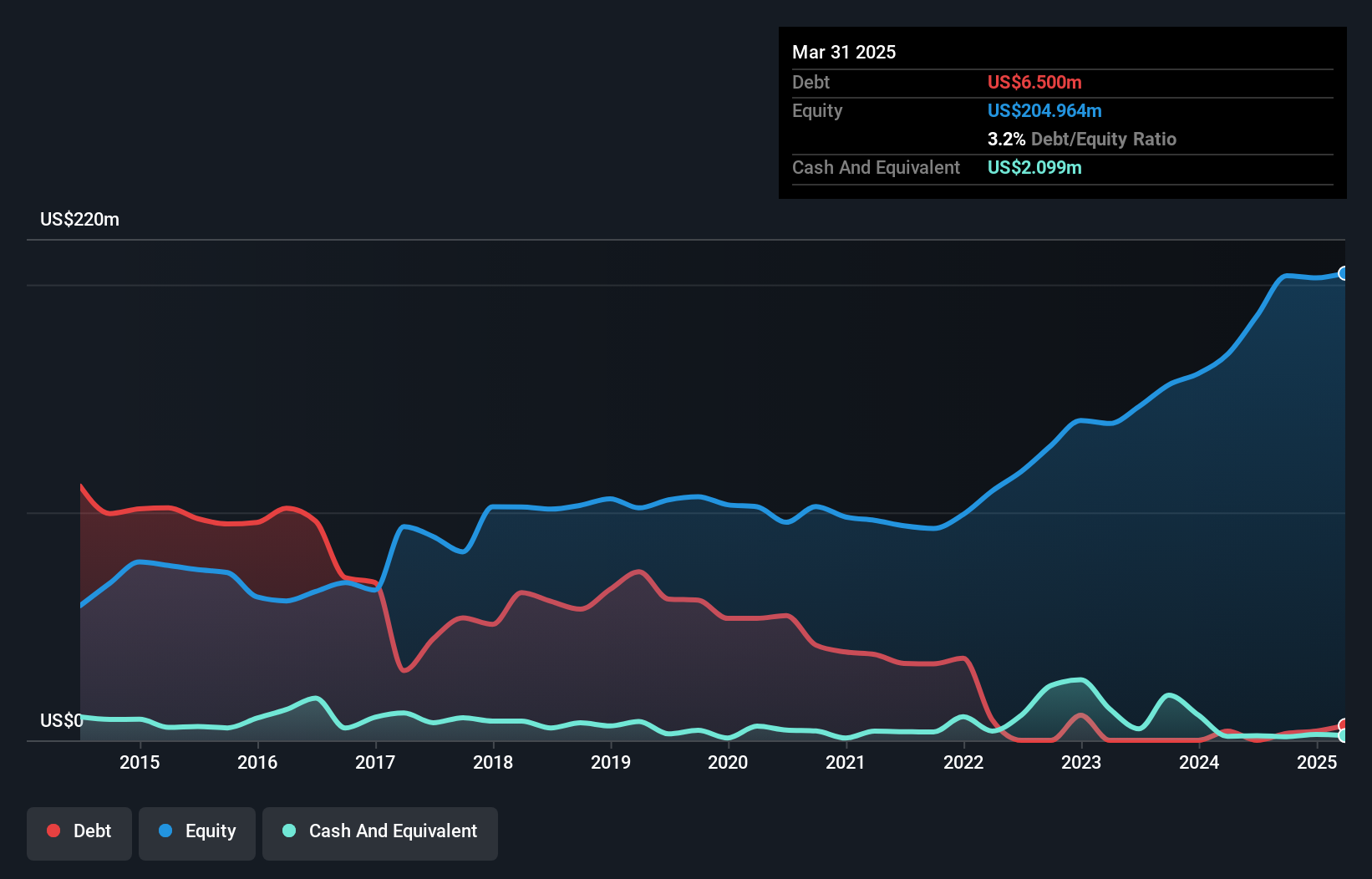

PrimeEnergy Resources, a relatively small player in the energy sector, has shown impressive growth with earnings rising 65.7% over the past year, outpacing the industry average. Trading at 95.2% below its estimated fair value, it appears to offer significant potential for value investors. The company's debt to equity ratio has improved dramatically from 57.5% to 1.5% over five years, indicating prudent financial management. Recent production results are promising with oil and natural gas outputs nearly doubling compared to last year, while net income surged from US$10.72 million to US$22.08 million in the latest quarter alone.

- Take a closer look at PrimeEnergy Resources' potential here in our health report.

Understand PrimeEnergy Resources' track record by examining our Past report.

Kelly Services (NasdaqGS:KELY.A)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kelly Services, Inc. offers workforce solutions across multiple industries and has a market capitalization of approximately $466.87 million.

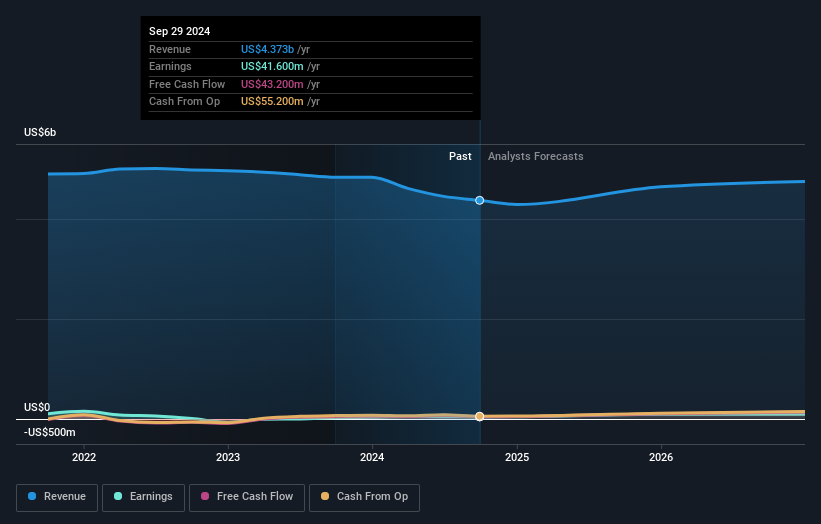

Operations: Kelly Services generates revenue primarily from its Professional & Industrial segment ($1.40 billion) and Science, Engineering & Technology segment ($1.31 billion), with additional contributions from Education ($941.10 million) and Outsourcing & Consulting ($458.30 million). The company has a market capitalization of approximately $466.87 million.

Kelly Services, a notable player in specialized staffing, is trading at 89.2% below its estimated fair value, indicating potential upside. With a satisfactory net debt to equity ratio of 15.3%, the company maintains financial stability despite market fluctuations. Recent earnings growth of 80.1% outpaces the industry average of 10.2%, although impacted by a one-off $15.9 million loss this year ending September 2024. The firm announced a $50 million share repurchase program to enhance shareholder value and improve long-term growth prospects amidst recent index drops from S&P listings on December 7, highlighting both opportunities and challenges ahead.

World Acceptance (NasdaqGS:WRLD)

Simply Wall St Value Rating: ★★★★★☆

Overview: World Acceptance Corporation operates in the consumer finance sector within the United States, with a market capitalization of $581.47 million.

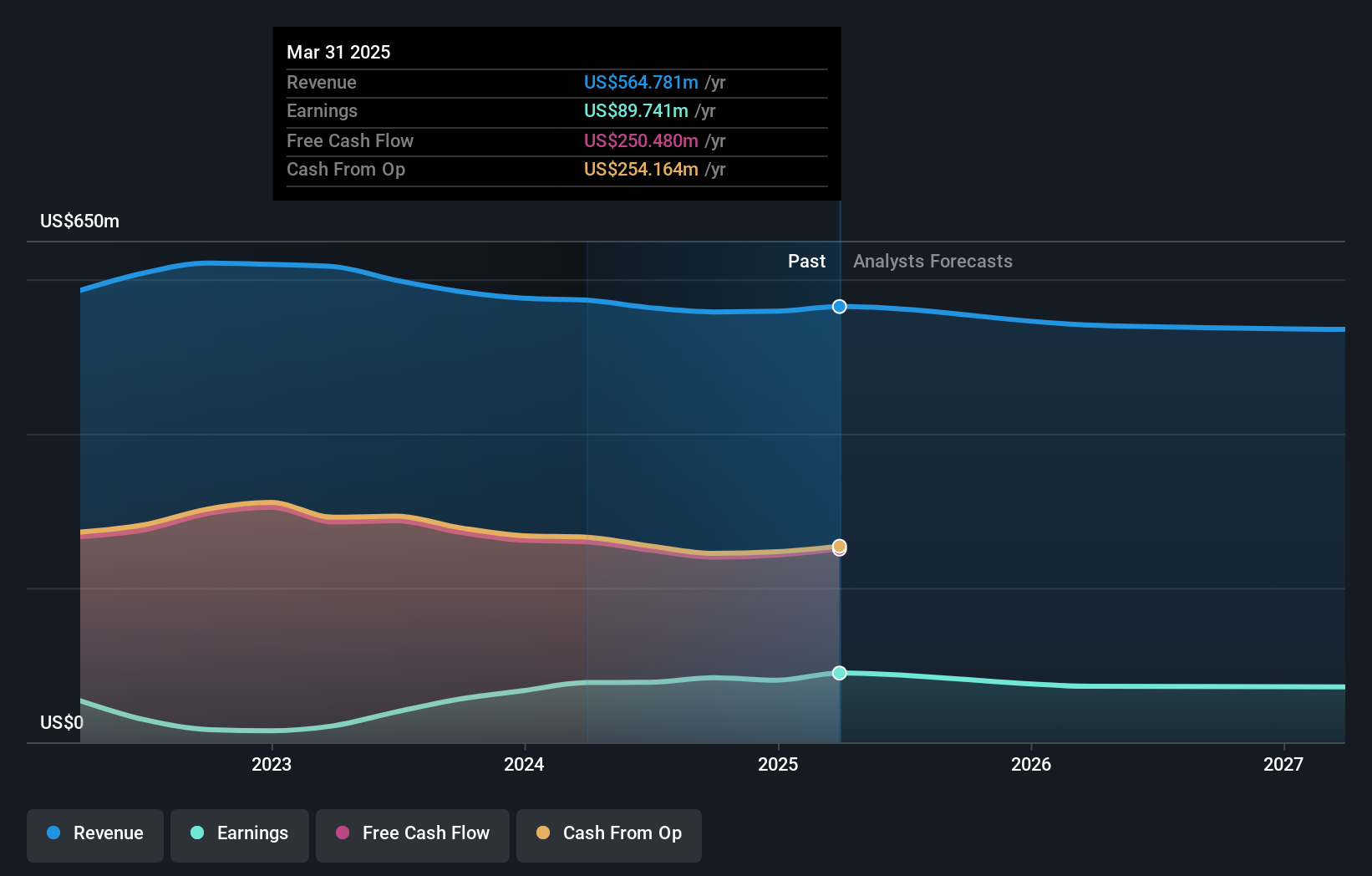

Operations: World Acceptance generates revenue primarily from its consumer finance segment, amounting to $557.89 million. The company's financial performance is reflected in its net profit margin trends, which can offer insights into operational efficiency and profitability.

World Acceptance, a notable player in the consumer finance sector, has shown impressive earnings growth of 49.5% over the past year, outpacing industry averages. Trading at 10.4% below its estimated fair value, it offers an intriguing valuation proposition. Despite a high net debt to equity ratio of 118.6%, interest payments are well covered with an EBIT coverage of 3.4 times. Recent buybacks saw the company repurchase shares worth US$10 million, indicating confidence in its financial health and future prospects amidst potential revenue declines and margin pressures forecasted for the coming years.

Taking Advantage

- Explore the 239 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PNRG

PrimeEnergy Resources

Through its subsidiaries, engages in acquisition, development, and production of oil and natural gas properties in the United States.

Good value with proven track record.