- United States

- /

- Food and Staples Retail

- /

- NYSE:DDL

SAB Biotherapeutics Leads The Pack Of 3 US Penny Stocks To Consider

Reviewed by Simply Wall St

As the United States stock market navigates a complex landscape of inflation data and interest rate adjustments, investors are exploring diverse opportunities across various sectors. The term 'penny stocks' may seem outdated, but these smaller or newer companies can still offer potential for growth when they possess strong financial fundamentals. In this article, we explore three U.S. penny stocks that stand out for their financial resilience and potential to deliver value to investors seeking to uncover promising opportunities in the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $99.16M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.36 | $1.91B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.89 | $6.46M | ★★★★★★ |

| Pangaea Logistics Solutions (NasdaqCM:PANL) | $4.84 | $227.01M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2109 | $7.76M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.84 | $86.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.9694 | $17.19M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.78 | $70.15M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.51 | $374.79M | ★★★★☆☆ |

Click here to see the full list of 742 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

SAB Biotherapeutics (NasdaqCM:SABS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SAB Biotherapeutics, Inc. is a clinical-stage biopharmaceutical company developing human polyclonal immunotherapeutic antibodies for immune system disorders and infectious diseases, with a market cap of $42.92 million.

Operations: SAB Biotherapeutics generates its revenue from the biotechnology segment, totaling $1.51 million.

Market Cap: $42.92M

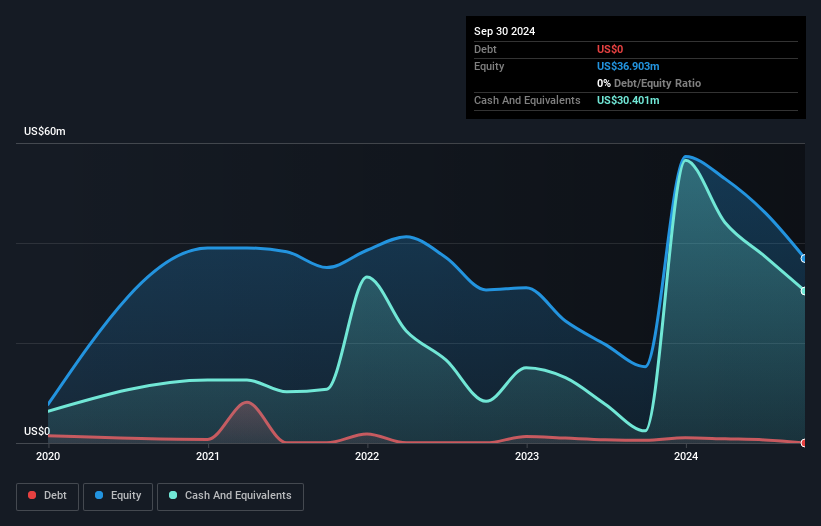

SAB Biotherapeutics, Inc., with a market cap of US$42.92 million, has faced increasing net losses, reporting a US$10.35 million loss in Q3 2024 compared to US$5.1 million the previous year. Despite being debt-free and having short-term assets exceeding liabilities, SAB is unprofitable with a negative return on equity and less than one year of cash runway. The company's revenue decreased to US$1.21 million for the first nine months of 2024 from US$1.93 million in the prior period, indicating challenges in achieving profitability amidst high share price volatility and declining earnings forecasts over the next three years.

- Dive into the specifics of SAB Biotherapeutics here with our thorough balance sheet health report.

- Understand SAB Biotherapeutics' earnings outlook by examining our growth report.

Vista Gold (NYSEAM:VGZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vista Gold Corp. is engaged in acquiring, exploring, evaluating, and advancing gold exploration and development projects in Australia, with a market cap of $70.71 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: $70.71M

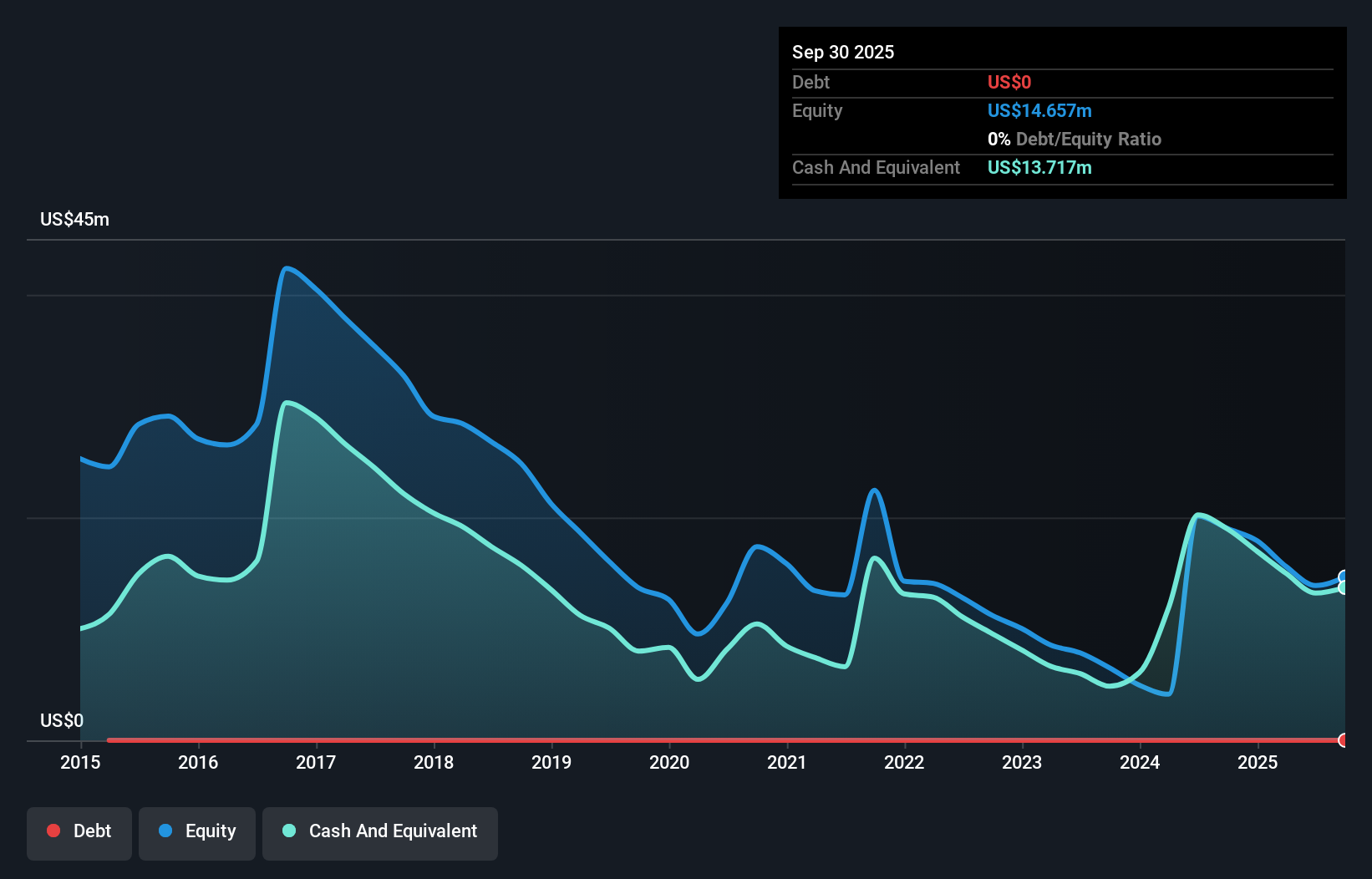

Vista Gold Corp., with a market cap of US$70.71 million, is pre-revenue but recently turned profitable, reporting net income for the first nine months of 2024. The company remains debt-free and has short-term assets exceeding its liabilities, indicating financial stability. Recent developments include a feasibility study for the Mt Todd gold project aimed at enhancing reserve grades and reducing initial capital expenditure to US$400 million. Drilling results show promising high-grade gold intercepts, suggesting potential resource expansion. Vista's low price-to-earnings ratio suggests it may be undervalued compared to the broader U.S. market average.

- Navigate through the intricacies of Vista Gold with our comprehensive balance sheet health report here.

- Learn about Vista Gold's historical performance here.

Dingdong (Cayman) (NYSE:DDL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dingdong (Cayman) Limited is an e-commerce company operating in China with a market cap of approximately $886.67 million.

Operations: The company generates revenue of CN¥22.15 billion from its online retail operations.

Market Cap: $886.67M

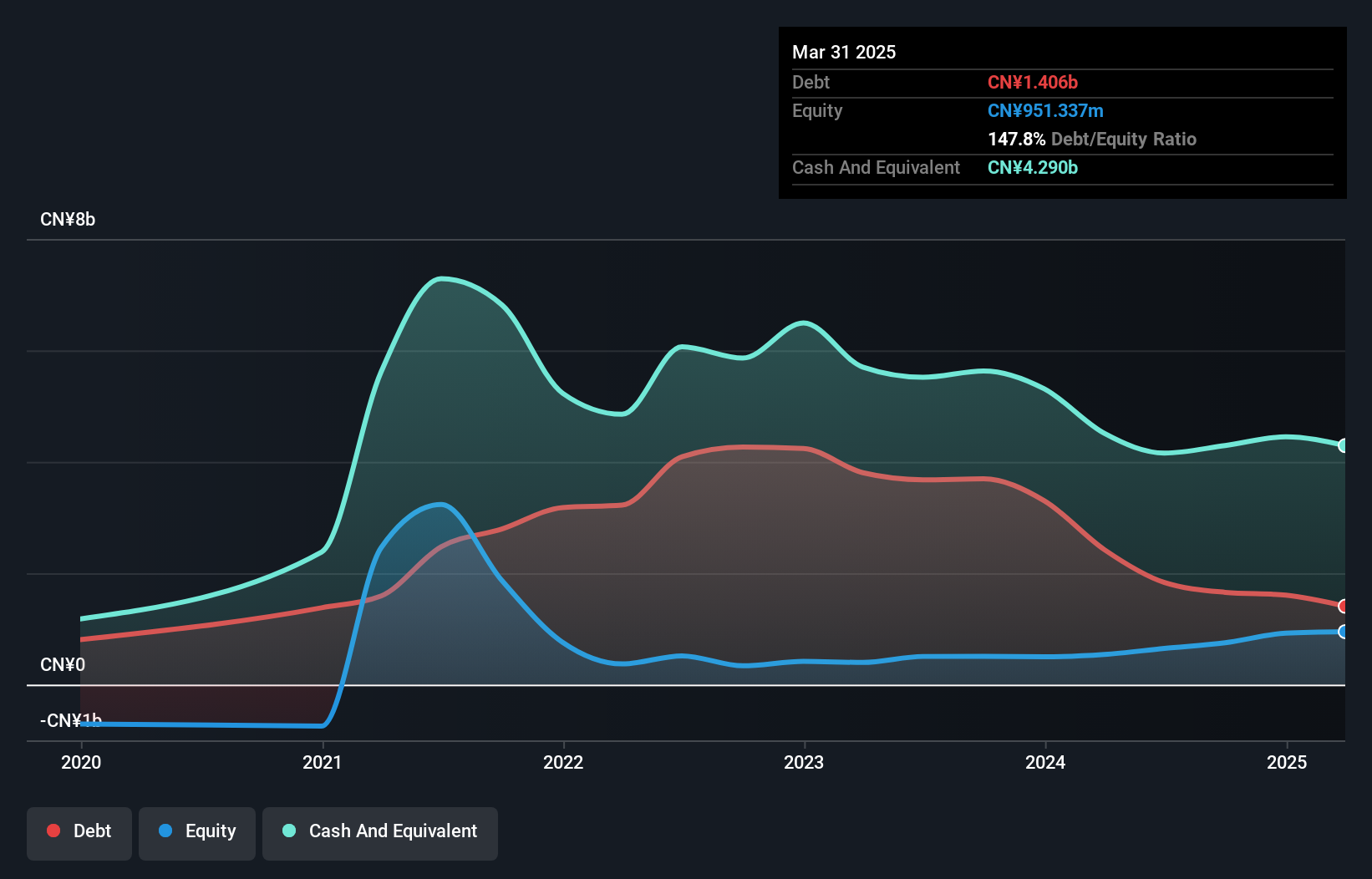

Dingdong (Cayman) Limited, with a market cap of approximately $886.67 million, reported significant revenue growth to CN¥6.54 billion for Q3 2024 and improved net income to CN¥133.41 million from the previous year. The company has become profitable over the past year, supported by high-quality earnings and effective debt management, as cash exceeds total debt and operating cash flow covers liabilities well. Despite its volatile share price, Dingdong is trading significantly below its estimated fair value and has raised financial guidance for 2024, anticipating substantial growth in net profit and scale for the fourth quarter and full year.

- Unlock comprehensive insights into our analysis of Dingdong (Cayman) stock in this financial health report.

- Explore Dingdong (Cayman)'s analyst forecasts in our growth report.

Where To Now?

- Click through to start exploring the rest of the 739 US Penny Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DDL

Flawless balance sheet and undervalued.

Market Insights

Community Narratives