- United States

- /

- Capital Markets

- /

- NasdaqCM:VALU

Discovering Undiscovered Gems in United States This September 2024

Reviewed by Simply Wall St

Over the last 7 days, the market has dropped 4.4%. As for the longer term, the market has risen by 19% in the last year. Earnings are expected to grow by 15% per annum over the next few years. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding. This article highlights three lesser-known companies that could offer significant opportunities this September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| First Ottawa Bancshares | 85.49% | 7.25% | 25.81% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

| AMTD Digital | 26.12% | 9.22% | 33.48% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Value Line (NasdaqCM:VALU)

Simply Wall St Value Rating: ★★★★★★

Overview: Value Line, Inc. engages in the production and sale of investment periodicals and related publications with a market cap of $403.19 million.

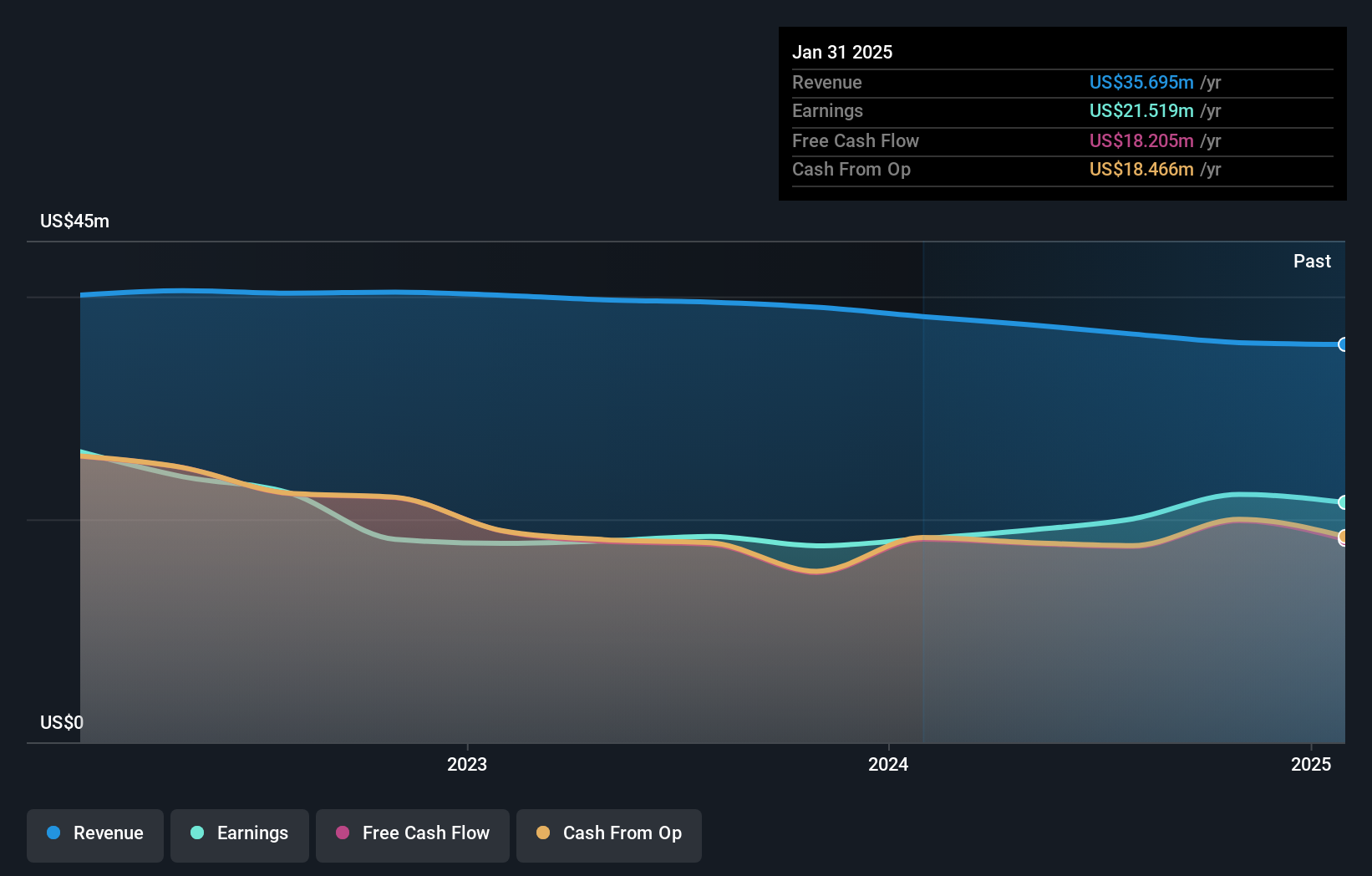

Operations: The company generated $37.49 million in revenue from its publishing segment.

Value Line, a small cap financial company, has shown steady earnings growth of 6.5% annually over the past five years. Despite trading at 5.9% below its fair value estimate, it did not outperform its industry peers last year with a 5.2% earnings growth compared to the Capital Markets industry's 15.7%. The firm remains debt-free and reported net income of US$19 million for the full year ending April 2024, up from US$18 million previously.

- Dive into the specifics of Value Line here with our thorough health report.

Gain insights into Value Line's past trends and performance with our Past report.

Lifeway Foods (NasdaqGM:LWAY)

Simply Wall St Value Rating: ★★★★★★

Overview: Lifeway Foods, Inc. produces and markets probiotic-based products in the United States and internationally, with a market cap of $303.80 million.

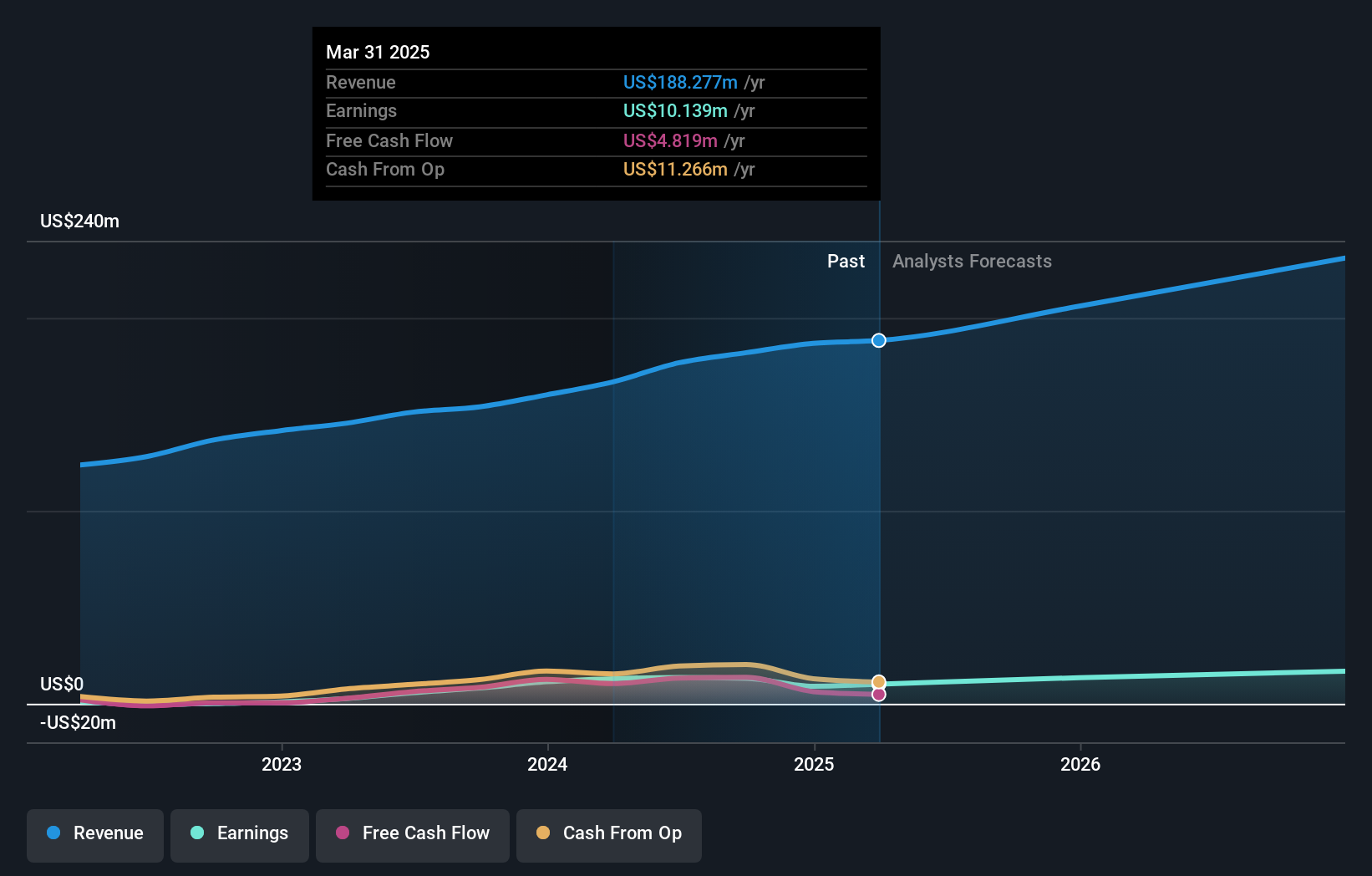

Operations: Lifeway Foods generates revenue primarily from its cultured dairy products, amounting to $176.78 million. The company’s net profit margin is an important metric to consider for understanding profitability.

Lifeway Foods, a notable player in the food industry, has demonstrated impressive financial health and performance. The company reported second-quarter sales of US$49.16 million, up from US$39.23 million last year, with net income rising to US$3.78 million from US$3.16 million. Lifeway is debt-free and its earnings grew by 139% over the past year, outpacing industry growth of 3%. Additionally, it trades at 54.9% below estimated fair value and boasts high-quality earnings with a promising forecasted annual growth rate of 31.66%.

- Click here and access our complete health analysis report to understand the dynamics of Lifeway Foods.

Understand Lifeway Foods' track record by examining our Past report.

China Yuchai International (NYSE:CYD)

Simply Wall St Value Rating: ★★★★★☆

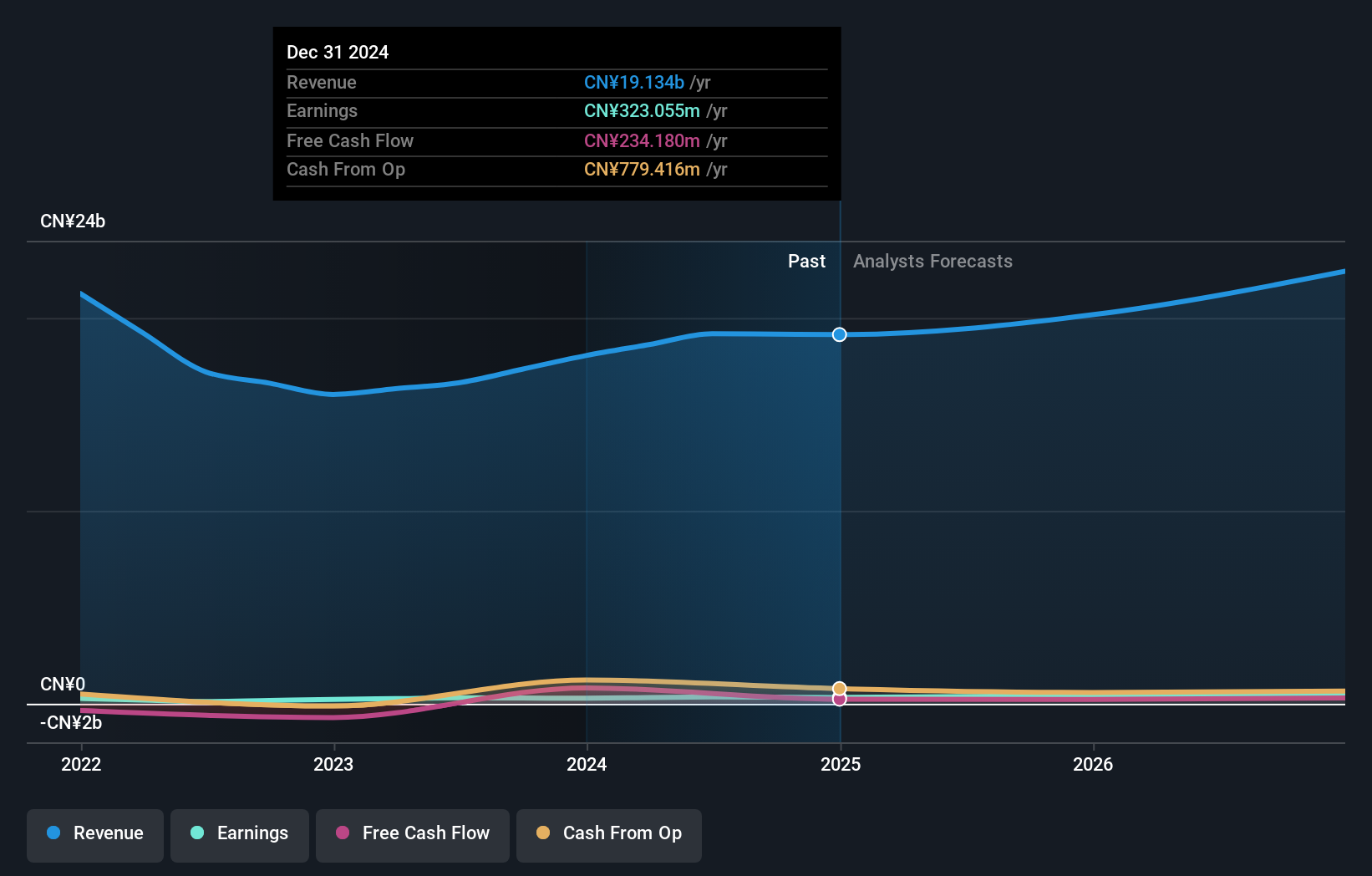

Overview: China Yuchai International Limited, with a market cap of $439.92 million, manufactures, assembles, and sells diesel and natural gas engines for various applications including trucks, buses, passenger vehicles, marine vessels, industrial machinery, construction equipment, agricultural machinery, and generator sets in China and internationally.

Operations: China Yuchai International generates revenue primarily through the manufacturing and sale of diesel and natural gas engines for a variety of applications. The company’s net profit margin has shown notable fluctuations over recent periods.

China Yuchai International has shown impressive performance, with earnings growth of 14.6% over the past year, outpacing the Machinery industry's 10.9%. The company repurchased 3.23 million shares for $38.5 million recently, reflecting confidence in its valuation, which is trading at 57.6% below fair value estimates. Additionally, net income for H1 2024 was CNY 240 million compared to CNY 178 million a year ago and basic earnings per share rose to CNY 5.88 from CNY 4.37 last year.

Where To Now?

- Unlock our comprehensive list of 208 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VALU

Value Line

Engages in the production and sale of investment periodicals and related publications.

Outstanding track record with flawless balance sheet and pays a dividend.