- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Upstart Holdings, Inc.'s (NASDAQ:UPST) Earnings are Mixed, but Institutions are Selling

Upstart Holdings, Inc. ( NASDAQ:UPST ), just released their Q1 earnings, we will review their performance, and look into why the stock lost more than half of its value pre-market open.

Q1 earnings performance highlights:

- Q1 EPS $0.61, vs $0.22 a year ago

- Q1 Revenue at $310m, vs $121.3m a year ago

- Q1 Net income at $32.4m, vs $10.1m a year ago

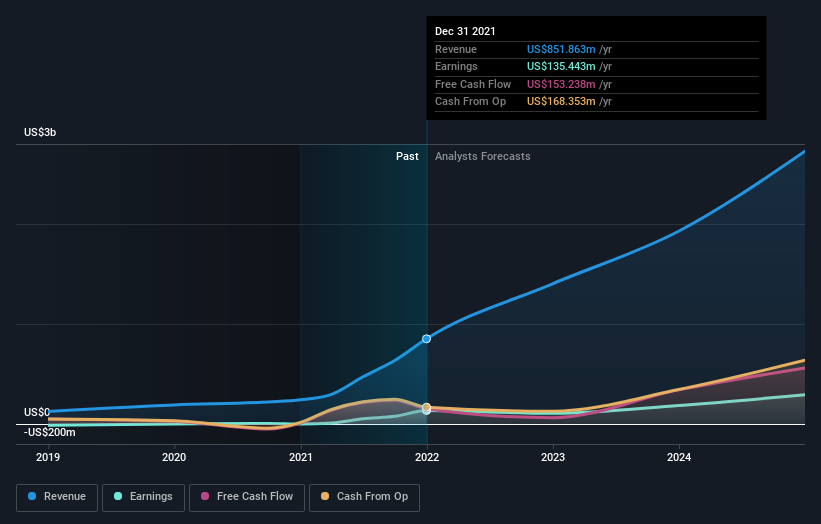

The image blow illustrates what analysts WERE expecting the company to make on a 12-month basis , before earnings - so, we can see the changes in future outlook.

- Expected revenue in 2023 was $1.4b, revised down to $1.25b (-10.7%)

- Expected net income in 2023 was 106.9, seems to be revised to around $150m (based on adjusted Net Income to EBITDA proportions)

Get an interactive chart of analyst estimates at our daily Upstart report.

We can see that, while management adjusted expectations somewhat, it does not coincide with the drop in the stock price.

Rather, we can turn to the comments made during the conference, where the CEO noted that:

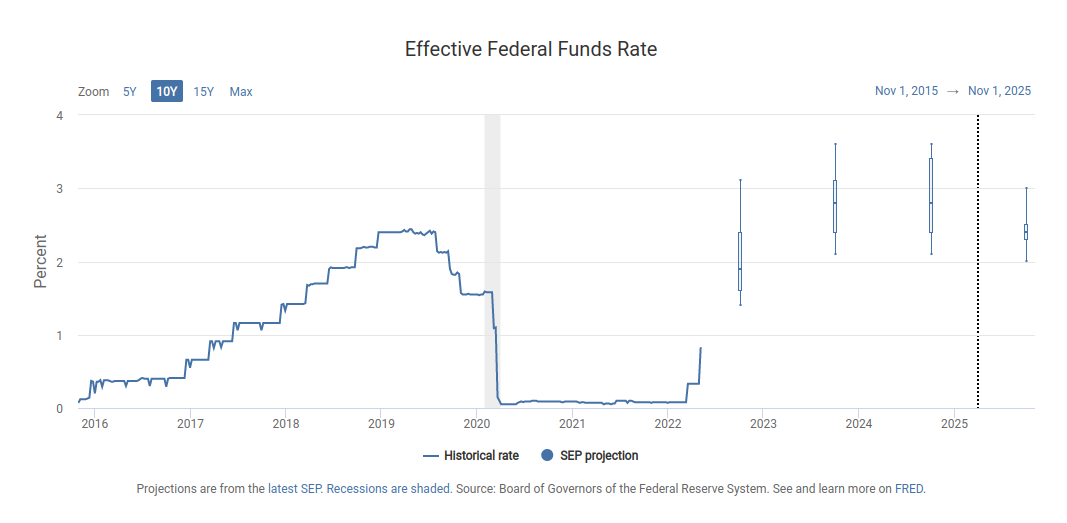

".../ the average loan pricing on our platform has increased more than 300 basis points since October. /... also has the effect of lowering approval rates for applicants on the margin. Given the hawkish signals from the Fed, we anticipate prices will move even higher later this year, which will have the effect of reducing our transaction volume /..."

It seems that the rise in interest rates is expected to negatively affect lenders and the company may lose customers and transactions.

This is likely a key factor to how institutional investors see the future risk of the company. When interest rates were low, upstart had the double benefit of enjoying higher valuations by investors as well as more business from people that wanted to borrow.

Now, that interest rates are rising, and unpredictable in the future, investors are pricing-in more risk, and borrowers are turning away .

A potential time horizon for investors wishing to stick with the company may be late 2024, as that is when rates are currently expected to start dropping . Keep in mind that these projections have and will likely change again in the future!

It seems that multiple institutional investors are unloading their 52% ownership stake today . Which will be reduced by more than 50% pre-market open. The public usually moves second, and it may be harder to find a way to manage the volatility.

On the plus side, it seems that management are still holding their 14% stake and intent on solving the "hard problem" of consumer loan automatization, which can significantly cut expenses for lending institutions and borrowers.

Next Steps:

We've identified 2 warning signs with Upstart Holdings , and understanding them should be part of your investment process.

Ultimately, the future is most important . You can access this free report on analyst forecasts for the company .

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives