- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFi Technologies (NasdaqGS:SOFI) Reports Revenue Rise Despite Net Income Dip

Reviewed by Simply Wall St

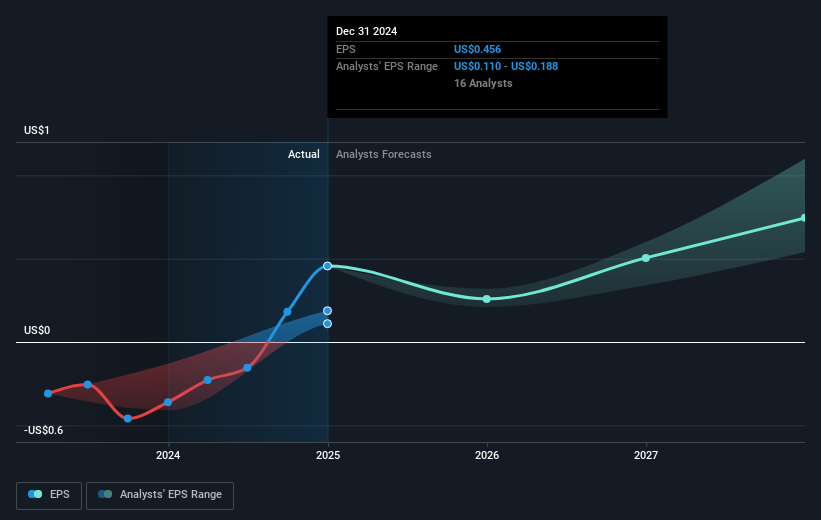

SoFi Technologies (NasdaqGS:SOFI) introduced its SmartStart student loan refinancing option and expanded access to private market funds, aligning with recent financial results that reported a revenue increase but a dip in net income. Despite this mixed financial performance, SoFi's stock price rose 33% last month. These new offerings and results may have contributed positively to the stock's performance, although the market's broader 3% rise also aided the move. While the company's developments were supportive, no single event stands out as the sole catalyst for the significant stock price increase. The broader market trends played a supportive role during this period.

SoFi Technologies' recent introduction of the SmartStart student loan refinancing option and wider access to private market funds aligns with its strategic emphasis on expanding its digital financial services. These initiatives could potentially bolster future revenue and earnings by attracting a broader customer base and enhancing cross-selling opportunities within their existing ecosystem. The new offerings may support SoFi's forecasted revenue growth of 14.1% per year, although economic uncertainties could still pose a challenge to these projections.

Over the past three years, SoFi's total shareholder return stood at 102.70%, highlighting significant long-term performance, despite recent fluctuations. This three-year return contrasts with the recent one-year performance, where SoFi outperformed the US Consumer Finance industry by a notable margin. The share price's upward movement, rising 33% last month, reflects investor anticipation of these positive developments, though the broad market rally also played a supportive role.

SoFi’s current share price of $13.27 remains slightly below the consensus analyst price target of $13.82, reflecting that analysts believe the stock is close to fair value. The news and developments could influence upward adjustments in price targets if SoFi demonstrates consistent revenue and earnings growth. However, with SoFi trading at a higher Price-To-Earnings Ratio (33.4x) compared to the industry average, there are concerns about its valuation relative to peers, which could temper expectations of significant price gains beyond the forecast period.

Gain insights into SoFi Technologies' future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SoFi Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives