- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFi Technologies (NasdaqGS:SOFI) Expands Alternative Investments With Cashmere Fund Partnership

Reviewed by Simply Wall St

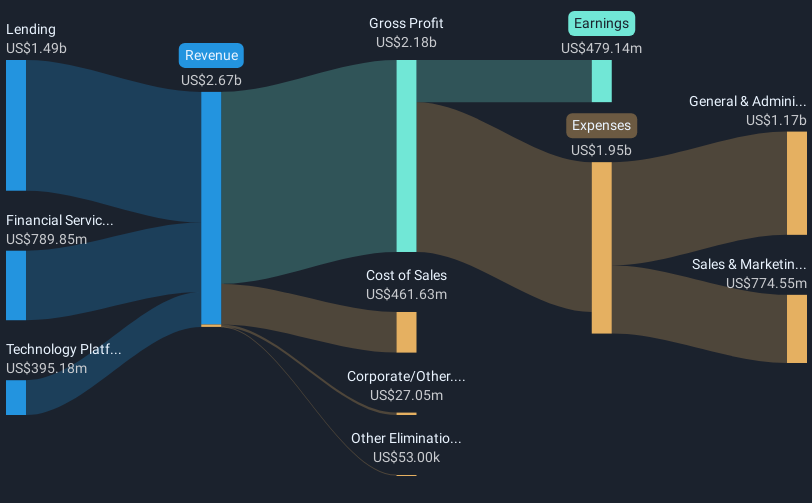

Recent developments for SoFi Technologies (NasdaqGS:SOFI) include the launch of the Cashmere Fund on SoFi Invest and the expansion of their alternative investments, offering broader access to private market funds. These events were aligned with a significant 103% rise in the company’s share price over the last quarter. While the market itself remained relatively stable, up 13% over the past year, SoFi's impressive stock performance may have been bolstered by its product expansion and strategic partnerships, enhancing visibility and accessibility for a broader investor base amidst static broader market movements.

SoFi Technologies has experienced substantial growth, evidenced by a total shareholder return of 220.13% over the past three years till today’s date, 8 July 2025. This return reflects both share price appreciation and dividends. In the shorter term, the company's shares surged 103% over the last quarter. This rise coincides with recent initiatives, including launching the Cashmere Fund and expanding alternative investments, potentially enhancing the company's market standing amid relatively static broader market conditions.

Over the longer-term period, the company's total return indicates superior performance, especially when compared to the US market and industry returns over the past year. This suggests that SoFi's diversified financial services strategy, including the expansion of SoFi Invest, might be positively influencing investor sentiment and demand. The strategic partnerships, such as those with ESPN and the Country Music Association, could further bolster revenue and earnings forecasts by increasing brand awareness and consumer engagement.

Currently trading at US$13.27, SoFi's share price is relatively close to the consensus price target of US$13.82. This indicates that the analysts see a limited upside from the current valuation, suggesting that the market might have already factored in the company's growth prospects and strategic initiatives. The recent price increases align with forecasts of revenue growth driven by a capital-light loan platform and fee-based services, which are expected to achieve US$1 billion in revenue. However, the reliance on fee-based revenue and competition on high APYs could exert pressure on margins, highlighting a potential area of risk amidst ongoing growth efforts.

Jump into the full analysis health report here for a deeper understanding of SoFi Technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success