- United States

- /

- Software

- /

- NasdaqCM:FUFU

Unveiling August 2024's Hidden Gems in the United States

Reviewed by Simply Wall St

The market is up 2.9% in the last 7 days, with all sectors gaining ground. In the last year, the market has climbed 17%, and earnings are expected to grow by 15% per annum over the next few years. In such a robust environment, identifying stocks that combine strong fundamentals with growth potential can be particularly rewarding for investors seeking hidden gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.32% | 6.73% | ★★★★★★ |

| Jiayin Group | NA | 23.46% | 30.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

BitFuFu (NasdaqCM:FUFU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BitFuFu Inc. offers digital asset mining and cloud-mining services in Singapore, with a market cap of $729.80 million.

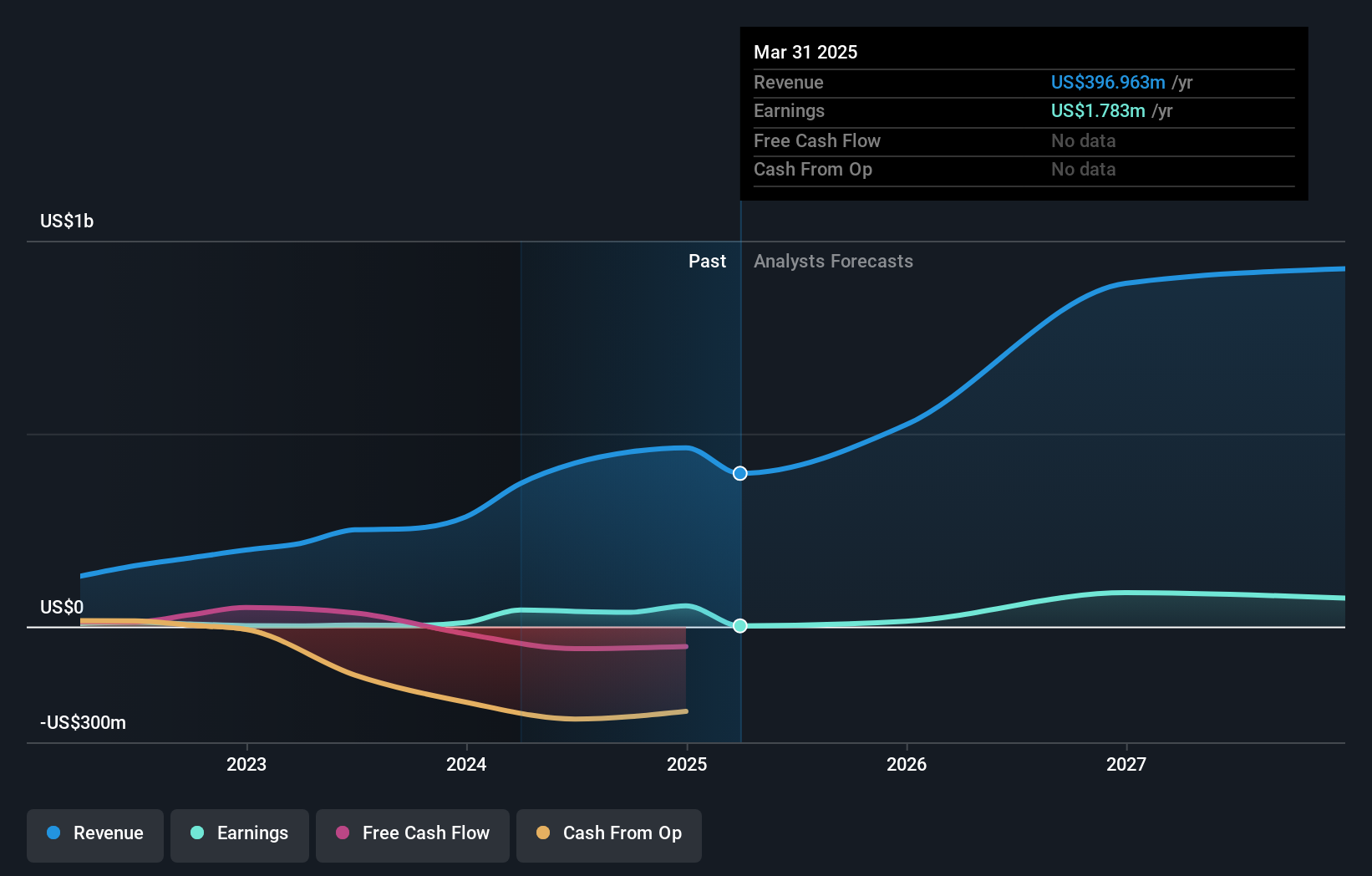

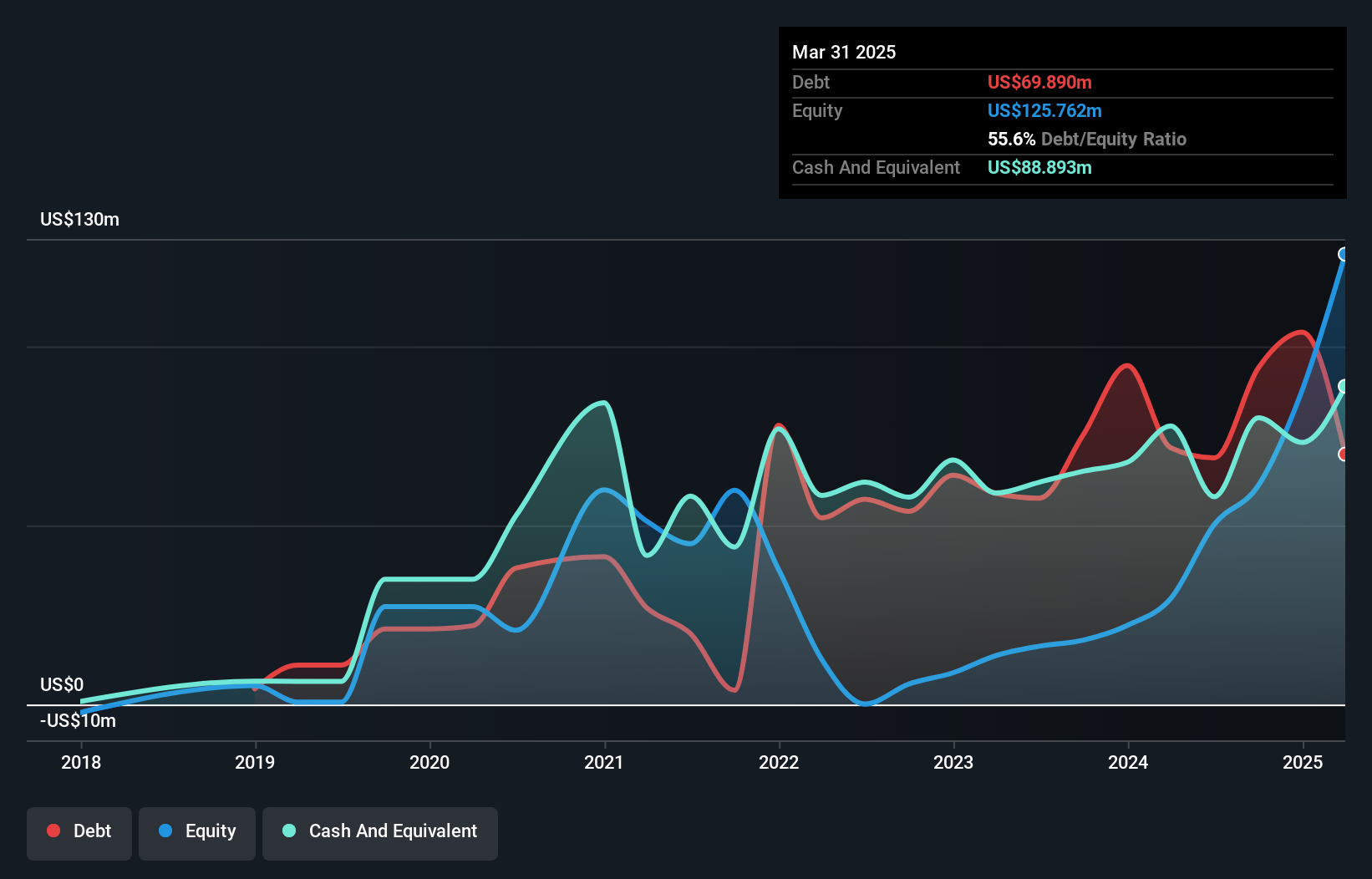

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $370.55 million.

BitFuFu has shown remarkable earnings growth of 2285.5% over the past year, significantly outpacing the Software industry average of 23.3%. Despite its high volatility in share price recently, BitFuFu's net debt to equity ratio stands at a satisfactory 13.1%, and its interest payments are well covered by EBIT with a coverage ratio of 4.5x. Recent board changes include appointing Huaiyu Liu and Joshua Kewei Cui as independent directors, bringing extensive financial expertise to the company’s leadership team.

- Get an in-depth perspective on BitFuFu's performance by reading our health report here.

Examine BitFuFu's past performance report to understand how it has performed in the past.

Sezzle (NasdaqCM:SEZL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sezzle Inc. is a technology-enabled payments company operating mainly in the United States and Canada, with a market cap of $651.87 million.

Operations: Sezzle generates revenue primarily from lending to end-customers, totaling $192.69 million.

Sezzle, a rising player in the financial sector, has shown impressive earnings growth of 434.8% over the past year, outpacing its industry peers. Its debt to equity ratio improved significantly from 1676.6% to 137% over five years, indicating better financial health. Recently added to multiple Russell indexes and reporting a net income of US$29.7 million for Q2 2024 compared to US$1.14 million last year, Sezzle is gaining traction with strategic partnerships like the Minnesota Timberwolves deal and new product features such as Spanish-language support on its app.

- Delve into the full analysis health report here for a deeper understanding of Sezzle.

Understand Sezzle's track record by examining our Past report.

XPEL (NasdaqCM:XPEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: XPEL, Inc. is a company that focuses on selling, distributing, and installing protective films and coatings globally with a market cap of $1.23 billion.

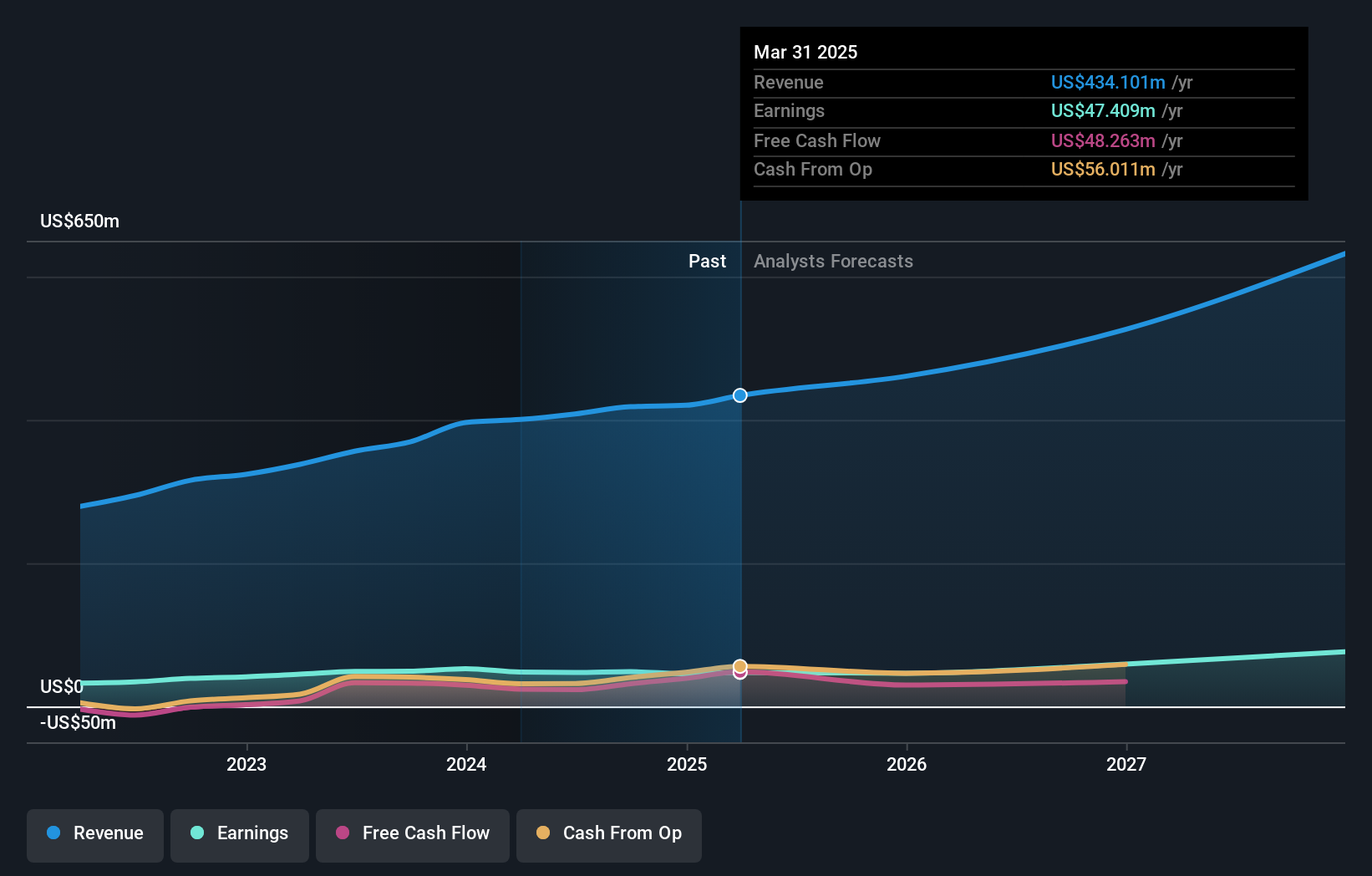

Operations: XPEL generates revenue primarily from its Auto Parts & Accessories segment, amounting to $408.24 million. The company's market cap stands at $1.23 billion.

XPEL, a niche player in the auto components sector, has seen its debt to equity ratio rise from 4.6% to 5.6% over five years. Despite this, it trades at 32.1% below estimated fair value and boasts high-quality earnings with EBIT covering interest payments by 48 times. However, recent negative earnings growth of -3.1%, compared to the industry average of -0.01%, and ongoing legal issues may impact investor sentiment moving forward.

Key Takeaways

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 220 more companies for you to explore.Click here to unveil our expertly curated list of 223 US Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade BitFuFu, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BitFuFu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FUFU

BitFuFu

Engages in the provision of digital asset mining solutions in Singapore, North America, Asia, and Europe.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives