- United States

- /

- Metals and Mining

- /

- NYSE:GATO

Sezzle Leads 3 Undiscovered Gems With Strong Foundations

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it remains up 38% over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying stocks with strong foundations and growth potential can be crucial for investors seeking opportunities beyond the well-trodden paths.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Sezzle (NasdaqCM:SEZL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sezzle Inc. is a technology-enabled payments company operating mainly in the United States and Canada, with a market capitalization of $1.26 billion.

Operations: Sezzle generates revenue primarily through lending to end-customers, amounting to $192.69 million.

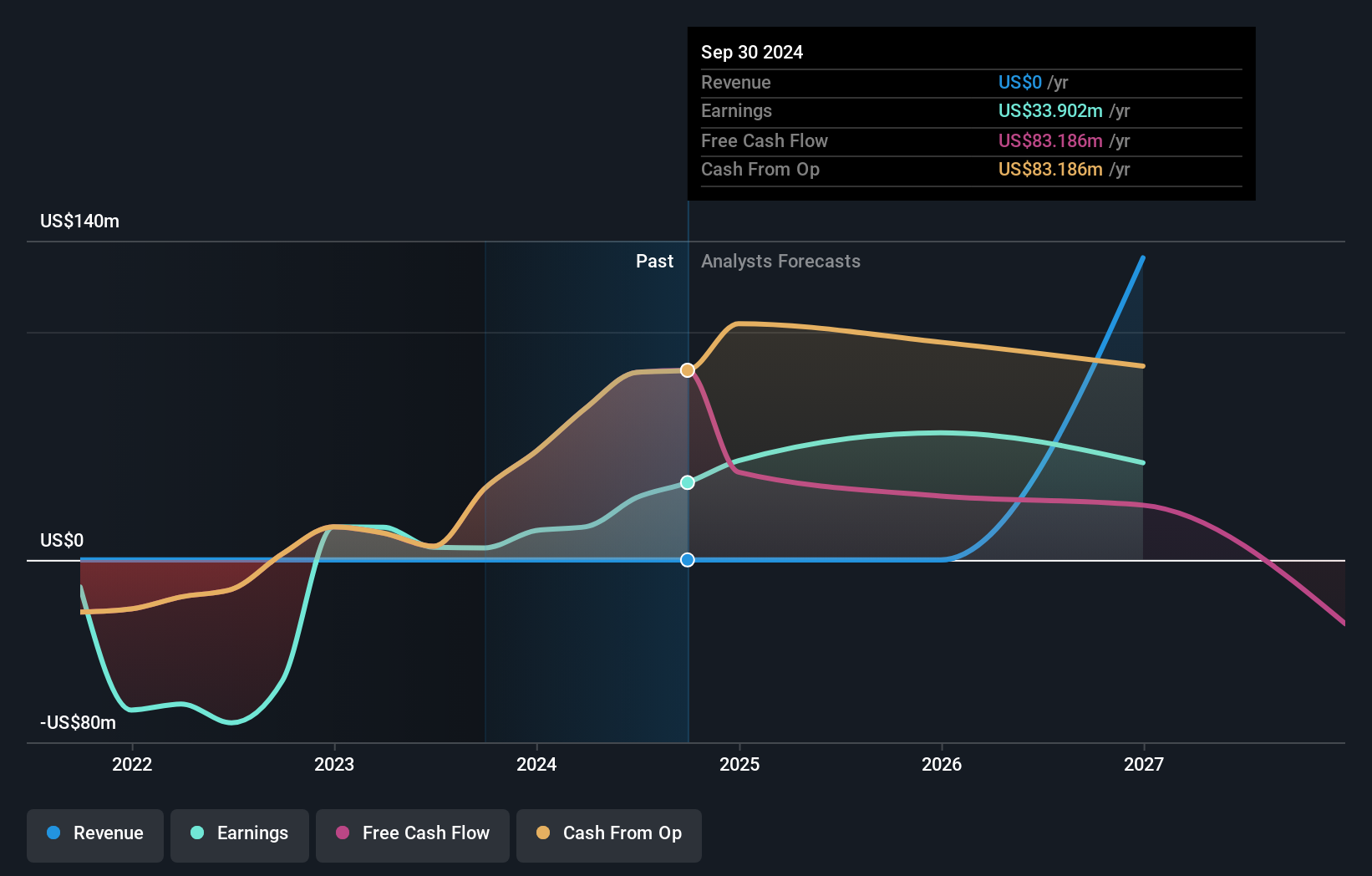

Sezzle, a dynamic player in the payments industry, has seen impressive earnings growth of 434.8% over the past year, outpacing its industry peers. The company's debt to equity ratio has significantly improved from 1676.6% to 137% over five years, indicating stronger financial health. Despite recent share price volatility and insider selling activity, Sezzle's net debt to equity ratio stands at a satisfactory 21.6%. Strategic partnerships and innovative products like high-margin subscriptions are expected to boost revenue by an estimated 29.2% annually over the next three years, although execution risks remain a concern for ongoing profitability improvements.

Centrus Energy (NYSEAM:LEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centrus Energy Corp. supplies nuclear fuel components and services for the nuclear power industry across the United States, Belgium, Japan, and internationally, with a market cap of approximately $1.61 billion.

Operations: Centrus Energy generates revenue primarily from two segments: Low-Enriched Uranium (LEU) at $320.80 million and Technical Solutions at $71.80 million. The company's net profit margin provides insight into its profitability trends over time, reflecting the efficiency of its operations relative to total revenue.

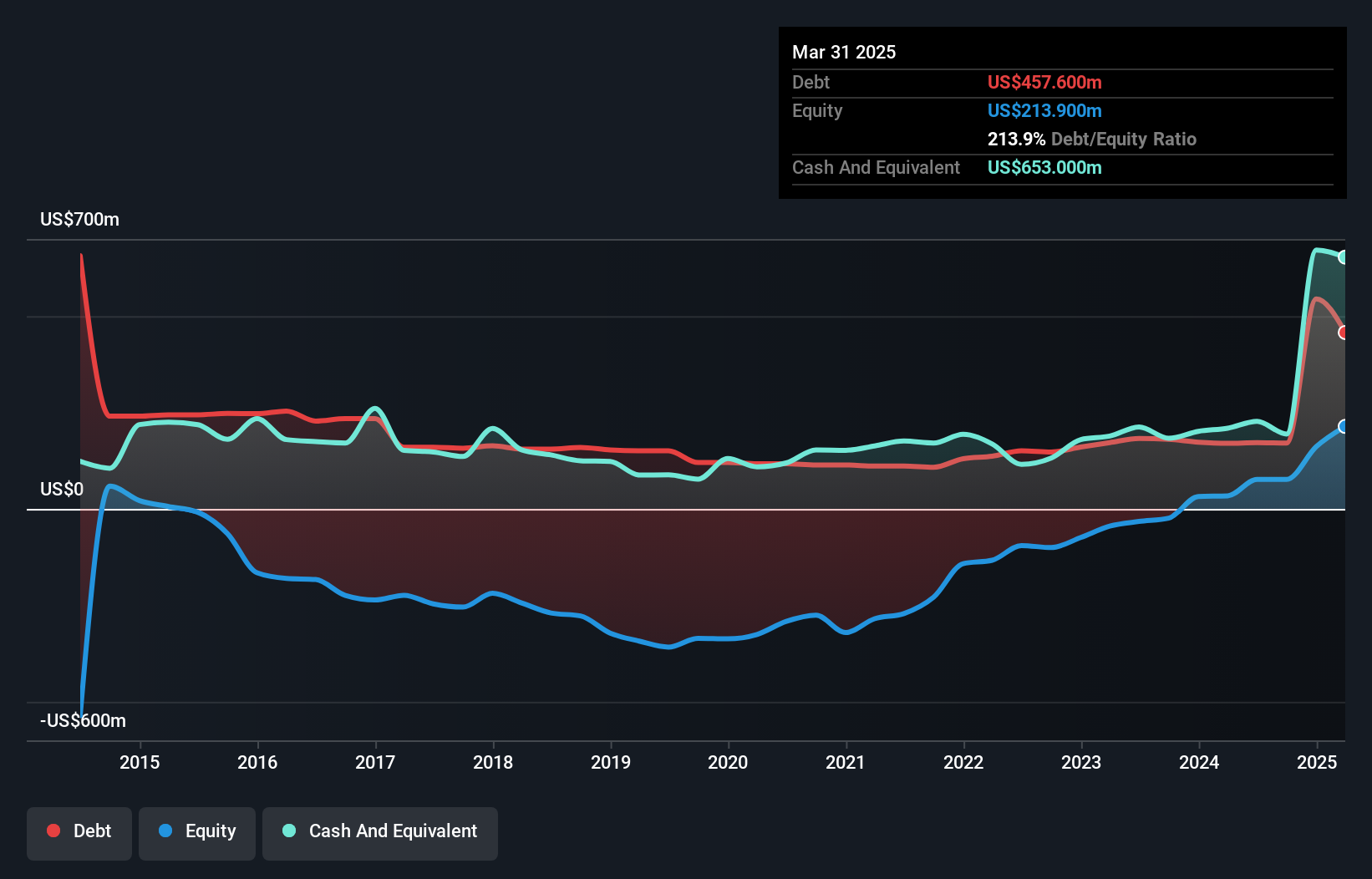

Centrus Energy, a nimble player in the energy sector, has seen its earnings skyrocket by 165% over the past year, outpacing the broader oil and gas industry. Despite a volatile share price recently, it maintains a strong cash position exceeding its total debt. The company reported impressive Q2 2024 results with revenue at US$189 million compared to US$98 million last year and net income reaching US$30.6 million from US$12.7 million previously. Trading at 42% below estimated fair value suggests potential for investors seeking undervalued opportunities in this dynamic market segment.

- Click here to discover the nuances of Centrus Energy with our detailed analytical health report.

Gain insights into Centrus Energy's past trends and performance with our Past report.

Gatos Silver (NYSE:GATO)

Simply Wall St Value Rating: ★★★★★★

Overview: Gatos Silver, Inc. is involved in the exploration, development, and production of precious metals with a market cap of $1.28 billion.

Operations: Gatos Silver generates revenue primarily from the sale of precious metals.

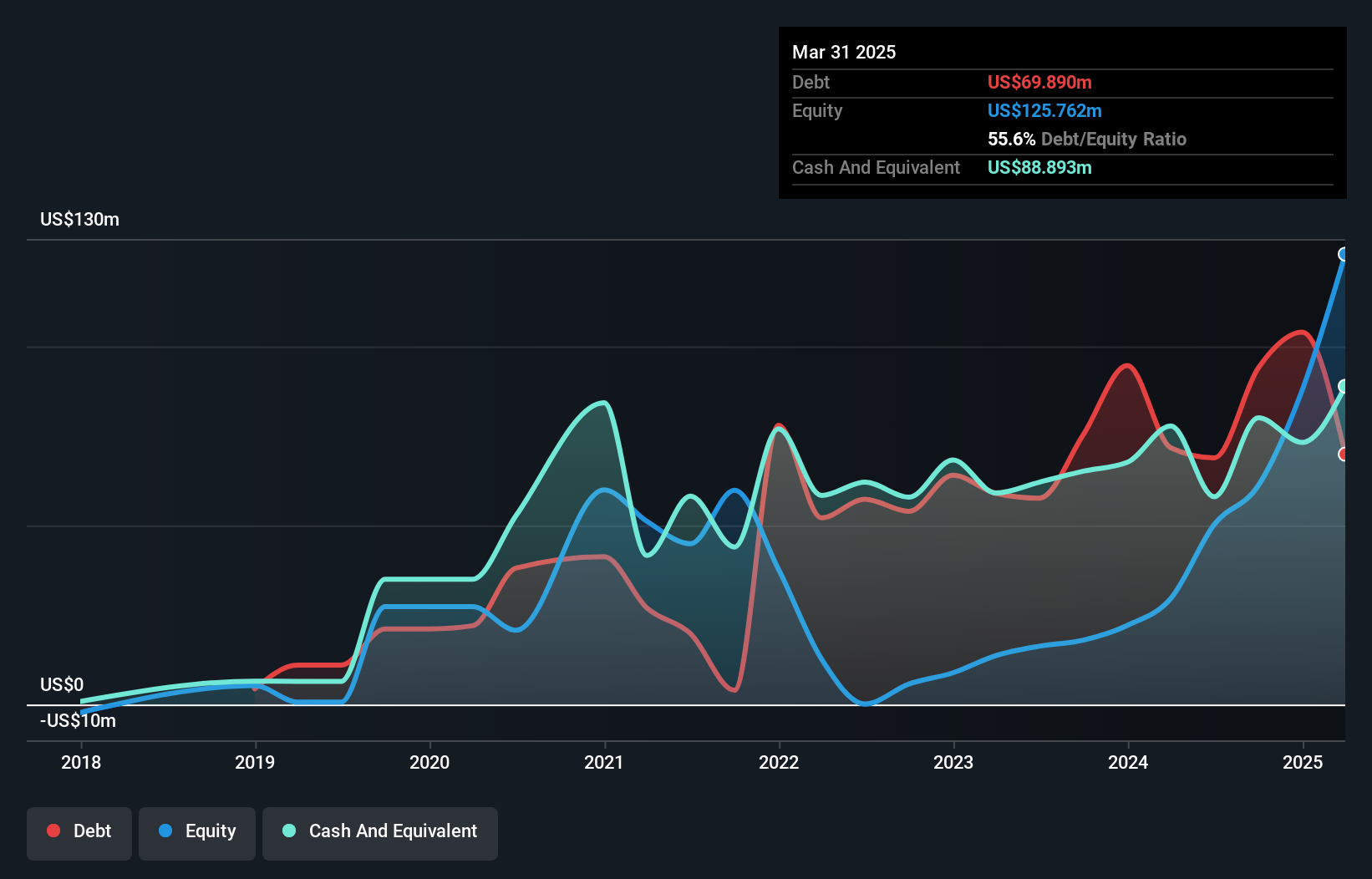

Gatos Silver, a player in the metals and mining sector, has showcased impressive growth with earnings surging 397% over the past year, outpacing industry averages. Operating without debt for five years now, this debt-free status eliminates concerns over interest payments. Recent production updates reveal increased output across key commodities: silver production rose to 2.42 million ounces from 2.22 million ounces year-over-year in Q3 2024, while zinc and lead outputs also saw significant upticks. The company projects silver production between 9.2 million and 9.7 million ounces for the full year, reflecting robust operational performance and potential future growth opportunities.

Next Steps

- Unlock our comprehensive list of 226 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GATO

Gatos Silver

Engages in the exploration, development, and production of precious metals.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives