- United States

- /

- Consumer Finance

- /

- NasdaqGS:QFIN

Qfin Holdings Faces Sharp Price Drop Amid Regulatory News Is There Value for 2025?

Reviewed by Bailey Pemberton

- Wondering if Qfin Holdings is finally trading at a price that makes sense? You are not alone, with the stock's value story catching the attention of investors looking for an edge.

- The shares have seen some sharp moves recently, with a -19.4% slide in the past week and a -29.1% drop over the last month. Looking further back shows gains of 133.5% over three years.

- News coverage has focused on regulatory changes in the Chinese fintech sector and shifting investor sentiment towards technology-related financial services. These headlines have added both uncertainty and opportunity to the recent price swings.

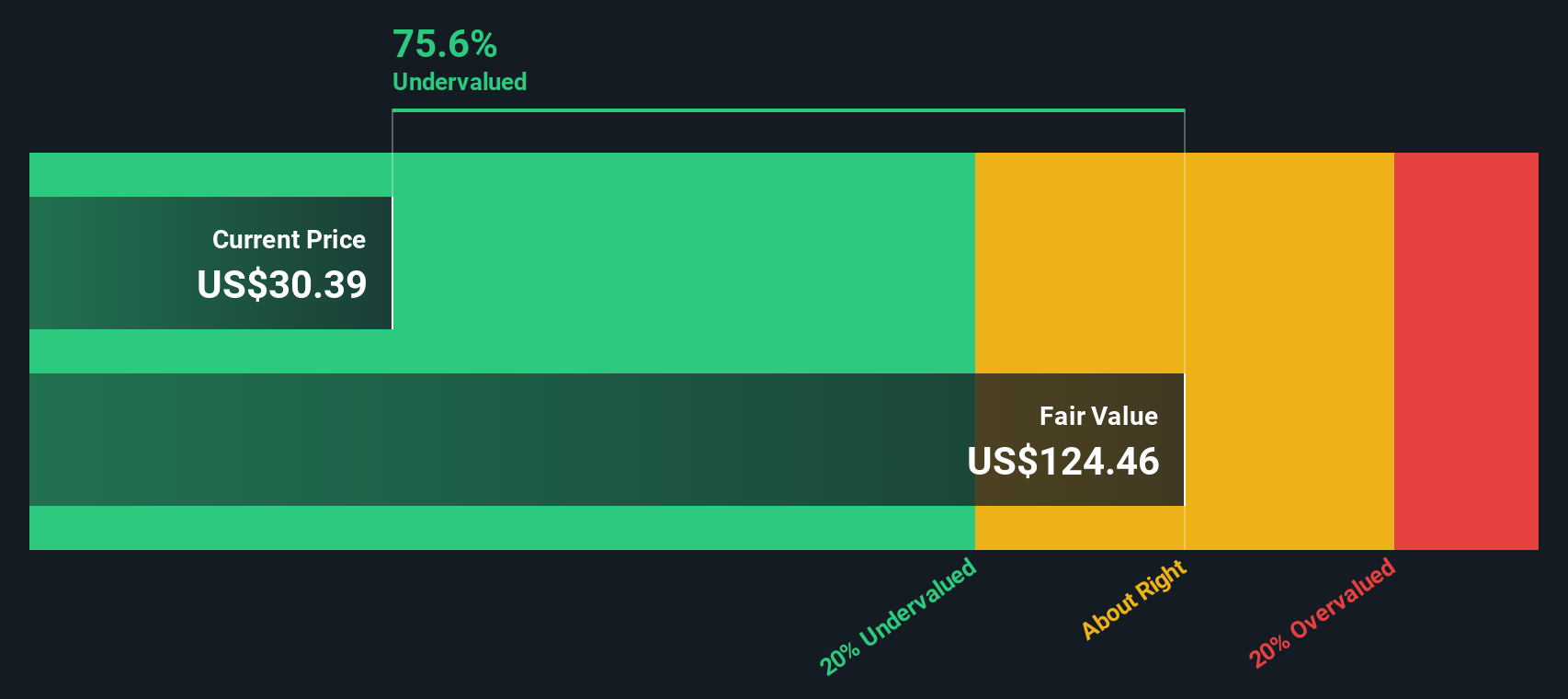

- On our valuation checks, Qfin Holdings scores an impressive 6 out of 6, suggesting it is undervalued across all key metrics. There is more than one way to measure value, however, so we will compare some of the main methods. Stick around for an even better perspective on value at the end of the article.

Find out why Qfin Holdings's -34.4% return over the last year is lagging behind its peers.

Approach 1: Qfin Holdings Excess Returns Analysis

The Excess Returns valuation method focuses on how much additional profit a company can generate above its cost of equity. In other words, it estimates the value created for shareholders by comparing the return on invested capital to required returns and projecting this over a stable, long-term period.

For Qfin Holdings, the current Book Value stands at $181.67 per share, while analysts project a Stable Book Value of $223.13 per share in the future. The company is expected to earn a Stable EPS of $58.09 per share, based on weighted future Return on Equity estimates from 12 analysts. Importantly, the average Return on Equity is a robust 26.03%, significantly higher than the Cost of Equity at $21.12 per share. This results in a healthy Excess Return of $36.96 per share, highlighting Qfin's ability to generate high returns from its equity base.

Bringing all these factors together, the Excess Returns model indicates that Qfin Holdings is substantially undervalued, with an intrinsic discount of 81.3%. This means the current share price is well below what longer-term fundamentals would justify.

Result: UNDERVALUED

Our Excess Returns analysis suggests Qfin Holdings is undervalued by 81.3%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

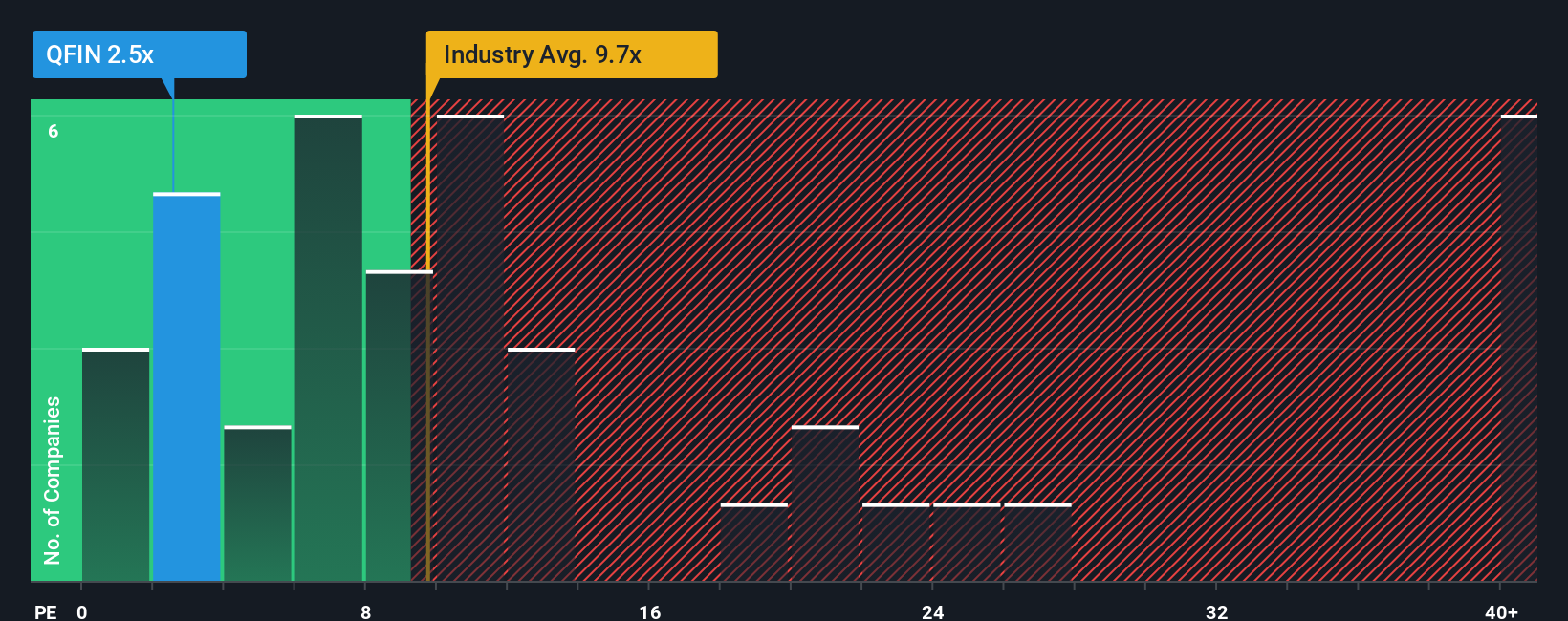

Approach 2: Qfin Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation tools for companies that consistently generate profits, like Qfin Holdings. The PE ratio helps investors understand how much they are paying for each dollar of earnings, making it a straightforward way to gauge value, especially for businesses with stable and predictable earnings streams.

However, what constitutes a "normal" or "fair" PE ratio depends on several factors. Growth expectations and business risks play a big role. A company with higher earnings growth prospects typically deserves a higher PE, while greater risks tend to depress the multiple investors are willing to pay. Benchmarking against relevant peers and industry averages provides context, but each company's situation is unique.

Qfin Holdings currently trades at a PE ratio of 2.73x. This is significantly below both the industry average of 10.10x and the average for its closest peers at 9.90x. While these comparisons suggest the stock could be undervalued, the real question is what multiple the company actually deserves. Here, Simply Wall St's proprietary “Fair Ratio” comes into play. The Fair Ratio for Qfin Holdings is estimated at 14.29x and goes a step further than simple peer or industry comparisons. It factors in the company’s specific earnings growth, profit margins, risk profile, market cap, and unique industry context to deliver a more precise fair value gauge.

Since Qfin Holdings' current PE ratio (2.73x) is well below its Fair Ratio (14.29x), the stock appears materially undervalued when accounting for its actual fundamentals and growth outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1382 companies where insiders are betting big on explosive growth.

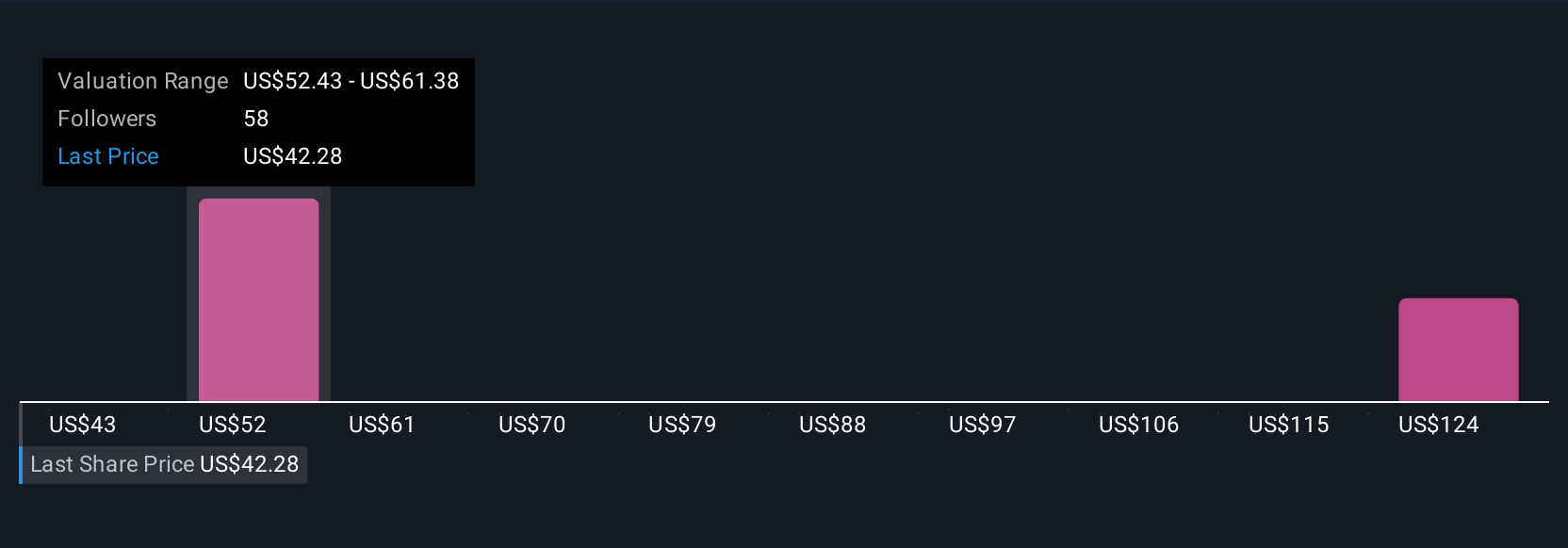

Upgrade Your Decision Making: Choose your Qfin Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a smarter and more dynamic tool for making investment decisions. A Narrative is your way of describing the story behind a company, connecting your assumptions and outlook for its future (such as expected revenue growth, profit margins, or the impact of new technologies) to a clear estimate of fair value. Narratives link the company's story directly to a financial forecast, letting investors see how their personal perspective or the community consensus translates into a projected share valuation.

Available directly within the Simply Wall St Community page, Narratives are easy to use and constantly updated as new information, news, or earnings are released. This means you can see in real time how different scenarios or risk factors impact fair value and compare it instantly to Qfin Holdings’ current share price. This can help you decide when to buy or sell, with context that goes beyond numbers alone.

For Qfin Holdings, some investors believe global expansion and AI-driven efficiencies will drive the share price up to $59.18, while more cautious perspectives, focusing on regulatory risk and earnings volatility, peg fair value as low as $40.25. This demonstrates just how powerful and personalized Narratives can be in your investment process.

Do you think there's more to the story for Qfin Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Qfin Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QFIN

Qfin Holdings

Qfin Holdings, Inc., together with its subsidiaries, operate AI- driven credit-tech platform under the Qifu Jietiao brand in the People’s Republic of China.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)