- United States

- /

- Consumer Finance

- /

- NasdaqGS:OMCC

With EPS Growth And More, Nicholas Financial (NASDAQ:NICK) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Nicholas Financial (NASDAQ:NICK). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Nicholas Financial

How Fast Is Nicholas Financial Growing Its Earnings Per Share?

Over the last three years, Nicholas Financial has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Nicholas Financial's EPS shot from US$0.45 to US$1.09, over the last year. Year on year growth of 144% is certainly a sight to behold.

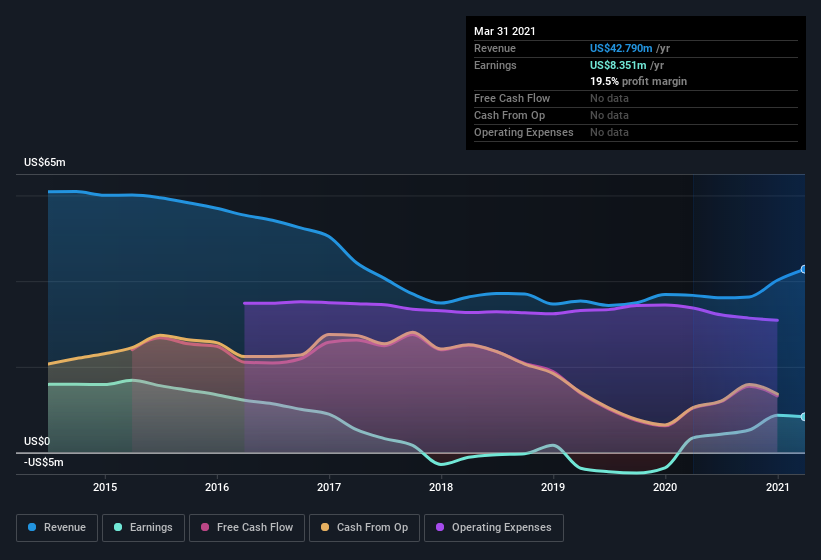

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Nicholas Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Nicholas Financial maintained stable EBIT margins over the last year, all while growing revenue 17% to US$43m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Nicholas Financial isn't a huge company, given its market capitalization of US$87m. That makes it extra important to check on its balance sheet strength.

Are Nicholas Financial Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Nicholas Financial insiders refrain from selling stock during the year, but they also spent US$122k buying it. That's nice to see, because it suggests insiders are optimistic. We also note that it was the President, Douglas Marohn, who made the biggest single acquisition, paying US$17k for shares at about US$8.25 each.

Should You Add Nicholas Financial To Your Watchlist?

Nicholas Financial's earnings have taken off like any random crypto-currency did, back in 2017. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put Nicholas Financial on your watchlist. We don't want to rain on the parade too much, but we did also find 3 warning signs for Nicholas Financial (2 are concerning!) that you need to be mindful of.

As a growth investor I do like to see insider buying. But Nicholas Financial isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Nicholas Financial, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:OMCC

Old Market Capital

Provides broadband internet, voice over internet protocol, and video services in Northwest and Northcentral Ohio.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives