- United States

- /

- Consumer Finance

- /

- NasdaqGS:NAVI

Does Navient's (NAVI) Dividend Decision Reflect Resilience or Highlight Deeper Profitability Challenges?

Reviewed by Sasha Jovanovic

- Navient Corporation previously announced that its board of directors approved a fourth quarter 2025 dividend of $0.16 per share, scheduled to be paid on December 19, 2025, to shareholders of record as of December 5, 2025.

- This announcement comes as the company faces continued operational challenges, with three consecutive quarters of negative results and a persistent decline in both operating and pre-tax profits.

- We'll explore how Navient's continued financial difficulties could alter its medium-term growth and profit outlook as reflected in recent analyst expectations.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Navient Investment Narrative Recap

To own Navient today, you need to believe in both a turnaround in its core student loan business and the company’s ability to sustain returns despite rising credit risk and ongoing profit pressures. The latest dividend affirmation keeps payouts steady but does little to offset immediate concerns around credit quality, margin compression, and the risk of further earnings volatility, none of which are addressed in the announcement, leaving the most important risk of continued credit losses unchanged for now.

Among recent developments, Navient’s disclosure of third quarter results, reporting a net loss of US$86 million and increased net charge-offs, stands out as especially relevant given the dividend news. With negative earnings momentum and worsening delinquency trends, the company’s ability to maintain its current dividend policy may be directly influenced by ongoing credit events and provision expenses in quarters ahead.

But the bigger issue investors should watch is how persistent reserve adjustments and charge-offs could signal...

Read the full narrative on Navient (it's free!)

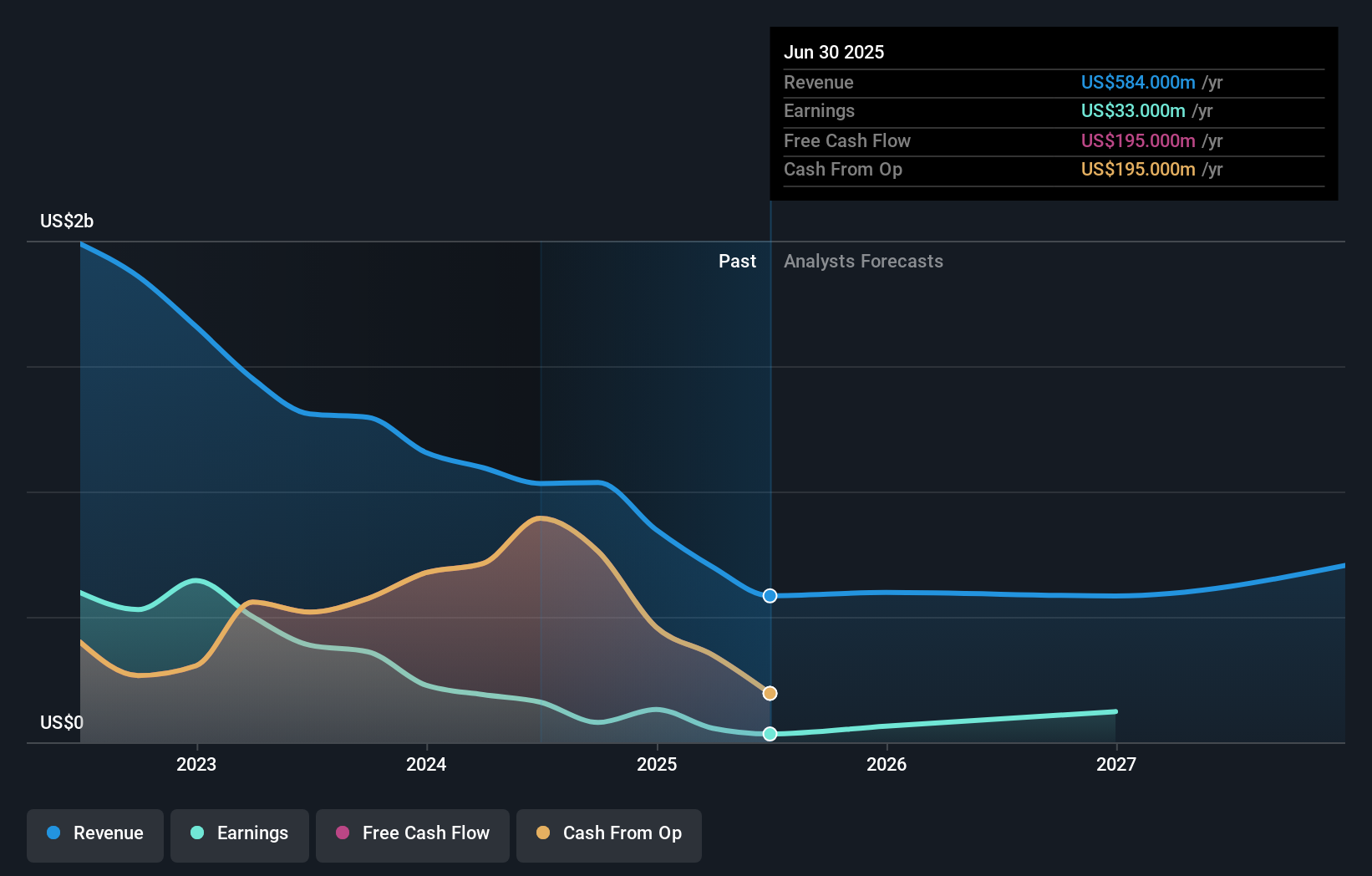

Navient's narrative projects $668.0 million in revenue and $321.8 million in earnings by 2028. This requires 4.6% yearly revenue growth and an increase of $288.8 million in earnings from the current $33.0 million.

Uncover how Navient's forecasts yield a $12.89 fair value, a 12% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community shared two fair value estimates for Navient, ranging from US$12.89 to US$14.34 per share. With ongoing negative earnings and heightened delinquency trends, your approach to risk and opportunity may differ from others, explore these varied viewpoints to better inform your next step.

Explore 2 other fair value estimates on Navient - why the stock might be worth as much as 25% more than the current price!

Build Your Own Navient Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Navient research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Navient research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Navient's overall financial health at a glance.

No Opportunity In Navient?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navient might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NAVI

Navient

Provides technology-enabled education finance and business processing solutions for education, health care, and government clients in the United States.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success