- United States

- /

- Consumer Finance

- /

- NasdaqGS:LX

US$50 Million Share Buyback Might Change The Case For Investing In LexinFintech (LX)

Reviewed by Simply Wall St

- LexinFintech Holdings Ltd. recently announced that its Board of Directors has approved a share repurchase program, with the company planning to buy back up to US$50 million of its shares or ADSs over the next 12 months.

- This move can serve as a signal of management’s confidence in the company’s future prospects and may often be interpreted as a way to enhance shareholder value.

- We'll explore how the US$50 million share buyback authorization could influence LexinFintech's equity story and future capital allocation.

LexinFintech Holdings Investment Narrative Recap

To be a LexinFintech shareholder today, you need to believe in the company’s ability to balance profit growth with active risk management and capital-light expansion. The newly authorized US$50 million buyback signals supportive capital allocation and could positively affect near-term sentiment; however, it does not fundamentally change the biggest short-term catalyst of improving earnings quality through better risk controls or the primary risk of execution around revenue diversification through technology-driven lending models.

Among recent developments, the board’s decision in May 2025 to increase the dividend payout from 25% to 30% of net income stands out. This move, alongside the buyback, reflects a focus on shareholder returns while raising questions about the sustainability of increased cash outflows if profit growth falters. In contrast, investors should also be aware of ...

Read the full narrative on LexinFintech Holdings (it's free!)

LexinFintech Holdings' narrative projects CN¥15.7 billion in revenue and CN¥3.8 billion in earnings by 2028. This requires 3.8% yearly revenue growth and a CN¥3.05 billion earnings increase from the current CN¥749.8 million.

Exploring Other Perspectives

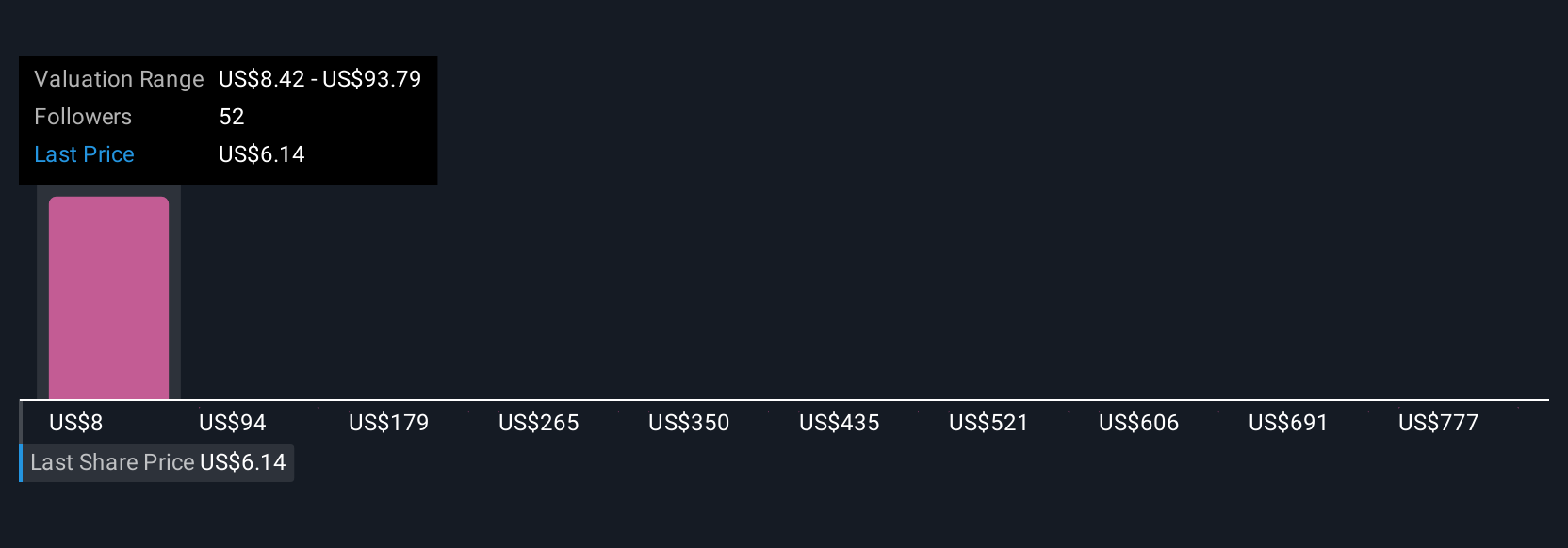

Seven members of the Simply Wall St Community provided fair value estimates for LexinFintech, ranging widely from US$6.13 to US$862.11 per share. While some see substantial upside, many are watching how the company’s investments in risk management and capital-light models could shape long-term growth and payout sustainability.

Build Your Own LexinFintech Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LexinFintech Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LexinFintech Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LexinFintech Holdings' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LX

LexinFintech Holdings

Offers online direct sales and online consumer finance services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives