- United States

- /

- Capital Markets

- /

- NasdaqGS:LPLA

Is Now The Time To Put LPL Financial Holdings (NASDAQ:LPLA) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in LPL Financial Holdings (NASDAQ:LPLA). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide LPL Financial Holdings with the means to add long-term value to shareholders.

See our latest analysis for LPL Financial Holdings

How Fast Is LPL Financial Holdings Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that LPL Financial Holdings has managed to grow EPS by 34% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that LPL Financial Holdings' revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. The good news is that LPL Financial Holdings is growing revenues, and EBIT margins improved by 2.3 percentage points to 17%, over the last year. That's great to see, on both counts.

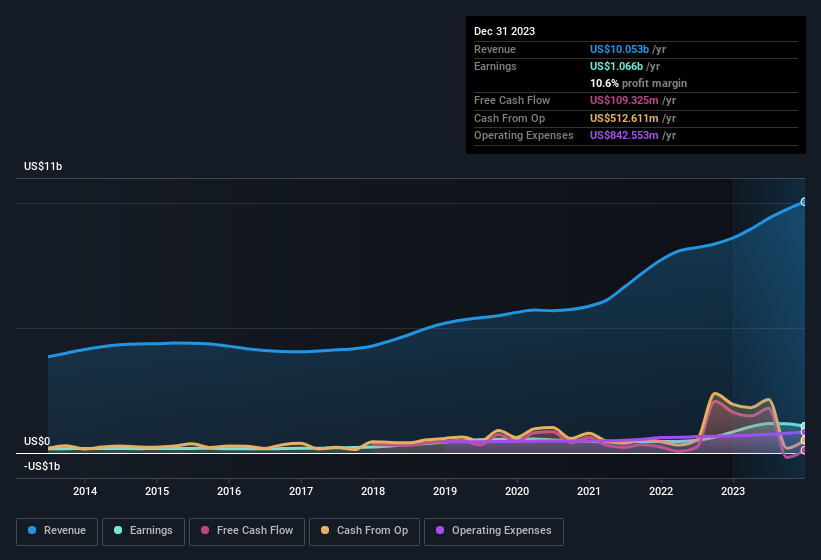

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of LPL Financial Holdings' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are LPL Financial Holdings Insiders Aligned With All Shareholders?

Since LPL Financial Holdings has a market capitalisation of US$20b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. Notably, they have an enviable stake in the company, worth US$150m. We note that this amounts to 0.8% of the company, which may be small owing to the sheer size of LPL Financial Holdings but it's still worth mentioning. This should still be a great incentive for management to maximise shareholder value.

Should You Add LPL Financial Holdings To Your Watchlist?

You can't deny that LPL Financial Holdings has grown its earnings per share at a very impressive rate. That's attractive. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for LPL Financial Holdings (2 make us uncomfortable) you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LPLA

LPL Financial Holdings

Provides an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at institutions in the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives