- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Robinhood Markets (NasdaqGS:HOOD) Surges 10% As Investors Anticipate Federal Reserve Policy Statement

Reviewed by Simply Wall St

Robinhood Markets (NasdaqGS:HOOD) experienced a significant price movement last week, surging by 10%. This upward trajectory coincides with a broader market reflection of investor sentiment ahead of the Federal Reserve's policy statement. While the Dow Jones, S&P 500, and Nasdaq registered gains, Robinhood outpaced these indices, illustrating a distinctive investor outlook. The platform's unique position within the financial services sector, combined with anticipation of regulatory or strategic updates, may have provided momentum to the stock. Despite broader economic concerns and fluctuating performance in technology and consumer-related stock categories, such as Tesla and General Mills, Robinhood's performance signals investor confidence in its operational strategy. As the market awaits economic forecasts from the Fed, Robinhood's recent rally could be reflective of expectations for continued growth and adaptation in a rapidly evolving financial landscape. This price increase stands out amidst a backdrop of stable market recovery and potential interest rate considerations.

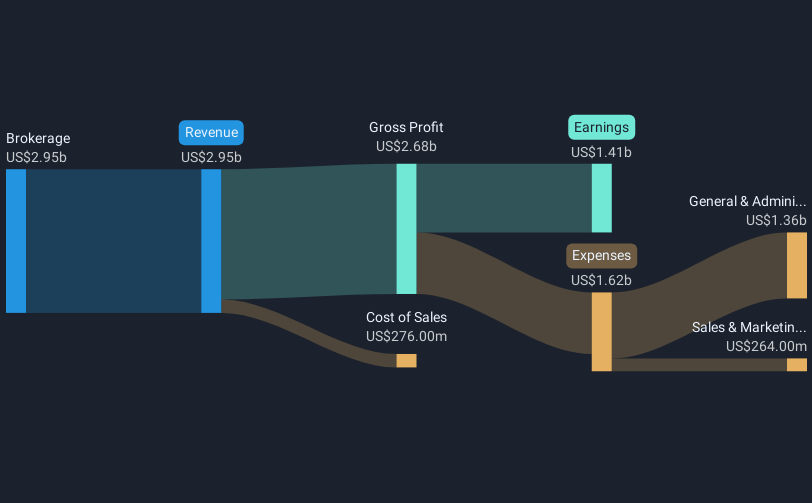

Over the past three years, Robinhood Markets, Inc. has delivered a substantial total shareholder return of 198.81%. A critical factor in this impressive performance is the company's remarkable financial turnaround, moving from negative to positive net income, substantially boosting revenue figures with repeated year-over-year increases. The company's return of profitability over the last year has also been a significant milestone, placing it ahead of the broader US Capital Markets industry over the past year. Successful earnings results, including a recent Q4 2024 net income of US$916 million, reflect strong operational execution.

Robinhood's share price has benefited from proactive initiatives like the buyback program initiated in May 2024, authorizing up to US$1 billion in stock repurchases, which provided confidence to investors. Additionally, the company's focus on mergers and acquisitions and expanding its Board of Directors reflects a commitment to growth and governance enhancements. Challenges remain, such as the class action lawsuit related to 2021's trading restrictions, but these have not overshadowed the company's progress in recent years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives