- United States

- /

- Consumer Finance

- /

- NasdaqGM:DAVE

The Bull Case For Dave (DAVE) Could Change Following Standout Q2 Revenue and EPS Beat

Reviewed by Sasha Jovanovic

- Dave, a digital financial services platform, recently announced exceptional Q2 results, reporting a 64.5% increase in revenue year over year and exceeding analyst expectations for both revenue and EPS.

- Despite these strong results, the reaction highlights a possible gap between investor expectations and analysts’ published projections, reflecting broader sentiment in the personal loan sector amid ongoing regulatory and competitive pressures.

- We’ll explore how Dave’s significant revenue and earnings beat this past quarter impacts the outlook for its long-term growth narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Dave Investment Narrative Recap

For someone to be a long-term shareholder in Dave, it's important to believe in the ongoing expansion of digital-first financial services and the company’s ability to innovate and monetize its user base faster than regulatory and competitive challenges erode margins. The recent Q2 results, while impressive, do not materially shift the immediate catalyst of driving recurring revenue growth through new product features; the main near-term risk remains regulatory scrutiny, which could impact fee-based revenues if new rules are enacted.

Among recent announcements, the full rollout of CashAI v5.5 is highly relevant, as it directly supports improved underwriting and could enable larger and more frequent ExtraCash advances, feeding into the company's core growth engine. Early indications point to more accurate risk segmentation and higher approval amounts, potentially reinforcing the revenue trajectory outlined in the latest earnings report.

In contrast, ongoing regulatory uncertainty, especially around fee structures and data access, is something every investor should keep top of mind as...

Read the full narrative on Dave (it's free!)

Dave's outlook anticipates $702.2 million in revenue and $193.0 million in earnings by 2028. This is based on analysts' assumptions of 17.5% annual revenue growth and a $137.9 million increase in earnings from the current $55.1 million.

Uncover how Dave's forecasts yield a $271.86 fair value, a 39% upside to its current price.

Exploring Other Perspectives

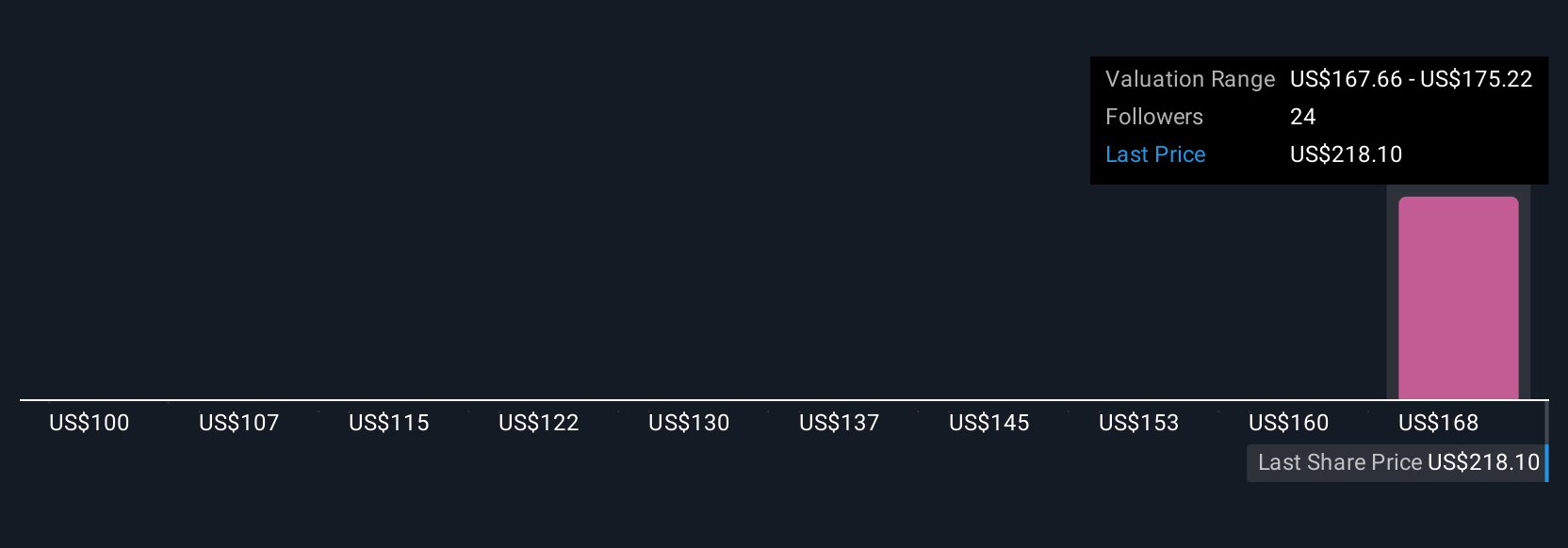

Private fair value estimates from the Simply Wall St Community span a wide range, from US$99.65 to US$320, across four distinct opinions. While analysts see strong earnings potential, opinions still diverge sharply when considering regulatory risks that could reshape Dave’s revenue model.

Explore 4 other fair value estimates on Dave - why the stock might be worth as much as 64% more than the current price!

Build Your Own Dave Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dave research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dave research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dave's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:DAVE

Dave

Provides various financial products and services through its financial services platform in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives