- United States

- /

- Consumer Finance

- /

- NasdaqGM:DAVE

Dave (DAVE): Reassessing Valuation After a Strong Multi‑Year Share Price Rally

Reviewed by Simply Wall St

Dave (DAVE) has climbed over the past year, even after a recent pullback, as investors reassess its subscription banking and cash-advance model in light of tightening consumer budgets and rising digital finance competition.

See our latest analysis for Dave.

With the share price now at $198.93, Dave’s strong year to date share price return of 130.48 percent and powerful three year total shareholder return of 2259.23 percent suggest that momentum has been rebuilding as investors re rate its growth prospects.

If Dave’s run has you rethinking your watchlist, it may be a moment to explore fast growing stocks with high insider ownership for other high potential names riding similar sentiment shifts.

Yet with Dave still trading at a steep discount to analyst targets despite surging returns, the question is whether the market is underestimating its subscription banking upside or investors are already pricing in the next leg of growth.

Most Popular Narrative: 35.1% Undervalued

With Dave closing at $198.93 versus a most popular narrative fair value of about $306, the gap points to a materially more optimistic long term outlook.

Anticipated gains from CashAI v5.5, which leverages deeper transaction data analytics and more variables for risk segmentation, are likely to improve credit performance, enable larger and more frequent ExtraCash advances, and reduce credit losses, supporting higher net margins and gross profit.

Curious how a single model upgrade, rising subscription monetization and a richer margin profile can justify a higher value than today’s price? The projected step change in profitability might surprise you.

Result: Fair Value of $306.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory scrutiny of fee based short term credit and intensifying neobank competition could cap pricing power, pressure margins, and slow Dave’s longer term growth.

Find out about the key risks to this Dave narrative.

Another View: Market Ratios Tell a Different Story

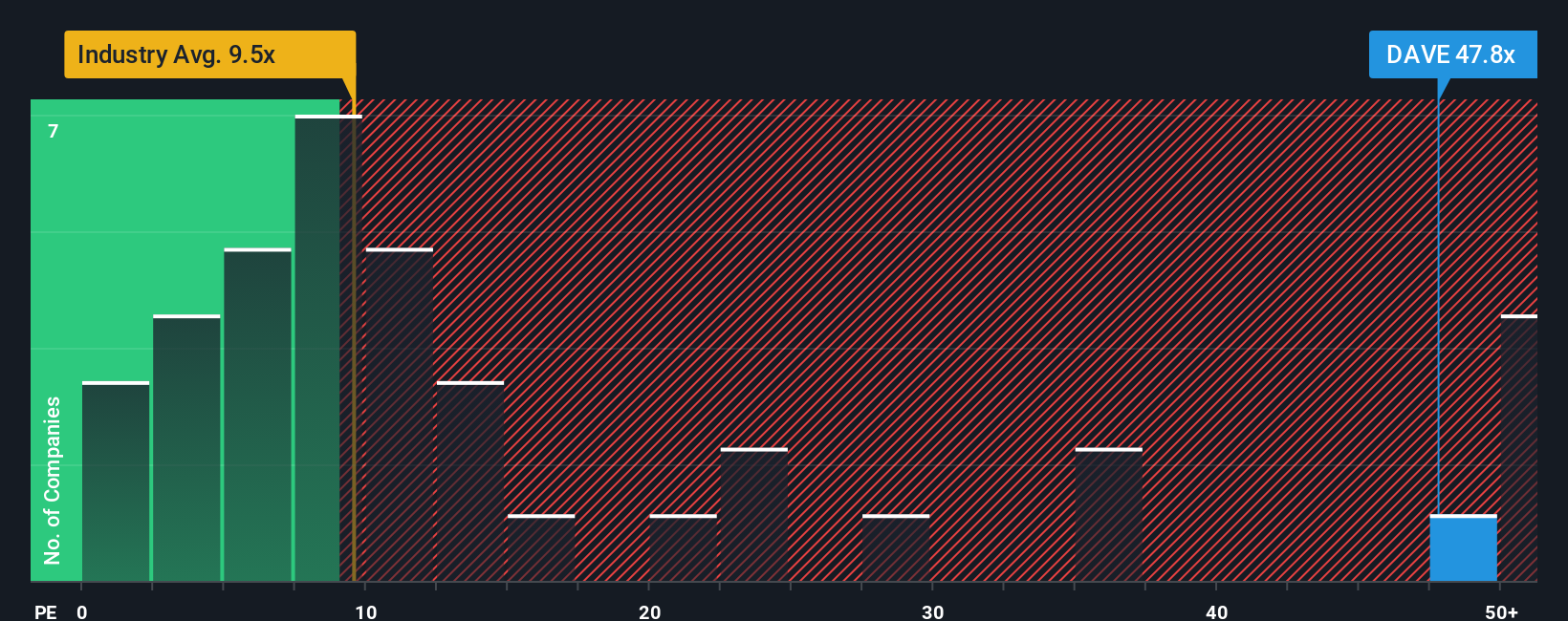

While the narrative fair value points to upside, Dave’s current price implies an 18.3 times earnings ratio, which is rich versus peers at 11.1 times and the broader Consumer Finance industry at 9.3 times, but still below its 21.9 times fair ratio. That mix of premium and headroom raises a tougher question: is this a margin of safety or a valuation trap if growth normalizes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dave Narrative

If you see the story differently, or want to weigh the numbers yourself, you can shape a fresh narrative in just minutes: Do it your way.

A great starting point for your Dave research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover focused, data driven ideas tailored to your strategy.

- Capture potential multi baggers early by scanning these 3632 penny stocks with strong financials that pair tiny market caps with real balance sheet strength and improving fundamentals.

- Position your portfolio for structural change by targeting these 25 AI penny stocks harnessing artificial intelligence to reshape industries and earnings power.

- Boost your income stream by zeroing in on these 13 dividend stocks with yields > 3% that combine payouts with the financial strength to support distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:DAVE

Dave

Provides various financial products and services through its financial services platform in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)